*Disclosure: I own shares in CRON. I am not a professional. Please do your own due diligence.

Apologies if the prices not being exact. I am traveling in Japan and not keeping tabs on daily prices.

Price: $1.86 USD

Shares: 386 million

Market Cap: 718 million USD

Enterprise Value: -105 million USD

1 year performance: -19%

*All numbers in USD unless stated otherwise. I am purchasing on the Canadian exchange for my portfolio.

Why I'm Dipping a Toe into Cannabis—Starting with Cronos

There’s been a noticeable uptick in interest from smart, value-oriented investors in the cannabis space. The industry is deeply out of favor, and valuations reflect that. I’ve been looking across the sector and decided to take a basket approach. My first position is in Cronos Group (CRON).

For deep dives on CRON, check out previous work by:

Rather than repeat their excellent analysis, I want to share why I’m comfortable owning CRON at these levels, and how I’m thinking about the broader setup.

I am going to skip over the various use cases and testimonials and such. I think that information is best sourced elsewhere.

My Thoughts From a Top Down Perspective

Sector Setup: Bombed Out, But Turning?

1. An Uninvestable Reputation

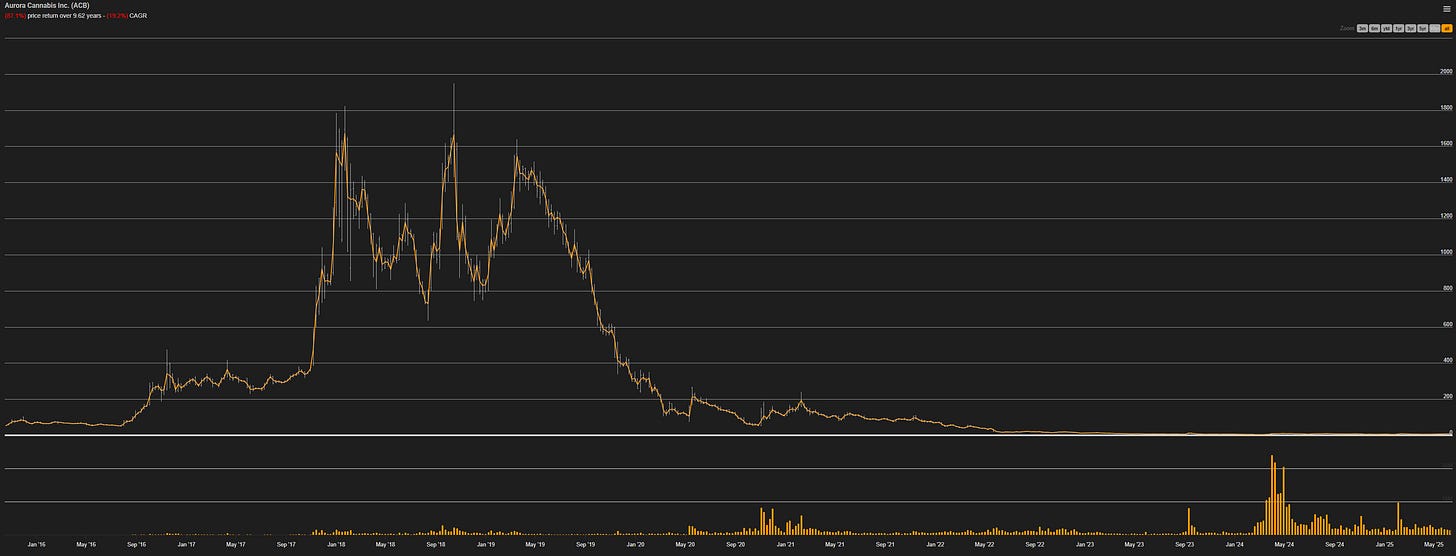

Cannabis stocks have been torched. Remember Aurora Cannabis? One glance at the long-term chart explains why the sector has been left for dead.

Back in 2018, I was still working in corporate and hearing from folks on the shop floor about “getting rich” off cannabis stocks. Legalization was supposed to mean infinite demand. Just as our friends did south of the border with SPACs in 2021/22, we Canadians proved we can incinerate capital with the best of them.

If Buffett once joked about shooting down the Wright Brothers, I wonder what he’d say about the cannabis gold rush.

2. Capital discipline is emerging

The industry essentially had capital rammed down it’s throat for 5-7 years. Everything and anything got approved with not much focus on the, you know, business side of things. It was really a focus on growing capacity in anticipation of demand. The last 12-24 months have been really difficult as a wave of bankruptcies has resulted in consolidation in the industry.

I have noticed that the tone on conference calls has shifted from funding capacity to responsible growth from the major players. This discipline is welcome as they will have a harder (if not impossible) time tapping the capital markets to fund side quests.

3. Prices are firming

As @ragingbullcap points out, prices have been firming in Canada. As much needed sign of stability. This is a very positive sign of a more balanced market.

4. Canada has the regulatory framework for legal commercialization

Despite all the dysfunction, Canada remains one of the few developed markets with a functioning regulatory framework for legal cannabis. That head start could turn into a competitive advantage as other countries move toward legalization.

5. Excise Tax may get reformed

There’s growing recognition that Canada’s cannabis excise tax regime needs reform. Most provinces support a coordinated federal approach. While nothing is official yet, this could be a long-term tailwind—though as I’ll explain later, it could also backfire.

Why Cronos Group?

