Company Spotlight - Viemed - $VMD

A reprofile of a core holding

Price: $8.85 US

Shares: 40.4 million

Market Cap: 357 million US

Enterprise Value: 358 million US

I have held VMD in various sizes since the split in late 2017. The last time I spent this much detail was over 2 years ago, so I thought it would be a good time to reprofile.

Background

VMD (then Sleep Management) was originally purchased by former fan favorite in Canada Patient Home Monitoring (PHM) in 2015. The transaction was cash and stock for 80.5mil USD at a valuation of 1.9x ttm rev and 4.5x adjusted EBITDA.

There was some drama over insiders dumping shares and handing over the reigns to the business. This left a sour taste in investors mouth for sure. The CEO of VMD (Casey Hoyt) took over PHM.

The medical device roll-up PHM was split into two business in late 2017, VMD and what is now Quipt Home Medical Corp ($QIPT.to).

Viemed Healthcare, Inc., through its subsidiaries, provides in-home durable medical equipment (DME) and post-acute respiratory healthcare services to patients in the United States. It provides respiratory disease management solutions, including treatment of chronic obstructive pulmonary disease (COPD), which include non-invasive ventilation, percussion vests, and other therapies; and invasive and non-invasive ventilation and related equipment and supplies to patients suffering from COPD. The company also leases non-invasive and invasive ventilators, positive airway pressure machines (PAP), percussion vests, oxygen concentrator units, and other small respiratory equipment; and sells and rents DME devices. In addition, it provides neuromuscular care and oxygen therapy services; and sleep apnea management related solutions and/or equipment, such as PAP, automatic continuous positive airway pressure, and bi-level positive airway pressure machines. Further, the company offers in home sleep apnea testing services, as well as healthcare staffing and recruitment services. Viemed Healthcare, Inc. was founded in 2006 and is headquartered in Lafayette, Louisiana.

What sets them apart?

VMD provides a high touch services by having respiratory therapists inside the home managing 24x7 care. This separates them from many of the medical device companies that look to offer lots of breadth, but not as intimate. They do this as the largest independent specialized provider of NIV (non-invasive ventilation). They have pulmonologists on staff and have recently been focusing on behavior support for their patients. They offer several other services to support their patients.

They mainly serve patients with late stage COPD. There are about 25 million people in the US with COPD at the moment. 10% have stage 4 COPD with 50% of those patients suffer from chronic respiratory failure and being likely candidates for NIV.

Some business highlights

Revenue of about 170 million USD. 58% of revenue come from ventilators, 18% from sleep, 11% from oxygen and the balance (13%) from other sources.

The majority of plans are covered by Medicare and private insurance. Medicare makes up 58% of the payor mix on a ttm basis so they are exposed to competitive bidding changing the reimbursement rates for NIV.

They have made a few acquisitions over the years, but the most significant one was Home Medical Products, Inc (HMP) made in June 2023. The acquisition was cash based at 29 million. This equates to about 1x revenue and 4.3x adjusted EBITDA. As important as the price discipline was that HMP added 40,000 patients and help diversify VMD from NIV.

During covid, they pivoted to supporting contact tracing and selling vents. I think this demonstrates their ability to adapt and think on the spot. Though this was the best path for the business, the margins and revenue ramped quicker (and pulled back quicker) than the core business recovered with reopening. As such, this period has some nuance when looking back.

One of their business strategies is to diversify away from vents. They have increased their exposure to oxygen, sleep and other services (like staffing). These small incremental changes each quarter don’t add up to much, but over several years they do move the needle. Vents were over 80% of revenue prior to covid, and are now less than 60%.

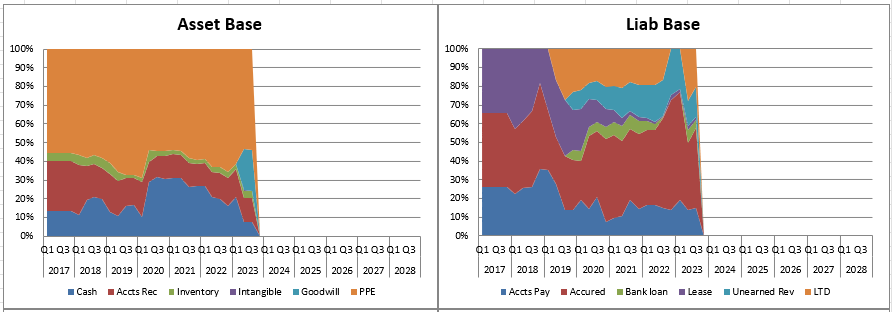

Balance Sheet

After the HMP acquisition, VMD is at essentially zero for net cash in Q3 2023. Half of their total assets are in PPE with the bulk of that being medical equipment like ventilators. They carry about 4.7 million in inventory and 18 million in receivables.

The largest liabilities for them are accrued liabilities (comprised of employee payroll, commissions, phantom shares, bonuses, etc), trade payable and deferred revenue at 16.7, 6, and 6.2 million respectively.

