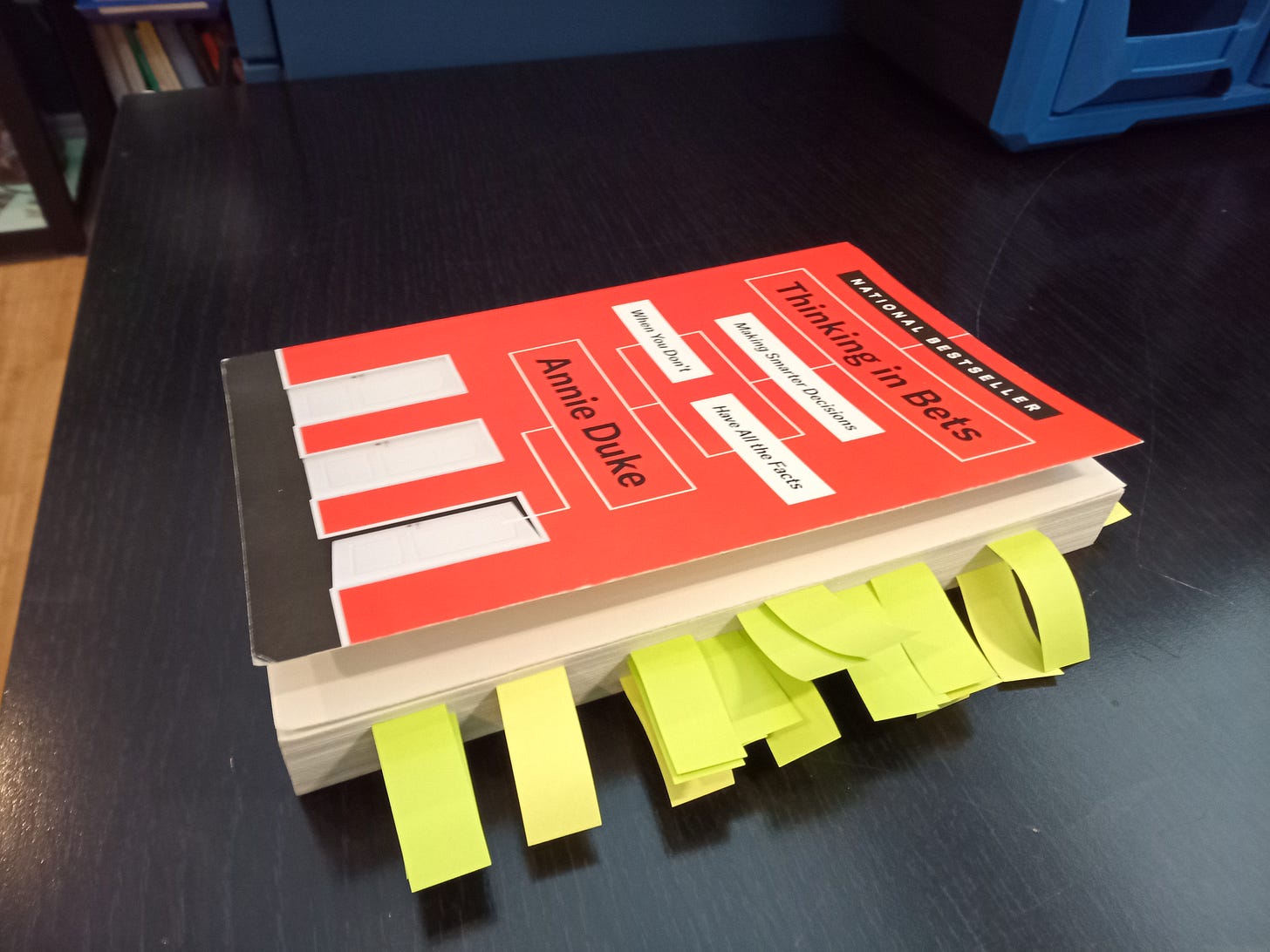

I read this one late last year. As I read, I make notes on the sides of the pages, or I make bookmarks for things that I thought were meaningful at the time. The number of bookmarks usually indicates how impactful the book was to me. Here is what Thinking in Bets looks like after I finished reading.

Since reading, I have since reviewed my bookmarks to better synthesize the key points and I thought I would share.

The book was published in 2018. There was quite a bit of buzz around the book and the author, Annie Duke. As usual, I am way behind on reading what is popular. I read another book of hers, Quit: The Power of Knowing When to Walk Away, which you can find the review on here.

My Thoughts

This book helped me find common language for some of my mental models while thinking about investing as well as other parts of life. As well, I learned some interesting new tidbits of information along the way. I have always cringed when someone says something like “I never went to college, and I turned out ok.” Just because the outcome was acceptable doesn’t mean the decision was wise. On a personal note, I did not go to college or university. And I think things turned out alright. That doesn’t mean I won’t be strongly encouraging my kids to attend post secondary school.

I have put this on the recommended reading list for new investors. But really, anyone can read this and learn about making better decisions.

Key Points from the Book

Here are some points that resonated with me:

Resulting is equating the quality of the decision with the outcome. We do this all the time.

Decisions were not good or bad based on the outcome alone.

The outcome (whether good or bad) does not tell you what you should take credit or blame for. It doesn’t tell you what your fault is and what isn’t.

Life is Poker not Chess.

We don’t know the best or optimal decision to make at the time. There is no way of knowing what the odds are.

