Corby Spirit and Wine Update - $CSW/A.to & $CSW/B.to

It's almost been a year since I kicked off dedicating more time to blogging since the covid lockdowns. I have toyed with the idea of having a dividend paying portfolio cover more and more of my living expenses. To be honest, I'm still on the fence. I have debating creating a 10-12 stock dividend portfolio for tracking purposes. Anyways, here's a quick update on Corby.

Since posting about Corby in May 2020, shares have underperformed the TSX and several dividend focused ETFs. Also, everyone was getting rich off bitcoin except you and me. The performance below doesn't include dividends.

As expected, Corby has weathered Covid well. Surprise surprise but people kept drinking throughout the (various degrees of) lockdowns. Revenue has been maintained and profitability hasn't been impacted.

I went over the business in more detail in the previous post so I won't repeat myself here. Basically, I view the business as very stable and long term demand for their products to grow with GDP. The CEO has been in place for a year and has done well (in my opinion) navigating the pandemic.

Dividends

I'm going to spend some additional time looking at their dividend payouts and policy.

The dividend policy is to pay out 90% of earnings in the previous fiscal year. They have also paid some special dividends out over the years.

In the last 5 and 10 years they have paid out 30 mil and 112 mil ($1.06 and $4.07 per share) in special dividends.

With a little more visibility on the (eventual) reopen in Canada, I would expect the dividend to increase and potentially pay out a smaller special dividend.

Valuation

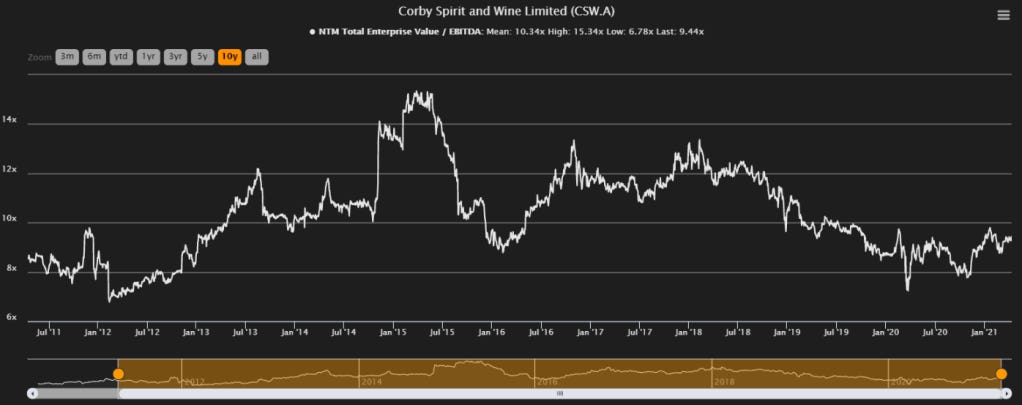

A quick look at absolute valuation is below. Forward numbers are my estimate for fiscal 2021 which is over in a few months.

Relative to where Corby has traded, it's a slight discount to mean for P/S and EV/EBITDA.

Risks

valuation is not cheap

there could be an issue with one of the brand's they market

people could drink less in the future compared to today (perhaps increase their consumption of cannibis)

the B shares are non-voting

Conclusion

Not ridiculously cheap and not expensive. Perhaps dividend paying stocks will have a tougher time if/when interest rates move up. Corby is not a debt heavy company that has a large portion of operating earnings going towards servicing debt.

Anyone own or have an opinion on CSW?

Thanks,

Dean

*the author does not have a position in $CSW/A.to or $CSW/B.to