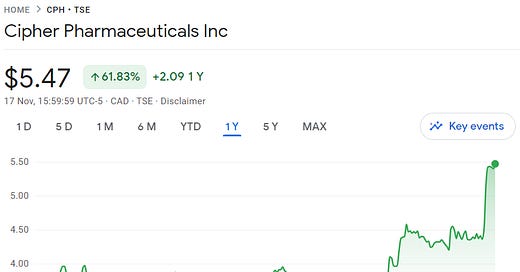

Price: $5.47 CAD / $3.90 USD

MC: 95 million USD

EV: 59 million USD

1 year performance:

CPH reported last week. Results were way ahead of my expectations and the stock up 20% over the next 2 days.

This week they announced another NCIB for up to 10% of the public float.

Quarter Recap (in USD)

Revenue was up to 6.1 mil

Highest since Q2 2021

Large increase driven by license revenue from Absortica

EBITDA up to 3.3 mil from 2.5 mil last year

They completed the SIB for 6mil after the quarter ended

Absortica marketshare up to 6.9% due to increase marketing effort from Sun

Epuris marketshare up to 46.1% (2% yoy)

Call Notes

Pipeline Update

MOB-015

They announced on Oct 6 the completion of the patient recruitment and enrollment of Phase 3 North America study

Expecting results early 2025

Market size is 82 million CAD

CF-101

Submitted drug application to US FDA

Earlier this month they commented that they are on track

Estimated market size for moderate and sever psoriasis is 45 million CAD

DTR-001

Still working on pre-clinical work

They still need to complete the formulation and proof of concept

They likely partner with a large pharma for further development

Balance Sheet and Capital Allocation

They have a higher deferred tax asset on the balance sheet mostly due to MOB-015 being on track to be commercialized

M&A market is still competitive

Even with the SIB they have more cash than they had at the start of the year with a full quarter to go

Closing Thoughts

I was surprised by the strength in Absortica in the US. I was also surprised that Epuris has seen no impact by the introduction of Absortica in Canada. I am now expecting a better Q4 than last year.

CPH is trading at less than 4x EV/ttm FCF. I would expect them to do something more with the cash again in 2024. Some small deals to diversify the revenue mix would also be welcomed, even if it isn’t at dirt cheap prices. I am assuming that they find some more institutional ownership as we move forward which would be a positive for the share price.

I continue to hold my shares.

Thanks for reading.

Dean

* long CPH.to

dean, the difference between between moberg's assesment and cipher's on market targets has my mind racing. Moberg has adjusted every single financial figure they've presented to investors based off of these market share figures for the last several years.