*Disclosure: I own shares in ESI.to. I am not a professional (far from it). Please do your own due diligence.

Price: $2.32 CAD

Shares: 184.5 million

Market Cap: 428 million CAD

Enterprise Value: 1.460 billion CAD

1 Year Performance: -16%

TLDR

You are probably best to just skip this post and head over to Canadian Value Investors post(s) on ESI here and here.

Ensign is an other OFS so that has low expectations as we head (into what I think) is a better operating environment. Along with the potential material increase in earnings, they have a deleveraging angle. There are some well known large holders that I think prevent the downside.

If by chance you are interested, keep reading.

Background

Copied from TIKR:

Ensign Energy Services Inc., together with its subsidiaries, provides oilfield services to the crude oil and natural gas industries in Canada, the United States, and internationally. The company offers shallow, intermediate, and deep well drilling, as well as specialized drilling services, including horizontal, underbalanced, horizontal re-entry, and slant drilling for steam assisted gravity drainage applications; and equipment and services. It provides coring and oil sands drilling services to the mining, and oil and natural gas industries; directional drilling services; equipment rental services; shallow to deep well services, such as completions, abandonments, production workovers, and bottom hole pump changes for oil and natural gas producers; and interactive pressure drilling services with self-contained systems comprising nitrogen generation and compression equipment, and surface control systems. In addition, the company rents drill strings, loaders, tanks, pumps, rig mattings, blow-out preventers, waste bins, and wastewater treatment equipment for the drilling and completions segments of the oilfield industry. Further, it offers transportation and well servicing services. The company operates land drilling rigs, specialty coring rigs, and well servicing rigs. Ensign Energy Services Inc. was incorporated in 1987 and is headquartered in Calgary, Canada.

About 50% of the company’s revenue comes from the US. 30% from Canada and the remainder from their International operations in Australia, Argentina, Venezuela and Kuwait. Most of the US rigs are “high-spec” located in the Permian.

What sets them apart?

They have a fairly diverse geographical revenue base for a company this size. I think it’s important to note that they have sufficient scale on both the service and drilling side. Below are their rigs by geography.

