ACCS Profile - $ACCS

Taking a position after the risk profile changes.

*Disclosure: I own shares in ACCS. I am not a professional. Please do your own due diligence.

Price: $10.14 USD

Shares (diluted): 3.857 million

Market Cap (FD): 39.1 million USD

Enterprise Value: 38.6 million USD

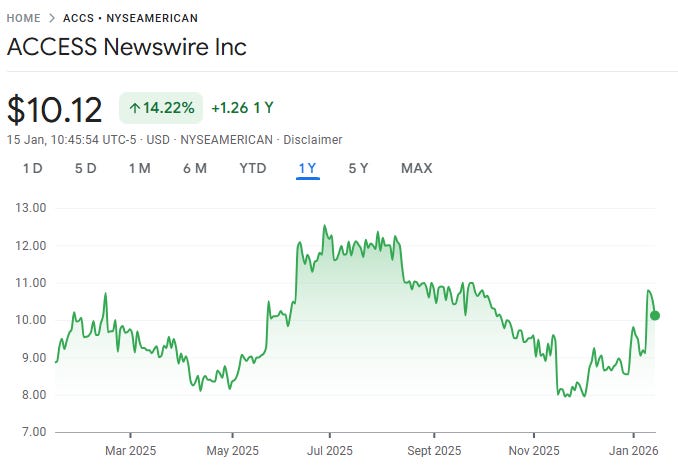

1 Year Performance: +14%

TL:DR

I had owned ACCS back when it was ISDR. You can see my profile on the company below.

ACCESS Newswire (ACCS) has completed a transformation from a debt-laden services company into a focused PR and IR communications platform with a SaaS-style subscription model. After selling its legacy compliance business, the balance sheet is now clean, operations are simpler, and management is focused on growing recurring revenue, improving margins, and returning capital to shareholders.

At today’s price, the stock isn’t “deep value,” but it offers an attractive risk/reward if management can deliver a revenue inflection and margin expansion over the next 1–2 years. With high gross margins, rising subscription ARR, strong insider and institutional ownership, and a valuation below relevant take-private comps, ACCS represents a patient turnaround opportunity rather than a near-term momentum trade.

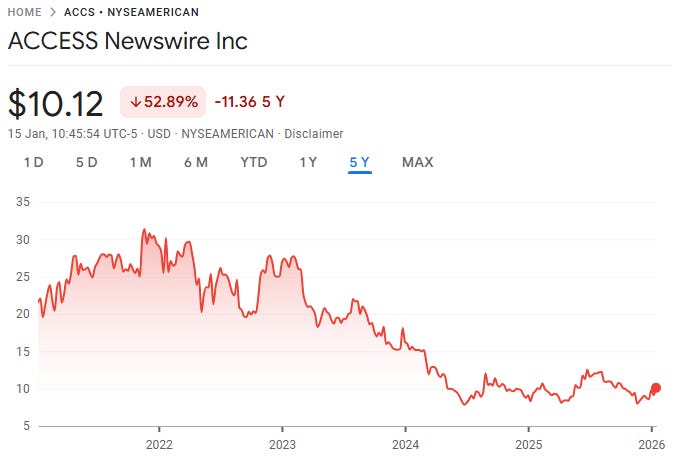

I think it’s worth looking back at a 5 year chart for ACCS to see that it’s essentially been flat for 2 years now. There has been meaningful churn in shareholders over this time. I think 2026 will be a year that ACCS will perform above expectations.

Company Background

ACCESS Newswire Inc. was founded in 1988 by current CEO Brian R. Balbirnie. For decades, the company operated under the name Issuer Direct Corporation (ticker: ISDR), offering a mix of regulatory compliance, investor relations (IR), and communications services to public companies. Its core offerings included EDGAR filing services, stock transfer agency, press release distribution (via Accesswire), and IR web services.

