CPH Update

A long overdue update on a core holding.

Well well well, how the turntables turn. I don’t actually know if that works here, but I’ve always wanted to start a blog post that way. Anyway, let’s get to Cipher.

Price: $15.24 CAD/$11.03 USD

MC: 288 USD (using pro forma numbers)

EV: 328 USD

1 year performance: +254%

*All numbers are in USD unless stated otherwise.

Background

CPH has been an eventful ride. Really all multibaggers are. In case you missed it, CPH announced an acquisition which wasn’t initially understood. As the market digested the news and did the math, the shares continued to march higher. Then Moberg announced some bad news on the MOB-015 product trial. Appropriately, MOB (and to a much lesser extent) CPH have sold off. Both CPH and MOB are topical on X, so of course there was lots of attention paid to the news.

I was/am overweight CPH and I think it’s important for me to take a step back and regroup here. I recently sat down with the CPH CEO (Craig Mull) and President (Bryan Jacobs) at the SCD SNN microcap conference in Vancouver. It was definitely worth the trip as I got some additional insight into the potential of the business.

How I’m Looking at CPH

You may not know me well enough to have figured this out, but I am not a “precision” investor, I am a “good enough” investor. To me the numbers have to be slap-you-in-the-face obvious for me to deploy (or continue to tie up) capital. Let’s look at what we know and what we can make some educated guesses at to come up with what CPH could be in 2-4 years. I’ll start with the reasonably certain and then work towards what we don’t know. It’s broken down into 7 different line items. If you want someone who has done better work on this than me, I will point you to Divergent Capital’s post here.

The Reasonably Certain

Epuris

They sell (and will continue to sell) Epuris in Canada. The market is mature. I really don’t see that changing at the moment. Quarterly revenue for the last 12 quarters was 2.78 million or 11.13 million annually. Using 50% EBITDA margins the asset generates 5.57 million in EBITDA each year. I don’t think it’s unreasonable to expect that to continue.

Non Epuris product sales in Canada

This will essentially be a rounding for CPH moving forward, but still I wanted to go through the exercise. Over the last 12 quarters non Epuris product sales have been 0.37 million per quarter or 1.48 million annually. 50% EBITDA margin gets us 0.74 million annually.

Non Absorica licence revenue (Mainly Lipofen)

We know that Absorica likely comes in house and ends up being sold by the Natroba sales team (more on that later). I haven’t done the work on what Lipofen could be, but for this exercise I will keep it simple and use the past 12 quarters for Lipofen and ignore the other products in the licence category. Lipofen has generated 0.68 million per quarter or 2.7 million annualised over the last 12 quarters. I assume this brings in about 1.36 million in EBITDA.

Natroba currently

In the press release when they announced the acquisition of ParaPRO, CPH said they essentially doubled sales and earnings. Given that statement, I am going to assume that Natroba as-is generates 23 million in revenue and 12.6 million in EBITDA in 2024. This assumes that there was some growth in Natroba in 2024, but still has some room to continue to take market share from permethrin.

Less Certain (but still optimistic)

I’ll go over what I see as potential then identify some risks.

Incremental growth of Natroba in the US

I’m going to assume a reasonable growth of 5 million in revenue from Natroba in the US. I feel like this is a reasonable assumption given that the product has grown to 23-23% market share since being approved in 2021. It has superior performance (though is more expensive for consumers) than the existing permethrin (both 1% and 5%) due to the resistance built up by mites. I am going to slap another 5 million in revenue on 70% incremental margins for Natroba. This may seem aggressive, but that is the sense I get for the next 5 million given the large opportunity in front of them with limited penetration. I don’t think this even takes them to 30% market share. This 5 million in revenue equates to another 3.5 million in EBITDA.

Absorica being brought in house and sold by CPH in the US

There is no secret that CPH likely brings Absorica in house and sells themselves once the agreement with Sun is up at the end of 2026. The severe acne market has already gone through genericization, so I am not expecting some big changes after the agreement ends. In order to understand the impact, we need to make some assumptions using the current Absorica revenue that CPH has. Over the last 12 quarters Absorica revenue has averaged 1.43 million or 5.72 annualised. Taking the 5.72 and dividing by CPH’s share of the royalty (CPH gets half the royalty as it is shared with Galephar) gives us a rough idea of the potential. Using the standard 15% we get 76.2 million potential. The company identified a “mid-teens” rate in 2021 which was lowered in 2021. So I may be I’m not assuming a big compression in margins from here, so I am keeping 50% EBITDA margins for Absorica once scaled. This equates to 38.1 million in EBITDA.

