In this post I’ll go over my overall portfolio performance for 2024 as well as the holdings that make up the portfolio. I’ll start with the largest positions and work down in size. The prices are as of the close on December 31st, 2024.

Overall Performance

2024 was a good year for the portfolio. Despite underperforming Fartcoin, I returned a respectable 59.8% in 2024. This compares favorably to the Nasdaq, S&P 500 and TSX at +32%, +25% and +18% (before dividends).

My last 5 year returns have been 71.6%, 7.6%, 8.7%, 13.5%, 59.8%. Overall I am pleased with the results of the portfolio.

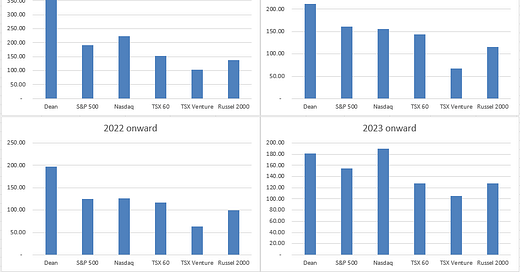

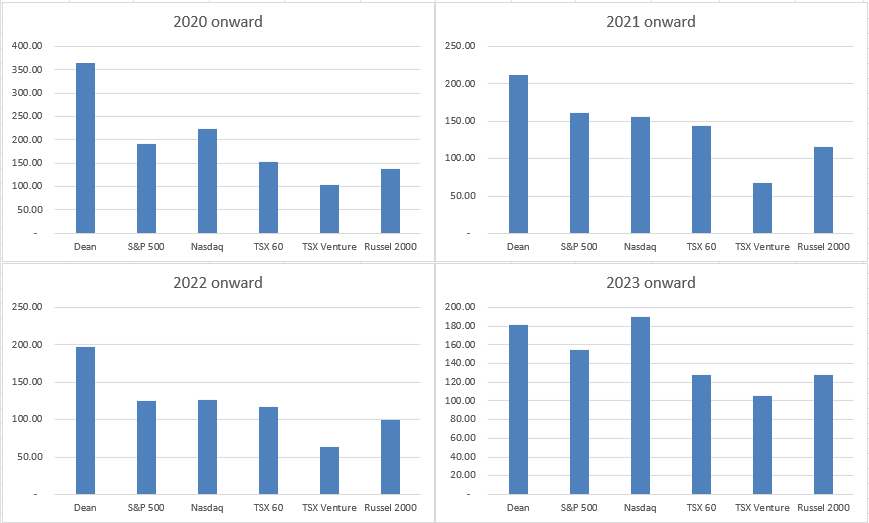

Below is a chart comparing how $100 invested on January 1 with me on or your index of choice would have performed.

Individual Holdings

Cipher (CPH.to) - +141%.

CPH certainly was popular in 2024. Despite the strong performance I still think it warrants a large position here. They have yet to completely integrate the ParaPRO acquisition and have several opportunities. The MOB news was a definite negative and lowered my most optimistic scenario for CPH.

OFS Basket (MCB.to, TOT.to, PSD.to, PHX.to, PSI.to) - +24-25% on average.

It was not a good year to be long energy in general. However 4 of the 5 companies listed above were positive on the year. I like the capital discipline that the entire sector has demonstrated.

I did own STEP.to for most of the year as well. I was fortunate enough to liquidate my holdings above the announced deal price. I am looking to increase my exposure to O&G and/or energy in general at the moment. I am digging through a few potential new holdings.

Viemed (VMD) - essentially flat.

Overall I would say VMD is executing very well. Margins and growth has normalized. There is still a GLP-1 overhand on the shares. I added a little to the position around $7.00 in the summer.

Sangoma Technologies (STC.to) - +140%.

STC had a great year. I am still waiting for them to demonstrate some organic growth. The valuation is still very reasonable for this business. I think we get a bit of multiple appreciation as they continue to reduce debt as well.

Redishred (KUT.v) - +68%.

KUT has agreed to be acquired for $5 in early 2024. I kept my position due to there being a bit of arbitrage here. I also had more cash than typical, so I figured the 10% annualized return was decent enough to hold until the deal closes.

Quipt Home Medical (QIPT.to) - -40% for 2024. I’m up a bit on my position due to averaging down.

I think QIPT offers a decent bet going into 2025. I think if they return to typical organic growth, maintain margins and resolve the investigation we get a jump in multiple from here. At least that’s me on hopeium.

Dirtt Environmental (DRT.to) - +86% for 2024. My position is up 40-45%, but I will be averaging up.

This is a newish position for me. I would happy to add to it on any weakness.

Geodrill (GEO.to) - +73%.

Overall a strong year for GEO.to. I would like them to return more capital to shareholders this year.

Foraco International (FAR.to) - +19%.

Despite the challenges, FAR stock has performed better than I would have expected. I add a bit on the weakness during September. I will likely continue to build out my position.

Cash

I actually have quite a bit more cash than typical. I usually run with only a small amount of cash, say 2-3% at most. I was well over 15% but managed to add to existing holdings and start a new position during tax loss season. Currently I am at 7% with another 8% coming in from the KUT acquisition. So call it essentially 15%. This isn’t a market call or anything.

Closing Thoughts

I don’t have any profound thoughts going into 2025. Despite many complaining that the market is overpriced (doesn’t someone influential always think things are overpriced?) I have been able to find places to deploy capital. I don’t know where inflation, interest rates, commodity prices, crypto, etc. are going. I have made my bets based on the probabilities as I see them.

Wishing you a happy and profitable 2025.

Thanks for reading my work.

Dean

Great stuff @Pettycash!

Congratulations on the year Dean!