In November 2022, the company completed a strategic acquisition of Newswire.com (iNewswire.com LLC), a competing press release and media communications platform. The deal—structured as a mix of cash, stock, and a seller’s note—expanded ACCESS’s communications business by over 80% and nearly doubled its customer base in press distribution. The move positioned the company as one of North America’s largest press release platforms, combining the brands Newswire.com, Accesswire, and PressRelease.com under one operational umbrella. Integration of Newswire’s media database, analytics tools, and content platform into ACCESS’s ecosystem was central to broadening its SaaS communications offering.

In mid 2024, ACCESS appointed two new independent directors: Wes Pollard and Joe Staples after two board members resigned. This was setting the stage Pollard, a veteran CFO with public and private company experience, joined the Audit and Compensation Committees. Staples, an experienced B2B SaaS CMO, was named Chair of the Compensation Committee. Their addition complemented existing board members Graeme Rein (Audit Chair and principal at Yorkmont Capital) and CEO Brian Balbirnie, who also resumed the role of Chairman of the Board. This board refresh brought additional financial discipline and marketing expertise into governance during a key transitional phase in the company’s evolution.

In February 2025, ACCESS sold its legacy Compliance and Transfer Agent business to Equiniti Group for $12.5 million in cash. This divestiture marked a decisive break from its historical identity as a hybrid compliance-communications provider. The transaction eliminated most of the company’s debt, allowed for reinvestment into its communications platform, and significantly simplified operations.

Following the asset sale, in January 2025, the company rebranded as ACCESS Newswire Inc. (ticker: ACCS) to reflect its singular focus on Public Relations (PR) and Investor Relations (IR) communications. The rebrand also coincided with the rollout of new fixed-price subscription offerings (“ACCESS PR,” “ACCESS IR,” and “All ACCESS”), a move toward recurring revenue and a SaaS-oriented model.

In late 2025, ACCESS also announced a share repurchase program, signaling a shift toward capital return and further aligning with investor-friendly priorities.

Today, ACCESS Newswire is a focused communications software company, aiming to become a leading subscription-based platform for media outreach, investor communications, and compliance-lite services tailored to small and mid-sized public companies. The transformation from a diversified service provider to a pure-play communications platform has fundamentally reshaped its business model and investor profile.

Industry Background

ACCESS operates in the corporate communications and investor relations services industry. This niche straddles PR distribution (press release dissemination and media outreach) and IR services (shareholder communications, earnings events, regulatory filings). The sector is characterized by a mix of traditional players and digital platforms. Competitors include large incumbents like Business Wire and PR Newswire (Cision) for press release distribution, as well as IR web service providers (e.g. Nasdaq’s IR Solutions) and compliance specialists. Many customers are value-focused smaller public companies and private firms looking for cost-effective ways to reach media and investors. Historically, bigger PR firms charged premium prices; ACCESS Newswire differentiates itself by emphasizing affordability and customer service, catering to startups and small-caps that find legacy services expensive. Macro-wise, demand for press release distribution can fluctuate with capital markets and corporate activity levels – e.g. downturns see fewer deals and announcements, softening volumes. However, the long-term trend is toward digital distribution and integrated communication platforms. ACCESS Newswire’s focus on a SaaS subscription model aligns with industry shifts favoring predictable budgets for communications, although it also introduces execution risk during the transition.

Products & Services

ACCESS Newswire provides an integrated suite of PR and IR communication tools. Key offerings include: Accesswire PR Platform for drafting and distributing press releases; a global Press Release Distribution network; Media Database & Outreach tools to pitch journalists; Media Monitoring for tracking coverage; and ACCESS IR Platform for investor websites and webcasting earnings calls. The company also delivers service plans (ContentPRO, MediaPRO, TotalPRO) and add-ons like premium onboarding and PR content writing. In late 2025, ACCESS introduced fixed-price subscriptions: “ACCESS PR”, “ACCESS IR”, and “All ACCESS”, priced ~$1,000–$2,500 per month, bundling these services into predictable monthly packages. This SaaS model aims to drive recurring revenue by offering clients unlimited or high-volume access to press distribution, media analytics, and IR support for a flat fee. The comprehensive “All ACCESS” plan, for example, provides the full suite of communications solutions under one subscription.

