*Disclosure: I own shares in DRT. I am not a professional. Please do your own due diligence.

1 year return: +128%

Price: $0.89 CAD

Shares: 195 million

I usually use diluted share count for this calculation. I believe that DRT is the rare example of using basic share count due to them having most of the dilution coming from convertible notes that I’m not sure will be converted (and net dilutive) given the recent transaction to retire convertible debt at a discount to their par value. I did add 2 million shares for DSUs and RSUs.

Market Cap: 173.6 million CAD / 121.6 USD

Enterprise Value: 194.7 million CAD / 142.7 USD

I stumbled on DRT while chatting with another investor about OneSoft. Another example of how having a good network pays off. I was fortunate enough to meet with management and even tour their facilities in Calgary.

TLDR

DRT has successfully executed a turnaround after the involvement of some activist funds starting in 2021. They are now a realigned organization that has a very strong value proposition to an industry that is ripe for disruption. The leadership team is thinking far into the future and overqualified for a business with this market cap. Valuation is very reasonable today and with modest growth, it’s dirt cheap (pun intended).

Background

DRT makes and sells modular/prefab interior construction systems. They utilize their ICE software to design, visualize, organize, configure, manufacture, price, and assemble the products. The solutions include doors, casework, electrical, networks, floor access, glass and a combination of several of the mentioned.

If you do a quick Google search using the words “Dirtt Environmental” and “activist” (or go find the filings on SEDAR) you will see a wee bit of drama in the form of a activist investor (22NW) beginning in November 2021. The initial request was to strengthen the board after several years of business underperformance and poor capital allocation decisions. Eventually in mid 2022 a new slate of directors was announced and the current CEO was brough on board. Since then, the business has gradually executed on a turnaround. I’m not going to spend any more time on the “turnaround” part of the investment as I think we have turned and should now be focused on sustainability and what the next 3-5 years brings for DRT.

The best place to get some background on DRT is to listen to the recent interview the CEO Benjamin Urban did with MicroCapClub on YouTube. He goes over the transition since he took the helm.

What sets them apart?

They have a very unique value proposition to the industry. It starts with their ICE software which is capable of very strong visualization of finished spaces as well as providing real time quotes to the finished build. The direct link from the software to the production floor gives DRT visibility on lead times for raw materials, labour, equipment utilization, etc. The customer gets a very accurate idea of the cost of a project with timelines. The products are extremely well made and durable. They customers can re-configure their space as their needs change. This is a very large selling point.

Given the design of the products, the set up and install time is substantially less than typical construction. If you think about this from a customer standpoint, if you can get a hospital or medical practice up and running a couple weeks or a month early, you can treat a lot of patients (and earn a bunch of revenue).

The main competition comes from the traditional construction industry. They have said it many times that they are competing with how the industry operates and slow adoption to change.

So you have the following main points on their value proposition and marketplace position.

Accurate end product pricing by aligning their ICE software with the manufacturing facilities.

Their lead times for products are substantially lower than typical construction. They have product delivered on site weeks or months sooner than traditional construction.

Strong continuous improvement mindset in their facilities to minimize waste and focus on meeting customer demands.

The products are versatile for any space and require substantially less personnel to install. This reduces the reliance on many different contractors on site to get to final install.

They provide training to installers to have them assemble and install the products as efficiently as possible.

They even schedule the product to be delivered on site in such a way to reduce waste of having something sit onsite before it’s needed.

Given the durability and ease of install, customers can reconfigure their space as needed.

DRT is also a great real world candidate for ESG investing. Their products are so versatile that they last many years and can be repositioned over and over. This is completely different than the traditional drywall walls that are scrapped every time there is a change. There has been some concerted effort to recycle drywall, however, if you drive by a construction site you will see the dumpster full of drywall.

Some business highlights

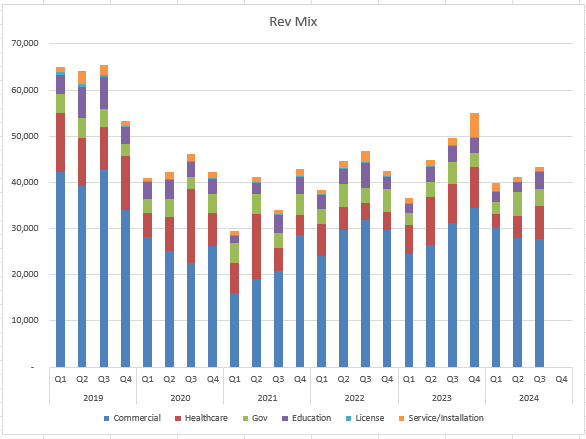

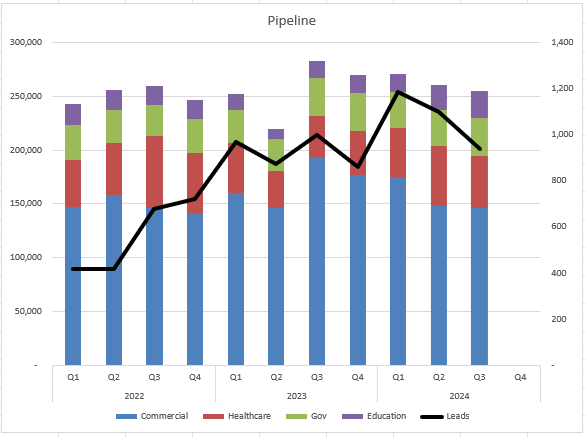

They sell into four different industries. The largest being commercial. The majority of their revenue is from the US. It should be noted that Commercial construction activity is experiencing a slowdown. I believe we are at or near a bottom in activity.