Managing working capital is important to any business. VMD has been able to run with a slight working capital deficit if you remove cash and debt from the equation. This aids in the growth strategy as they don’t need a ton of new capital as they scale.

Given the age and health status of their patients, they will experience a higher than typical amount of receivable charge offs. For the first 9 months of 2023 they allocated a provision of 10.8 mil vs the 7.7 million of actual charge offs. This is something to monitor for this business.

Share Structure & Ownership

There are about 40.4 million shares out on a fully diluted basis. There are quite a few institutional owners. The largest make up well over 30% of the outstanding. I could not get a ton of information of all the larger holders, but none of them appear to have a really large position in VMD outside of Forager Capital with a 4-5% allocation. Some of these larger holders have added and some have sold some shares.

Management owns over 16% of the company. The co-founders have over 10x their total comp (salary and all other comp included) worth of shares in the company.

Management & Compensation

The current CEO & President, Casey Hoyt and Michael Moore, founded the company in 2006. The CFO, COO and CMO came over when PHM and VMD split. I think this bodes well for their thoughts on the future on VMD.

Base compensation is reasonable in my opinion. The incentive plans are comprised of cash, phantom shares and LTIP (which has a few different ways to compensate NEOs). The only variable compensation that had any specific criteria that I could fine was the cash bonuses. The rest seems to be at the discretion of the compensation committee. The compensation committee is comprised of independent board members.

Cash bonuses are awarded, in large part, when performance meets or exceeds certain objective benchmarks, but the Compensation Committee reserves the ability to determine Bonus Amounts based on discretionary, subjective factors as well. Performance criteria under the Cash Bonus Plan include Adjusted EBITDA and other financial and operational goals (which goals are weighted at 70%) such as revenue, business line growth, and number of patients, and corporate goals (which goals are weighted at 30%) such as capital deployment opportunities, technological capabilities, internal leadership and communications, corporate governance, and staffing levels.

The phantom share plan was adopted in 2018 for the purpose of furthering long-term growth in earnings by offering long-term incentives to key employees of the Corporation in the form of phantom shares. Shares vest in thirds annually starting at the first anniversary. The LTIP has several potential avenues that are used to align executives to the long term business performance.

Board

The board is comprised of 8 members with 5 of them being independent. The independent directors collectively own about 1% of the common.

Compensation is a mix of cash and stock. The cash fees are around 100k with another 80-100k coming from stock.

In my opinion the board has a good mix of capital markets presence and industry experience. There are no term limits for board membership and the oldest member is the chair at 72.