Sales Channels & Customer Engagement

ACCESS Newswire reaches customers both directly and via channel partners. It serves over 12,000 clients ranging from small-cap public companies to private enterprises and PR agencies. Sales are largely direct through an in-house team and self-service online signups (e.g. companies can directly submit press releases via the platform). The company has also leveraged reseller partnerships (such as legal firms or financial printers) to bundle its newswire services. With the new subscription model, ACCESS is focusing on upselling existing users into annual plans – a strategy evidenced by subscription customer count growth (972 subscribers as of Q3 2025). Customer feedback loops are maintained through account managers and the platform’s analytics: clients see pickup reports and can relay needs, which informs product improvements like the recently launched AI content analysis tool and social media integration.

Competitive Positioning (My Analysis)

Compared to larger competitors, ACCESS offers a more cost-effective, user-friendly solution. Its platform (an integrated compliance & communications platform) seeks to eliminate complexity in producing and distributing financial news, appealing to resource-constrained companies. While giants like Cision target big enterprises, ACCESS’s niche is under-served small/mid caps that value hands-on support and affordable pricing. The addition of new tech features (e.g. an AI writing assistant “AIMee” launched in 2023) and the unified brand suggest an effort to stay innovative despite its smaller size.

Balance Sheet

Debt and Cash Levels

Following a major divestiture in early 2025, ACCESS Newswire’s balance sheet is substantially de-levered. As of September 30, 2025, the company had $3.26 M in cash and $2.77 M in total debt. This leaves it in a modest net cash position of roughly $0.5 M (cash exceeds debt). The debt consists of a small term loan (~$1.9 M long-term with ~$0.9 M current portion due).

Leverage & Liquidity

Net Debt-to-EBITDA is effectively zero (net cash), a dramatic improvement from prior periods when net debt/EBITDA was high. Before the asset sale, leverage was a concern - net debt/EBITDA well above 3× given 2024’s depressed earnings. Now, with EBITDA improving (TTM ~$2.3 M EBITDA) and net cash on the books, ACCESS has no meaningful leverage constraint. Borrowing capacity should be available via its bank if needed.

Financial Performance

Revenue (TTM and Trend)

Things are a bit messy with the sale of the Compliance business taking place early in 2025. Recent quarterly trends show stabilization in the core business: Q3 2025 revenue was $5.7 M, up 2% year-on-year and sequentially. Similarly, Q2 2025 revenue of $5.62 M, though 7% lower YoY (vs a strong Q2 2024), grew 3% from Q1 2025. Management attributes this to rising volumes in press release distribution (core PR revenue +7% YoY in Q3) offsetting declines in other products. The subscription model transition initially dampened reported revenue (as one-time project fees give way to smaller recurring fees), but it is expected to drive a return to growth. Indeed, the company guided for sequential revenue improvement going forward and is targeting 1,500–1,600 subscription customers by end of 2026 (from ~972 as of late 2025). This suggests an expectation of re-acceleration in 2026 as more clients come on-board fixed-fee plans.

Gross Profit and Gross Margin

ACCESS maintains a high gross margin, reflecting its software/platform business model. TTM gross profit for the continuing business is estimated around $16–17 M, implying ~74–75% gross margin on continuing revenues. In Q3 2025, gross profit was $4.3 M, a 74.6% gross margin (identical to Q3 2024’s 75%). This is consistent with historical annual figures. The stable high margin indicates pricing power and a largely fixed-cost infrastructure – once press releases and webcasts are delivered, incremental costs are low. Notably, gross margin held steady even as revenue declined. For the first 9 months of 2025, gross margin was 76%, same as 9M 2024, showing resilience. Looking forward, management expects gross margin to remain strong or even improve with scale. They are working on efficiency improvements in distribution and leveraging technology (AI, automation) to keep cost of services low. Barring an extreme price war, gross margins should stay ~75%, which provides a solid base for earnings if volume grows.