They also breakdown their leads and pipeline by industry. They have committed to continuing to give investors more visibility on their backlog in the coming quarters.

Balance Sheet

The recent rights offering was used to clean up some convertible debt. The balance sheet is now very strong. They mentioned that they are targeting less than 1x EBITDA turns in net debt by end of 2025.

Subsequent to the end of Q2 2024, they entered into a repurchase agreement with 22NW for the cancellation of around 32 million in debt (principal value) at around 68% of principal value. Given the guidance (more on in later) I am using about 21 million in net debt for them right now and expecting it to get trend down over time.

The debt remaining on the balance sheet is convertible debt that was issued in January and December 2021. The January debentures mature on January 31, 2026, have an interest rate of 6% and are convertible at $4.03. The December debentures mature on December 31, 2026, have an interest rate of 2.5% and are convertible at $3.64. There is 12.2 million and 15.5 million remaining on the January and December debentures respectively.

At the end of Q3 2024 they had 94.7 million of non-capital loss carry-forwards in Canada and $51.3 million of non-capital loss carry-forwards in the United States. The loss carry-forwards will begin to expire in 2037.

Share Structure & Ownership

The funds mentioned above (WWT Opportunity & 22NW) together own over 50% of the common. Despite lowering their cost basis by participating in a rights offering in 2023, I believe their cost basis is over 3x the current share price. WWT Director recently added with his own capital.

According to TIKR, the CEO, COO and CFO own 1.2 million, 1 million and 230k shares each. This adds up to about 1.3% of the common.

As always, I would like the C-suite to own more shares.

Management & Compensation

When you swim in the microcap waters long enough you get a sense of what kind of management team can run a business multiple times the current size, and I think the DRT fits team that description. My impression is that the current team is capable of running a (several) billion dollar company.

Benjamin Urban (CEO) came from Agile Interiors where he was a business development executive. He has been in the CEO role since June 2022. Agile is a customer of DRT’s. Urban was already well versed on the potential of DRT products. My assessment is that he has very strong operations and sales knowledge of this industry. Urban had to make some hard decisions since joining the company including closing their Rock Hill Facility and shifting production to Calgary.

Richard Hunter has been in the COO role since August 2022 and very recently he has been promoted to President. He brings an extremely deep knowledge of manufacturing with his experience at Danaher, General Motors and others. When I toured the facility in Calgary, I was very impressed by various continuous improvement tools being utilized. A few off the top of my head:

Major production projects where on a whiteboard with status updates, target dates and ownership.

Before and After pictures were on display for major improvement projects.

Preventative maintenance checklists were available and being used for equipment,

Employees received a cash compensation for improvement ideas that were implemented.

Production floor (or Gemba) walks where being done regularly.

In August 2023 DRT promoted Fareeha Khan to CFO. She has been with the company since 2019. She has a pretty geographically diverse background including starting her career in Zimbabwe. When I met Fareeha, she was very plugged into the business and seemed to really understand the value proposition to the customer. I usually don’t get that sense from microcap CFOs.

In October of 2022 the co-founder of DIRTT came out of retirement to return to the company. I am not sure of his role in operations, but I think it speaks to the uniqueness of the product and passion for the business.

Board

Since the success of the activists, the board has been overhauled. They now have a stacked board for this market cap.

The chair is Scott Robinson. He has a strong investment banking background and was interim CEO and board member of FullStack Modular.

The two major funds have board representation as well. Shaun Noll (WWT Opportunity #1 LLC) and Aron English (22NW) are also on the compensation committee.

The other members (Douglas Edwards, Scott Ryan and Shally Pannikode) bring various industry backgrounds and experience. All lend themselves well to who DRT sells to and where the business is heading.

Risks

There is obviously the short term risk to the commercial construction market. DRT has demonstrated an ability to grab market share in a down market, which is very impressive and hints at something special in their value proposition.

As with many microcaps, there is key person risk here. Given the momentum in operations and sophistication of the leadership team, I think if any of the C-suite left the company would struggle to keep this cadence of change.

I think something to watch for is adoption. A large amount of the story is multiple years in the future and the traditional construction industry is slow to change, so in order for this to be a multibagger from here, we need continued adoption.

Operational stumble as they grow. For this point I mean them having some sort of mis-step or sitting on their hands too long as they business grows. This could be taking too long to execute on geographical expansion, have delays in the purchase of another facility if/when it’s needed, or something else that I can’t think of at the moment.

Valuation

At the end of the Q3 2024 they issued the following guidance in USD:

2024 Revenue: $165-175 million

2024 Adjusted EBITDA: $12-15 million

2025 Revenue: $194-209 million

2025 Adjusted EBITDA: $18-25 million

Using these numbers I have them at about 6.5x EV/2025 EBITDA.