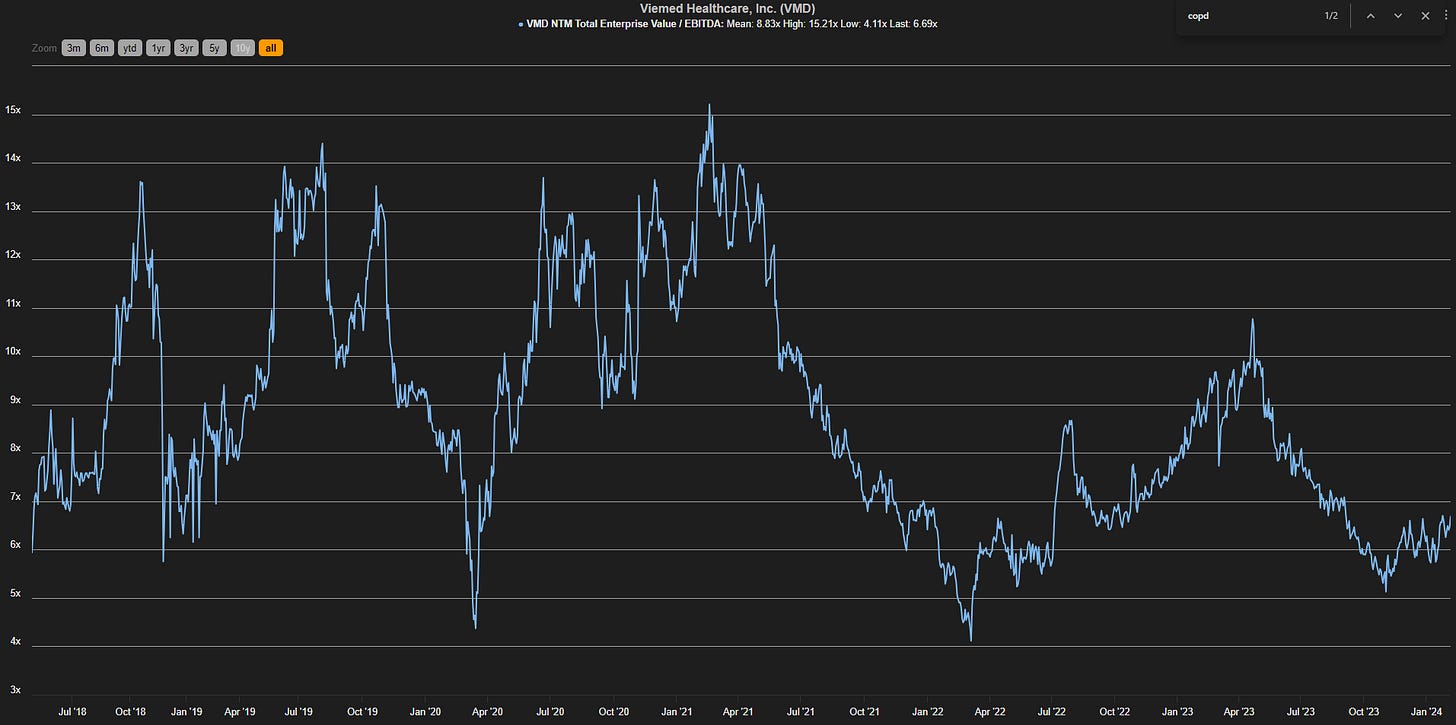

Valuation

VMD has a fairly high visibility business in the short term. This allows the to issue revenue guidance a quarter ahead. VMD is trading at a bit under 7x EV/my est run rate EBITDA. The mean over the last 5 years isn’t much higher at nearly 9. Although there is definitely some noise during the peak part of the pandemic as previously mentioned.

Competitor Apria was purchased by Owens and Minor in 2022 for 1.5x revenue and 7.3x EBITDA.

Recent Financials

The company has been able to grow revenue at a decent pace since the split as shown below.

In the same time the share count has gone from 38 million in 2017 to 40 million today. So minimal dilution which is positive.

Risks

I have identified 5 risks to the business and share price.

One of the major risks identified by investors is the potential for reimbursement cuts for ventilator patients. This has happened in the past and may happened again. So far, there not been indications that this will happen for the 2025 period. The 35% cut in 2016 was a hit, but there were able to “outgrow” the cut in a few quarters. Even if this year passes, there is a risk next year and the next time and the next time. I think this is a large hurdle for anyone running money for a living. A large decline in the stock over in one trading day is very hard to explain to clients.

The next big risk is the potential impact on their patient flow from GLP-1 drugs. The short and likely medium term risk to the business is likely fairly muted as VMD primarily focuses on later stage COPD. There is still a large funnel of early stage COPD potential patients. The uncertainty (rightly so) is with the terminal value of VMD given wide scale adoption of GLP-1 drugs. Things are still quite early and there is lots of hype around these. Resmed has been following over 500,000 GLP-1 patients for a couple years. What they found is an increase in patients being prescribed PAP (positive airway pressure) therapy once the patient is prescribed the GLP-1. This means you are actually 10% more likely to initiative PAP therapy if you are prescribed GLP-1 than if you are not. As mentioned, this is still early innings on the GLP-1 drugs and their effects for additional treatments. I would think that if you are seeking a GLP-1 prescription you are generally unhealthy and a doctor visit would include a health professional having an in depth examination which would result in multiple treatments. This doesn’t mean this is the same for NIV, which is more important to VMD. It also doesn’t mean the prevalence of COPD will stay at this level, which is important for VMD in the long term. Here is a link to the Resmed investor presentation.

Inflation and being able to pass along increased costs to customers is another risk.. The agreements typically have inflation adjustment built in, so they are protected from spikes in inflation. Although it takes time for the new rates to be implemented and hit the financials. This could mean some margin compression in the short term.

I view this business to be exposed to a change in management. I think given how far the business has come with a few key people, I would be worried if they left the business.

There was an OIG investigation released in 2021 that claimed the wrong codes were being billed to Medicare and that VMD was overpaid by 29 million. This was eventually proven to be incorrect and the use of NIV to be medically necessary. There is always a risk of another investigation.

My Thoughts

As with everything, there are risks involved. Whether or not you can identify them today or their potential significance does not mean they are not there. I think with VMD there are some risks or nuances with the business model you need to be comfortable with. Some of these risks ebb and flow and some can have their impact reduced over time. I think you get some reasonable organic growth with VMD of 15ish% and some added inorganic growth. So maybe per share growth of close to 20%. There is some room for multiple expansion as well, but I’m not expecting too much of it at these levels.

The long term impact on GLP-1 drug adoption is something that is very hard to quantify. I believe the market is quite good at pricing in business risk (most of the time), but not uncertainty. The reimbursement risk is something that scares most professionals running money. As a microcap investor I view it as a rite of passage to wake up and have your company down over 20% in a day. I mean it happened like 5 times to XPEL while I owned it. I believe this uncertainty is why the opportunity exists.

Thanks for reading. Let me know your thoughts.

Dean

*disclosure – long VMD

Hi 👋 good write up , I own shares (and also owner of medical supply co) for now I think it’s smart to move away from relying only on ventilators via insurance but I don’t know how I feel about them moving into staffing segment I was more hoping they would get their foot in VA and expend ventilators that way but for now it seems like a long shot