EBITDA and Profitability

Trailing “adjusted” EBITDA (earnings before interest, tax, depreciation & amortization) is approximately $2.8 M, an 11.8% EBITDA margin on TTM sales. This TTM figure is depressed by early-2025 transition costs; profitability has improved markedly in recent quarters.

Free Cash Flow (FCF)

ACCESS has historically converted a good portion of EBITDA to cash flow, aided by low capital expenditures. I have TTM FCF (before working capital) at 775k. I am assuming that this is fairly depressed.

A notable working capital dynamic is deferred revenue – as subscription sales grow, customers prepay, which boosts operating cash flow. Capex needs remain low; the business is not capital intensive (no manufacturing or hardware, primarily cloud software). Management indicated that after past acquisitions, they are now focused on organic growth and product enhancements that don’t require heavy capital outlay. Thus, barring acquisitions, FCF should closely track operating profit.

Other Key Metrics

The company’s subscription metrics are an emerging focus. Subscription ARR (Annual Recurring Revenue) exceeded $11.3 M by Q3 2025, up ~10% sequentially. Subscription customers were 972 as of Q3 2025, +12% QoQ, reflecting traction of the new model. Customer count overall is over 12,000, but many are one-time or periodic users – converting these to subscriptions is key. The ARPU for subscriptions is at $11.6k. This has been trending up over the last couple of years.

Capital Allocation & Shareholder Returns

The company is not currently paying a dividend and historically focused on reinvestment. With debt largely paid off, excess cash will be deployed in growth or buybacks. Indeed, in December 2025 the board authorized a $1 M share repurchase program (up to ~3% of outstanding shares). Though small in nominal terms, this signals confidence and provides a use for cash given the share price depression.

Share Structure & Ownership

I like the tight share structure for ACCS. Only 3.87 million shares out with the basic and diluted share count very close. Along with the CEO/founder, there are some large holders of the common.

Insider Ownership

Company management and directors together own roughly 18–19% of the shares. Founder/CEO Brian Balbirnie is the largest individual shareholder with ~619,500 shares (~16%), a stake worth ~$5.4 M at current prices.

CFO Steven Knerr holds ~23.6k shares (<1%).

CTO Mark Lloyd ~1.5k shares, and

independent directors Wesley (“Wes”) Pollard ~5.7k and Joseph Staples ~3.7k shares.

An exception is director Graeme P. Rein, who is a managing member of Yorkmont Capital. While personally owning ~62k shares (1.6%), Mr. Rein’s investment firm Yorkmont Capital holds an additional ~202.7k shares (5.2%). This effectively gives Rein influence over ~6.8% of ACCS (though Yorkmont is counted as an institutional holder).

Institutional Holders

About 46% of shares are owned by institutions, including hedge funds.

The largest shareholder is Topline Capital Management, a micro-cap investment fund, with ~709,000 shares (~18.3% of the company).

2717 Partners LP holds ~211,000 shares (5.5%). This is a more recent holder as they just disclosed in August 2025.

Yorkmont Capital (as noted) ~202,700 (5.2%).

Notably, these top holders are concentrated micro-cap investors with a strong understanding of the capital markets and shareholder value.

Other significant holders include Vanguard Group (~147k shares, 3.8%) and Punch & Associates (~138k, 3.6%).

Management & Compensation

Executive Team

Brian R. Balbirnie is the President, CEO, and Chairman. He founded the company and has led it since Feb 2006 as CEO, giving him 20 years’ tenure. Balbirnie steered the firm through its evolution from a regulatory filing service into a broad communications provider.