I know I know, “bullshit earnings”. But in the Q3 2024 press release this was specifically called out.

“with minimal capital expenditure needs in the short term and the availability of tax losses, we expect most of our Adjusted EBITDA will flow through to free cash flow.”

Shareholder Rights Agreement

From the latest MD&A:

On August 2, 2024, the Board of Directors adopted the Amended and Restated Shareholder Rights Plan (the “Amended and Restated SRP”) which superseded the plan adopted on March 22, 2024 and was approved by the Company’s shareholders at a special meeting held on September 20, 2024 (the “SRP Meeting”). The Company also entered a support and standstill agreement (the “Support Agreement”) with 22NW, DIRTT’s largest shareholder, and WWT Opportunity #1 LLC (“WWT”), DIRTT’s second largest shareholder. The Support Agreement replaces the previously announced support and standstill agreement entered into with 22NW on March 22, 2024.

I’m not 100% sure what to make of this. I think it says that the funds are comfortable with the management team and how the business is being run.

Lawsuit

It would be foolish of me to go over DRT without mentioning the open lawsuit. Here is some information copied and pasted from the Annual Report.

DIRTT is pursuing multiple lawsuits against its founders, Mogens Smed and Barrie Loberg, as well as Falkbuilt Ltd. and Falkbuilt, Inc. (collectively, “Falkbuilt”) and related individuals and corporations. DIRTT alleges breaches of fiduciary duties and non-competition and non-solicitation covenants, and the misappropriation of its confidential and proprietary information (in violation of numerous U.S. state and federal laws pertaining to the protection of trade secrets and proprietary information and the prevention of false advertising and deceptive trade practices).

DIRTT’s litigation against Falkbuilt, Messrs. Smed and Loberg, and their associates is comprised of three main lawsuits: (i) an action in the Alberta Court of King’s Bench commenced on May 9, 2019 against Falkbuilt, Messrs. Smed and Loberg, and several other former DIRTT employees alleging breaches of restrictive covenants, fiduciary duties, and duties of loyalty, fidelity and confidentiality, and the misappropriation of DIRTT’s confidential information (the “Canadian Non-Compete Case”); (ii) an action in the U.S. District Court for the Northern District of Utah instituted on December 11, 2019 against Falkbuilt, Smed, and other individual and corporate defendants alleging misappropriation of DIRTT’s confidential information, trade secrets, business intelligence and customer information (the “Utah Misappropriation Case”); and (iii) an action in the U.S. District Court for the Northern District of Texas instituted on June 24, 2021 alleging that Falkbuilt has unlawfully used DIRTT’s confidential information in the United States and intentionally caused confusion in the United States in an attempt to steal customers, opportunities, and business intelligence, with the aim of establishing a competing business in the United States market (the “Texas Unfair Competition Case”).

The latest update is that in February 2024 DRT

On February 4, 2024, the Company entered into a Litigation Funding Agreement with a third party for the funding of up to $4.0 million of litigation costs in respect of specific claims against Falkbuilt, Inc., Falkbuilt Ltd. and Henderson. In return, the Company has agreed to pay from any proceeds received from the settlement of such claims, a reimbursement of funded amounts plus diligence and underwriting costs, plus a multiple of such funded amount based on certain milestones.

I read this that they expect to receive more than the 4 million cost. Given the conservative nature of the management team at DRT, I wouldn’t be surprised if it’s quite a bit more than 4 million. I did not factor this into my valuation of DRT.

Closing Thoughts

I mentioned that I visited the DRT facilities in Calgary recently. It was honestly very impressive. I have not seen a facility that truly integrates the principles of Lean Manufacturing since my corporate job days. Below are a couple of pictures I took.

Turnarounds are always interesting. The largest (and most violent) gains seem to be at the very beginning when there is the largest risk. I think DRT is different. Shares have essentially tripled from their bottom, but I think there is more room for it to run. They are confident enough to issue guidance and backlog numbers when the largest industry they serve is facing some headwinds. I take that as a large vote of confidence.

Hat tip to Jeff, Trevor and the rest of the SCD team for help on this one.

Thanks for reading.

Dean

*disclosure – long DRT.to

I have spent a lot of time on Dirtt. I have a small position.

The op leverage here is real and exciting, and you rightly pointed that out. But they need to increase volumes to realize the op leverage.

What do you make of them suddenly releasing guidance not only for 2024 but also for 2025?

Coming into 2024, they did not give formal guidance but said they'd be about flat revenue. But then with formal guidance and reality, they are acknowledging they will miss 2023 revenue badly. Why would they then give blow out guidance in 2025 and what credibility does it have? Suddenly, they had visibility thru 2025 when they did in not have visibility in H1'24 for that half year? Odd, to say the least. I give zero credibility to those 2025 numbers, and I do not understand why they did that. Other than this mis-step, this management team has been about as competent as I have seen for a microcap. Incredible turnaround from the cliff's edge when they took over.

What a detailed write-up and thanks for writing this! Is there a price target that you're looking at?