Thoughts on Market Activity

Nothing new. I am just doing everything I can to not overthink the current situation and stay in the market. I am happy with how the businesses I own are performing at the moment.

The next few weeks will see more companies report their Q2 which should give a better idea of who is really affected by higher costs.

Podcasts I Enjoyed

First episode of 50X - TransDigm: Foundations with Nick Howley.

This was a great and very valuable. I do not follow TransDigm very closely, but have heard some good things about their capital allocation. I appreciated the detail on company culture, decentralization, finding the right fit for positions, cutting out those who don’t “get it”, focusing in on what really moves the needle and their M&A strategy. It is simply amazing what TransDigm has accomplished with relentless focus on what they do best.

Twitch (Emmett Shear) on How I Built This.

I liked the history of the company. I found it interesting their journey when they tried to get to break even and had a “doomsday” clock and all hands on meetings. I also appreciated Emmett’s perspective on managing employees and how much it was crucial for his own personal development.

I did not expect to enjoy this episode as much as I did. It is amazing what can be accomplished if you relentlessly focus in your niche. Rolex makes not sells watches was something that stuck with me. I also did not appreciate how vertically integrated Rolex is. This is worth your time to listen to.

Christian Ryther on Value Hive

Water The Flowers & Cut The Weeds is something I struggle with. Getting past the desire to add to losing positions mindlessly or averaging up is very hard. I appreciate Christian’s honesty around the topic. Very relatable conversation for me.

Dan McMurtire on Infinite Loops

Dan has a knack for breaking down the current situation into something that is understandable. The comments around behavioral risk, stable coins, leadership, beta risk, dopamine manipulators and much more were discussed. Who you are comparing yourself to and information overload were worth a re-listen for me.

Company Updates

Pulse Seismic - $PSD.to

reported Q2 2022

It was weaker than I expected but the business is really lumpy even during good times

they are now debt free and cash will quickly start building on the balance sheet

Sangoma Technologies - $STC.to

no news but I expect them to let the market know how Q4 and full year results are shaping up given the long time between them reporting results

Firan Technology - $FTG.to

Reported Q2 2022

was a tad weaker than I was expecting

book to bill and backlog is the strongest in a long time and the outlook was positive

hope they deploy some of that cash and execute on the sale leaseback of Chatsworth to free up additional capital

Exco Technologies - $XTC.to

reported fiscal Q3 2022

results were inline with my expectations

noted decent demand outlook with some inflationary pressures rising

there has been some strong indicators from insider purchases this month

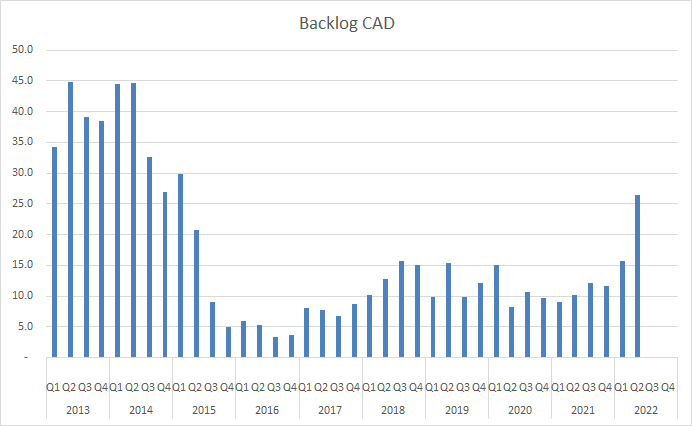

McCoy Global - $MCB.to

announced a large order and updated investors regarding their backlog

the backlog is the highest in many years

Long - $PSD.to, $STC.to & $SANG, $MCB.to

Loving these letters. Great collection of thoughts, internet pieces that stood out, etc.