Steven W. Knerr, CPA is the Chief Financial Officer, appointed permanently in September 2024 after serving as interim CFO from March 2024. Knerr has a background in accounting and joined following the prior CFO’s resignation in early 2024.

Mark J. Lloyd is Chief Technology Officer, appointed Jan 2024, bringing expertise in software development – crucial as the company pivots to SaaS.

Jennifer Hammers is Executive VP of Sales & Marketing, responsible for driving subscription growth; she appears to have joined the team by 2025 (her presence on the website indicates focus on go-to-market).

Executive Compensation

Top management compensation is quite modest for a public company of any size. In 2024, CEO Balbirnie’s total compensation was ~$285k, 100% of which was base salary (no cash bonus or stock award).

Newly hired CFO Knerr’s annual base salary is $200k; his package likely includes bonus potential (not paid in 2024) and some stock options.

Other named executives’ salaries are not disclosed in available sources, but likely in the low-to-mid six figures with small bonuses.

Board of Directors

As of July 1, 2024, Issuer Direct Corporation (now Access Newswire / ACCS) reconstituted its board with the following members:

Graeme Rein

Principal at Yorkmont Capital Management

Continuing Director

Audit Committee Chair

Wes Pollard

Chief Financial Officer of Primeritus Financial Services

Appointed July 1, 2024

Member of the Audit Committee and Compensation Committee

Joe Staples

Experienced Chief Marketing Officer; Adjunct Professor of Marketing at Utah Valley University

Appointed July 1, 2024

Compensation Committee Chair

Brian Balbirnie

Founder & CEO

Chair of the Board

Board Compensation, Independence & Oversight

All three outside directors appear truly independent. They each receive a standard cash retainer and/or stock grants – for 2024, board compensation was on the order of $48–66k per director, which is reasonable and not excessive. With Rein chairing Audit, the board has strong financial oversight; Pollard’s CFO experience also supports governance (his presence likely helps monitor internal controls, especially after a prior CFO transition). Staples as Comp Committee Chair oversees executive pay – his marketing expertise also provides guidance on product positioning.

Ownership on Board

Balbirnie’s 16% stake and Rein’s stake (via Yorkmont ~5%) mean about 21% of shares are directly represented on the board, aligning their interests with shareholders. The other two directors have smaller stakes (Pollard ~0.15%, Staples ~0.1%), but even those have increased via small open-market buys (Pollard) or initial equity grants.

Activist Influence: While no “formal” activists sit on the board, Rein’s presence can be seen as ensuring investor-friendly actions (Yorkmont has been a long-term holder). Additionally, Topline Capital (18%) is not on the board, but any discontent from such a large holder would likely be voiced behind the scenes. So far, there is no sign of activist pressure – rather, the strategic moves (divestiture, buyback program) appear preemptive and aligned with shareholder value creation, likely with board and major investor consensus.

Valuation

The ttm numbers on ACCS don’t look great. You have to have a little faith that ACCS can increase it’s profitability from here for this investment to work out. Previously ACCS, then ISDR, was able to do over 1 million in FCF per quarter. I think given enough time that can happen again. That included the Compliance business, so the incremental profitability will have to come from the existing business by increasing the ARPU and subscriber base. They have traditionally been good at converting EBITDA to CFFO. I don’t expect that to change.

I have ACCS at about what I would consider 10x run rate EBITDA. This would be 11-12x FCF. If they get to where I think they could be, we are at about 8.5x EV/FCF.

Comparables

There are lots of SaaS peers to draw from. Although looking specifically at PR/IR firms leaves us with less.

Q4 Inc was taken out in 2024 at $6.05 or 2.5x revenue after going public in 2021 at$12. They had consistent revenue growth, but where not profitable.

Meltwater (a much larger participant) was taken private in 2023 at a NOK 18. This was about 2x EV/revenue. They also where not consistently profitable.

Cision/PR Newswire, Business Wire and GlobeNewswire are all private as well.

Broadridge (BR) trades at over 15x EBITDA, although I don’t think they are a great peer to reference for valuation.