Saying “I’m not sure….” is looked at as a bad thing. As we are growing up and going through grade school, you either know the answer and get marked correctly or don’t and get it marked wrong.

This reminded me of how hard it is to say, “I don’t know.” In all parts of life (particularly finance).

On that note, how weird is it when your friend who is not in finance looks at you sideways when you say “I don’t know.” Yet a random YouTuber will know all the things around all the topics.

We don’t simply “react to” a situation in isolation. We bring all our priors with us.

This reminded me of all the relationship experience/baggage you bring into the next relationship.

Having a high IQ does not protect you against biases. There is evidence that it may make you more prone to believing that you can “outsmart” your biases.

This seems particularly true for people who are better with numbers. They have a knack for spinning the numbers to match their biases.

Self serving bias has you look back at an event or outcome and distort what may have happened to suit your narrative.

Ex: I failed a test because the teacher didn’t like me.

Happiness is driven by comparison. We would rather be extremely wealthy in the year 1900 than middle class in 2020.

This point I didn’t believe at first, so I tested it out myself. Turns out it was true. All 12 or so people I asked would have rather been wealthy in 1900 than middle class today. Even once I explained the difference between what a wealthy person has access to in 1900 vs middle class today, only one person changed their mind.

I still get stuck on this sometimes. I can’t help myself but wonder why this is for us humans.

Access to information has never been easier. Also access to misinformation that may distort our views has also never been easier.

Premortems help us in understanding the quality of our decisions. They can help us tease out what was skill vs luck (in some circumstances).

We may be likely to be overly critical or overly compassionate to our decision with hindsight. Premortems help us with this.

We are ticker watchers of our everyday lives. We measure things in moments, hours, days maybe weeks. We would be better served to zoom out and look at progress over months, years, decades.

We tend to overreact with our emotions in the moment.

Things like flat tires, losing money, missed job opportunities, etc. weigh so much heavier in the moment than they do once we have removed ourselves from that point in time.

The concept of a decision swear jar was introduced. The goal is to help us identify when are thinking patterns are steering us away from truth-seeking. Some of these I agree with more than others. Here are the examples provided:

Signs of the illusion of certainty. “I’m sure of ….”, “I knew it …, “this always happens …” are all statements that likely have too much certainty in them.

Overconfidence which is like the illusion or certainty.

Irrational outcome fielding. “I can’t believe how unlucky I am.”, “I can’t miss.” This removes the nuance in the outcome. Things like luck, skill, blame, or credit are given a disproportionate amount of weight.

Anytime you are complaining about luck without recognizing it and simply seeking sympathy.

Characterizations of people to dismiss their point. “Another typical liberal”. These immediately dimmish the credibility of the person, their point, and their perspective. This is something that I must work hard at and would say it is a development opportunity for me.

Other violations of universalism. Gun nut, bible belter, cold hearted conservative, dumb environmentalist, etc. are all examples of this.

Signals we zoomed in on a moment to justify an outcome as being out of our control. “Worst day ever” and “of course this happened, this is the day from hell” were examples provided.

Explicitly signal motivated reasoning, accepting, or rejecting information without much evidence. “If you ask anybody”, “Ken from Costco says ….”

Using the word WRONG as an absolute.

Lack of self compassion. “I’m dumb” or “I have poor judgement”. Though some of this may be true, it’s not productive.

Sharing points with people and leaving out specific details so they will agree with you.

Infecting listeners with our own beliefs without telling the whole story first. By sharing your point first, you pollute the opportunity for them to be objective.

Terms that discourage others from engaging with you. Saying things like “yes, but …”

Closing Remarks

I had a couple of “ah-ha” moments that made me get out of my own head. The term resulting is one I use regularly now. To the point at which I see my oldest son cringe when I say it. Lol.

Marketers are keenly aware of our inability to separate skill from luck or how we can determine the best path for us at that point in time. My personal example is when someone says they have had more success with one lifting coach than another. Yes of course, there are differences in how high touch one is vs another or how much autoregulation one style has vs another. But how do you know the one that is right for you. Let’s look at someone’s squat for example. What got your squat from 2 plates (225lb) to 3 plates (315lb) is likely different than what will get your squat from 3 plates to 4 plates (405lb) or even 5 plates (495lb). So, what worked before may or may not work moving forward. Similar to investing except the people involved know bigger words and are more likely to dazzle you (and themselves) with bullshit.

The comparison thing is probably the most interesting thing I held onto. Why on earth would you rather live rich in the year 1900 when middle class today has a better standard of living. I have my own example of how comparison shaped me. When I started looking at my lifting primarily from a strength standpoint I left the commercial gym and went to a strength and performance gym. It had periods of joy and some harder parts. I was at the top at the commercial gym and felt strong. When I went to the strength gym, I was just average. I would go back to the commercial gym a few times over the years just to make me feel better. Though it feels good to be stronger relative to others at the commercial gym, I was actually better served at the strength gym as the equipment was better and the other lifters were much more relatable to me. Keep in mind this is a hobby and I should just be comparing myself to myself a few years ago. Or even better, just be happy to have the privilege to put in the work.

I enjoyed the book not just as an investor, but as someone who just wants to make better decisions. Investing has such a long feedback look and it’s so hard to tease out skill from luck sometimes. If someone has outperformed for several cycles, then you can confidently say that they are skilled at stock picking. But even this person would have had periods of underperforming.

Have you read this book? Let me know in the comments.

Thanks for reading.

Dean

I don’t think people have the slightest clue what it was like living in 1900. It was before the discovery of penicillin…