1. Strategic Focus Across Consumer & Medical

CRON is active in both the consumer market (mainly Canada) and the medical market (primarily Israel, with expansion into Germany, the UK, and Australia). They aim to be as vertically integrated as possible. The majority of their product is produced by them with the remainder being provided by a JV with GrowCo. GrowCo.

2. Consumer Market in Canada

CRON has a few different brands that they use to market their products. The Spinach brand seems to be particularly strong as they boast about 5% flower marketshare in Canada (#3). There is mention of supply bottlenecks hurting marketshare in the last conference call, hence the investment in GrowCo. My personal channel checks show it having a strong shelf presence at the retail level here in Canada.

3. Medical Products: Anchored by Israel

The company has a about 30% of it’s revenue coming from Israel where they supply medical cannabis via their brand “Peace Naturals”. In Israel, the shift to more mainstream prescriptions for cannabis products has provided a tailwind for the industry. Israel has among the highest prescription rates in the developed world. The majority of external supply is from Canadian producers. It’s about 50/50 local supply vs external.

The growth rate has been high over the last year, but I hesitate to expect it to continue. Revenue from Israel was lower in 2023 than 2022 due to a variety of factors, including low pricing and a slowdown of patient permits. I don’t think we see a contraction in revenue, but a more moderate growth rate.

They have also ventured into other countries with their medical products, namely Germany, UK and Australia. Although they are not as material as Israel at this point, the initial rollout is just beginning.

4. Medical vs Consumer

The medical products come with higher gross margins, but carry operating costs that are not required for consumer based products. I have a tough time getting solid profitability numbers for CRON on each product line, although other LPs have stated that medical products have gross margin at 60-75% vs consumer at 25-45%.

5. GrowCo Relationship Secures Supply

The last couple of conference calls have mentioned a restriction in supply relative to the demand in the Canadian marketplace. The most recent announcement gives Cronos the option to purchase 70% of the expanded production facility.

6. Altria: Anchor Shareholder, Governance Influence

Altria originally completed a 2.4 billion (CAD) investment in CRON in 2019. They still hold about 41% of the common. They currently have three board members on the CRON board. This gives me some additional comfort that CRON won’t seek out poor acquisitions or unprofitable side projects. That said, Altria’s presence cuts both ways (see risks below).

7. Fortress Balance Sheet

The cash levels are well in excess of what the business needs. This helps insulate the business from poor industry conditions as they can withstand (another) downturn. As well, they could go on the offensive and deploy some of that cash.

CRON Specific Risks

International Tariffs or Protectionism

There could be a push from newly legalized markets or existing markets to have supply come from their own county instead of us friendly Canadians.

Competition in Canada

There is not guarantee of their brand value here in Canada. I personally don’t see any sign of significant brand value in Canada, yet. Of course this could just be my experience.

Capital Allocation Missteps

In an attempt to deploy the excess capital on the balance sheet, CRON could stumble. This reduces the large margin of safety in the bet.

Excise Tax “Reform” Could Be Negative

Though I have the potential reform of the excise tax as something positive, it could just as easily turn out to be negative. Never doubt us as Canadians to do something less than stellar and choke off an industry. Just look at how much we stifle growth in our own natural resources.

Key Management Turnover

I’m not very versed on the management team, but I thought I would call this out as a potential risk. The company could have the all the proper plans today, but a sudden change in management could be very disruptive to this.

Altria: Strategic Uncertainty

I stated the presence of Altria on the board as a positive, but I could be looking at this wrong. They did provide financing at a much higher valuation. They could also push to take this over just as the cycle is getting started.

A Note on Net-Nets…

I think it’s worth mentioning some nuances with net-nets and CRON specifically as we are trading at a small discount to NCAV. These are all my opinion.

Many net-nets are essentially just a bunch of working capital masquerading as a business. Slow moving inventory or poorly reserved receivables are not uncommon. CRON is not that type of net-net. The majority of the asset value is in cash. This is good in a sense that the stated value of the cash is much closer to reality than some stale buggy-whip that’s been sitting in a warehouse for 2 years carried at cost.

Many net-nets are bleeding cash and will eat into your margin of safety. On a ttm basis, CRON is losing money. The most recent quarter, they are EBITDA positive and it sounds like they will continue to run the business with cost discipline in mind. Though this is not guarantee that they won’t lose money or eat into their cash balance, I get some comfort that my margin of safety will not disappear in two or three quarters.

The net-nets with large cash balances can sit on the cash too long. That to me is a risk for CRON. There is a chance that that industry turns and CRON still has way too much cash for what the business needs. As well, if you put an EBITDA multiple on the business and add the cash balance, it doesn’t mean there is necessarily a ton of upside. So I could be right from a top down standpoint and miss the rising tide.

Closing Thoughts

Cronos is my initial foray into cannabis. I like the setup: a hated sector, a capital-light balance sheet, and a business trading below NCAV. I'm not banking on explosive growth, but I believe there’s asymmetric upside with reasonable downside protection.

Do you own CRON or any related cannabis stocks? What’s your highest conviction pick in the sector right now?

Thanks for reading my work

Dean

Glad to see more smart money looking at the sector! :-) I think your thesis is spot on. The main risk (or opportunity cost) I see is that the large cash position could create a significant drag on the share price even if the business fundamentals improve, so the upside might be limited (unless they do something accretive with the cash). That said, there seems to be extremely limited downside here. (No position)