Investment Thesis

For this to work, ACCS would need to improve the business as it’s not “dirt cheap” at today’s price. There are initiatives underway to drive ARPU higher, particularly for subscription based clients. They could also increase the customer count simultaneously. ARR is 11.6 million at the end of Q3 2025.

As the business generates more cash, I would expect more capital sent directly to shareholders via buybacks or dividends. I would obviously prefer the former.

The stock, trading under 1.5× ttm sales. If they execute and the business can demonstrate strong profitability (or the potential for strong profitability) then I don’t think 2x sales is unreasonable. With a bit more time, I can see using EBITDA and FCF multiples. That would get to over the $20 mark.

What Needs to Happen

For this investment to work, a few key developments are needed in the next 1–2 years:

Revenue inflection to growth: The company must demonstrate that 2025 is the bottom for revenue and achieve at least mid-single-digit growth going forward. This likely means hitting subscription customer acquisition goals (e.g. reaching ~1,200+ subs) and an uptick in ARPU, as well as continuing to win new PR distribution clients.

Margin expansion: ACCESS should continue improving its EBITDA margin toward 20%. This can happen via operating leverage and careful expense management.

Retention & customer success: Because the new model relies on recurring subscriptions, the company needs to keep existing clients engaged and renewing.

Shareholder-friendly capital allocation: On top of the ongoing $1 M buyback, the company would need to continue to focus on shareholder returns as the business executes.

Risks

Top Line Growth Risk: The largest risk to me is the top line growth. If this fails to materialize, then the thesis is dead. This can come from lower ARPU or customer growth (or both).

Competition & Pricing Pressure: ACCESS faces much larger competitors with deep pockets. For example, Berkshire Hathaway’s Business Wire and Cision can bundle services or cut prices to retain clients. There’s a risk of a price war in press release distribution – many customers are price-sensitive, and if competitors slash prices or if new low-cost entrants (even automated AI news distribution services) emerge, ACCESS may be forced to lower its subscription fees, compressing margins.

Liquidity Risk for Investors: Though this isn’t a risk to the business, there could be pressure on the stock if one of the large holders decides it’s time to liquidate their holdings.

Capital Allocation Mis-step: This could be in the form of M&A that is poorly executed or letting cash build up while the shares remain depressed.

Key Person Risk: The founder/CEO (Brian Balbirnie) could get seek an exist from the business for a variety of reasons. Given his tenure and the size of the organization, I would view this as negative for the business.

Closing Thoughts

I think ACCS offers a good risk/reward bet at the current price.

Twelve months ago, this investment would have faced significantly higher uncertainty – the company was juggling a debt-laden balance sheet, a structurally declining compliance segment, and unproven new products. Since then, major risks have been reduced: the high debt has been largely paid off, the low-margin business is gone, and the core communications segment has stabilized with early signs of growth.

In late 2024, ACCESS was an over-leveraged story in need of strategic change; now it is a leaner, focused entity executing a clear plan. The stock price, however, is roughly the same ~$9 (or lower) compared to a year ago (when it traded around $10 amid uncertainty), meaning investors today are not paying up for the improved outlook. Essentially, the risk profile is better now, yet the valuation remains depressed, creating a more attractive entry point.

They have been opportunistic with the capital markets in the past. They cut the dividend in 2018 to focus on growing the business. They did a raise in 2018 for 800,000 shares at $15.50 (around 3x revenue). Then subsequently purchased 218k shares a few months later at $12.25 from a shareholder who wanted out.

The large common ownership from the funds with microcap experience and board representation gives me comfort that the capital markets are well understood at the board level. This is one of the largest concerns investing in microcaps. The CEO owning as much as he does aligns his outcome with mine.

The story is pretty straight forward, which is always a plus for me.

Thanks for reading.

Dean

Disclosure: Long ACCS at time of writing.

Great read. Thanks Dean