*Disclosure: I own shares in DRT. I am not a professional. Please do your own due diligence.

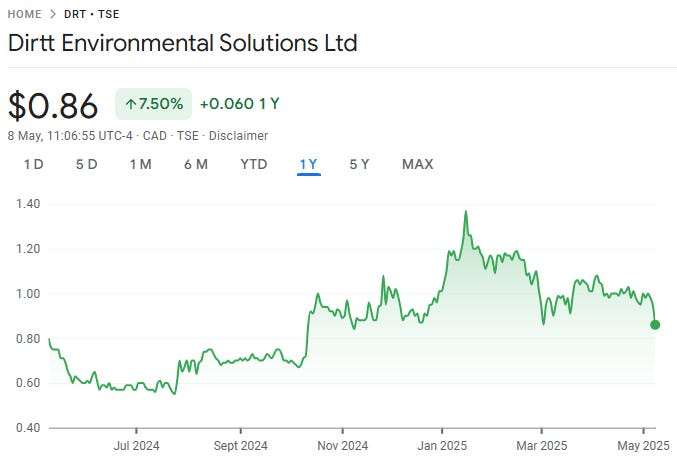

Price: $0.86 CAD / $0.60 USD

MC: 116 million USD

EV: 112 million USD

1 year performance: +7.5%

DRT reported yesterday after the close and held a call this morning. Results were in below my expectations and the stock is down 9-10% at time of writing.

*all numbers in USD unless stated otherwise

Quarter Recap

Revenue came in at 41.3 million or up 1%

EBITDA came in at 2.1 million

down from 2.7 million last year

Noted softening in leading indicators for the business

No significant cancellations at this put

Due to the uncertainty they are pulling guidance

Call Notes

Rev in line with expectations

EBITDA higher than expectations

Implemented measures due to increased prices that will start to show up in H2

Share purchases

4.6 million shares through private transaction and NCIB

NCIB expires December 2025

0.5 convertible shares NCIB

Convertibles NCIB expires Dec 2025

Increase in opex in 0.6 mil

Professional fees increased by 0.9 for share repurchase and litigation costs for Falkbuilt

0.5 lower compensation

Supply chain tariff impact

Aluminum - 25% tariff

aluminum is 10% of raw materials

looking to balance impact between the US and Canadian plants

145% on Chinese imports implemented after quarter end

They have 6% hardware for tariff

Q1 had higher costs of 0.6 million or 1.4% of revenue due to tariffs

They feel they will deliver positive adj ebitda this year despite guidance withdraw

Leading indicators

Above trend scheduling delays

Below trend signed awards

Unrelated to DRT specifically

No project cancellations or losses

Looking to apply Lean principles into back office

Integrated solutions team

Multiphase renovation in one of largest airports in US

5.2 million win as well

98.9% on time and full delivery

Valuation

I have them at about 10x EV/ttm EBITDA. I am not sure how the rest of the year plays out so I am hesitant to make many assumptions for 2025 numbers.

Closing Thoughts

The quarter was below my expectations. I was at some point expecting them to pull guidance given all the uncertainty with tariffs. The short term is cloudy for the business, so who knows how the shares will perform. I have a hard time seeing them catch a bid until we see some stability.

Having said that, the long term hasn’t changed for DRT and their value proposition. They are pulling the levers that they can to make their pre-fab solutions more competitive in the marketplace.

I think many investors are reluctant to own businesses where there will be a (potential) decline in profitability in the coming quarters. That is not the case for me.

Thanks for reading.

Dean

* long DRT.to