MOB-015 Canadian Sales

The size of the market for MOB-015 in Canada is 95 million Canadian or 65.9 million USD. Despite the last news release about the complete cure rate for MOB-015, the product is selling well in Sweden. It started selling in April 2024 and ended Q2 with 39% market share. As well it grew the market 52%. I don’t really have a reason to think that if we get positive news in December 2024 or early 2025 around MOB’s trial modification, that the eventual result for MOB-015 won’t be any different here in Canada. Assuming the trial modification works and MOB is everything we hope and dream, I am modelling 90% market share on top of a market that is 35% larger than it is currently. This equates to 80 million USD annually and (using 40% EBITDA margin) 32 million in EBITDA.

Optimistic Total

This all looks like the following.

A total of essentially 200 million in revenue and about 94 million in EBITDA. As you can see the largest drivers are Absorica and MOB-015 and then Natroba in the US.

Other potential outcomes

I have taken some time to model out lower possible outcomes for CPH. This would include lower Absorica revenue due to a lower royalty rate or to something changing in the marketplace. I also lowered the potential for MOB-015 in Canada. I do think that even if the trial data comes out less than stellar and MOB-015 has a harder time getting Health Canada approval, the company will do something like go over the counter or advocate for the focus to be on what the consumer actually cares about, mycological cure rate. I have also planned for 0 revenue from MOB-015 in a worse case scenario.

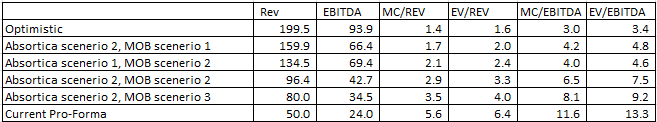

I won’t go into the nuts and bolts but here is what I came up with.

Using the current market cap of 288 million USD and 328 million USD enterprise value (this includes the slug of shares issued for the ParaPRO acquisition), we get these valuations.

So the worst case is that CPH is now at about 9.2x EV/EBITDA. That’s actually pretty cheap given the assets and unidentified catalysts. They are currently doing about 24-25 million in EBITDA now, that would be at 13.3x EV/EBITDA.

What I didn’t quantify

As much as some of our rigid little minds want perfection via Microsoft Excel, that just isn’t reality. Nothing happens in a vacuum. The above doesn’t include the following (many of them can be very meaningful to CPH shareholders):

Out-licence of Natroba in other geographies.

With the ParaPRO acquisition, this is now a potential. I have a feeling that the CPH team is a bit more enthusiastic to get something done to out-licence Natroba globally. There are many countries that the demographics lend themselves well to this product.

Selling Natroba in Canada.

CPH can (and will) sell Natroba in Canada. How successful and at what scale, I am not 100% sure.

Another acquisition or in-licence.

The CPH team has pulled off some pretty incredible stuff, I don’t think they are done yet. They mentioned that they have about 50 million in capital available.

The value of the tax loss carry forwards.

I think the fact that I’m using EBITDA and being very crude with my estimates makes this a line item that won’t move the needle in my valuation assumptions.

Risks

Here are the risks that I was able to identify in my numbers.

These assumptions are scaled up or in a steady state. There is always a ramp up time when you change things.

The Absorica line item has assumptions. Maybe they lower the price as I believe I recall them mentioning that they felt Sun could have been more aggressive on pricing. Or maybe I am wrong on the royalty rate and the potential is lower.

This ignores debt. Though the debt level given the earnings potential is more than manageable, it is still there and should (probably) be accounted for.

This ignores milestone payments. These are real. There are too many unknowns right now for what they will get for Natroba globally, so I just left it out.

This ignores the balance sheet and working capital. I don’t think this is really a big risk given the management team and dynamics of the business, but there are working capital needs here and I have just ignored them.

This ignores payor risk. Given how large of a driver Absorica is, this is actually a real risk. Though I don’t really think that they will have struggles maintaining the same payor relationship for Absorica due to it now being sold by Cipher rather than Sun, but you never know.

This assumes that the ParaPRO acquisition goes smoothly. There is always the chance that integration is harder than they originally thought.

Last (and most importantly) this ignores what I see as the largest risk to my capital, key man risk. If Mull or Jacobs leaves then I would seriously revisit my position. Though I don’t think either of them has plans to leave, things change. So I’m calling it out here.

Closing Remarks

There you have it. I think I am being quite conservative with my numbers and the potential with CPH is still large. Despite some trimming to manage position sizing along the way, I have topped up after this pullback. I really don’t see why CPH isn’t a billion dollar company at some point.

If you have an opinion on CPH, I would love to hear about it.

Thanks for reading.

Dean

*long CPH.to at time of writing

What is the math here? It is not clear to me: "Over the last 12 quarters Absorica revenue has averaged 1.43 million or 5.72 annualised.

Using the standard 15% we get 76.2 million potential"

Thanks for the update work.

There seems to be a note to self in there: "INSERT CHART" :)