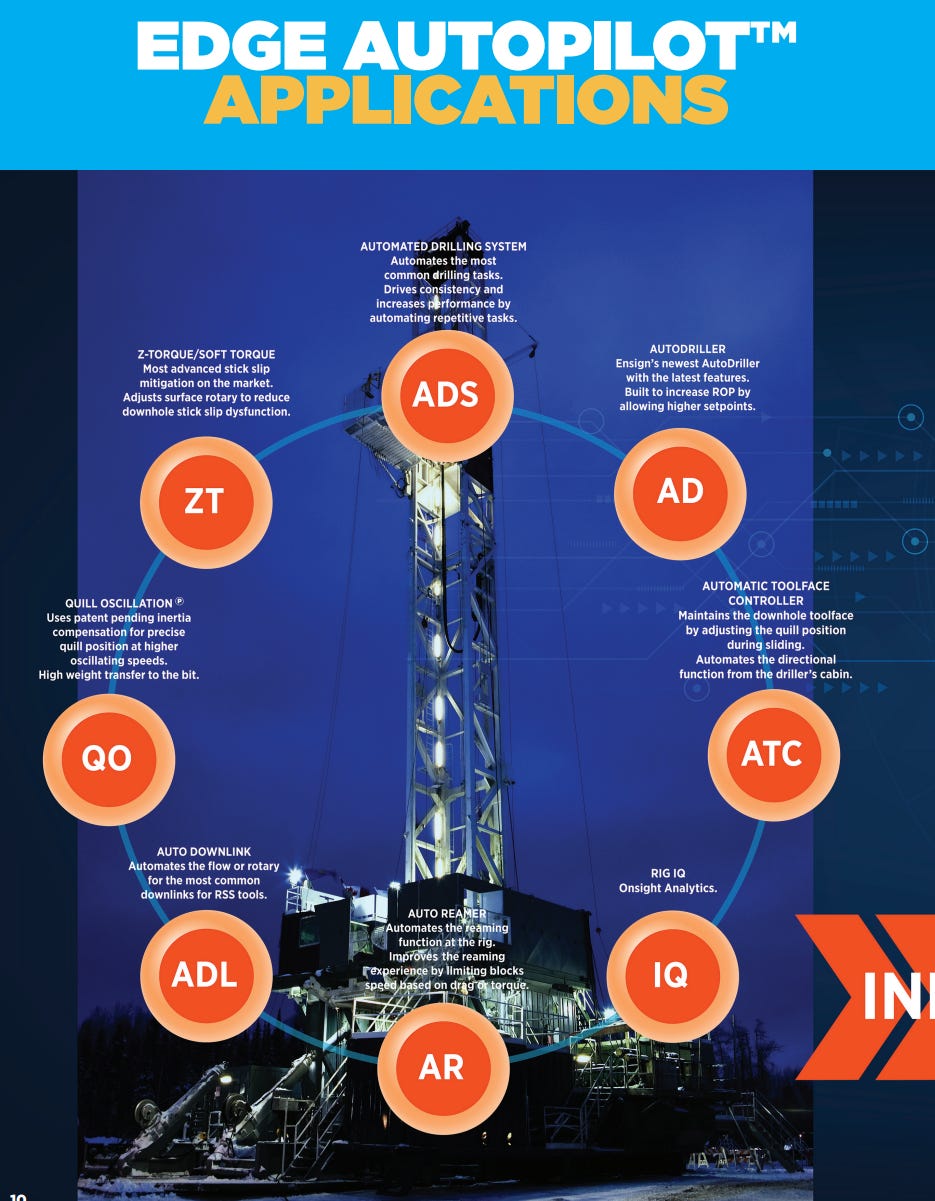

The company has invested in their EDGE AutoPilot platform that aims to automate certain process and streamline operations of a large rig. They are building out additional features and updates as they go. The result is better efficiency for the rig and higher day rates.

Balance Sheet

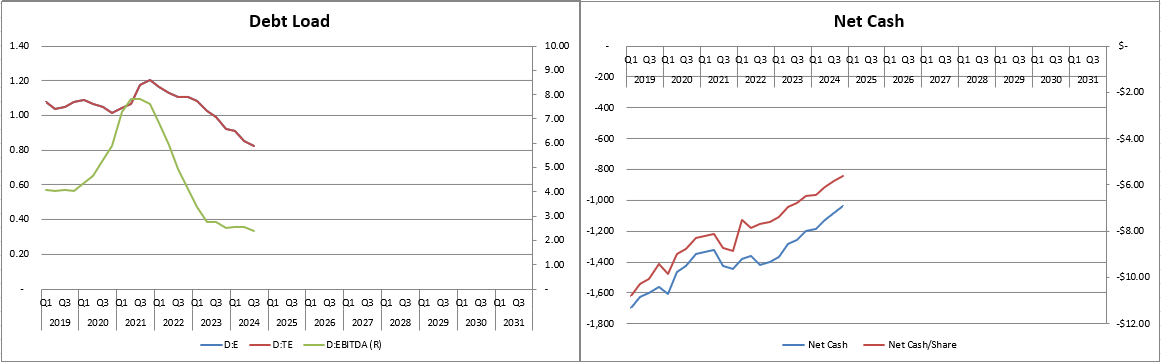

The balance sheet today is strong. Their net debt peaked in 2018/19 after the acquisition of Trinidad Drilling. The acquisition was originally announced in August 2018 and after some drama with Precision Drilling, ESI managed to get the shares tendered and replace the board. Trinidad was not doing well at the time and the purchase seemed reasonable to me at the time. Of course, it has not been the friendliest environment for OFS cos since 2019.

The company has been focused on paying down debt for the last number of years. You can see below the progress they have made.

They had a stated goal of paying off 200 million in debt in 2024 and 600 over the period from 2023 to 2025. They have hit the 2024 goal and should not have an issue meeting the 2023 to 2025 goal.

On December 31, 2024 they closed a $25 million placement of unsecured subordinated convertible debentures. The debentures have a 7.50% semi annual interest rate. They mature on January 31, 2029. They convert at $3.50. This results in a 3.72% (7,142,857 shares) dilution if fully converted. The shares closed the trading day at $2.98, so the conversion is a premium.

N. Murray Edwards, Barth Whitham, Darlene Haslam, Robert Geddes, Michael Gray and Trevor Russell, each a director and/or officer of the Corporation and certain subsidiaries of Fairfax Financial Holdings Limited ("Fairfax" and collectively with the other foregoing parties, the "Holders"), purchased $18,650,000, $1,500,000, $25,000, $262,500, $262,500, $100,000 and $4,200,000 of the Debentures.

I may be reading into this, but I think this is an easy way for the large holders to get more exposure to the business.

Share Structure & Ownership

There are currently just under 184 million common shares outstanding. On a fully diluted basis, it’s just over 184 million shares.

Fairfax originally converted the ownership of ESI’s convertible debt in 2022 at $1.75 and they have continuously added since then. Through their insurance holdings, Fairfax owns 36.5 million shares or just under 20%. Murray Edwards owns 43 million shares or 23.3%. This is without them converting any of the recent debentures. The 3rd largest shareholder is Barth Whitman who is classified as independent.

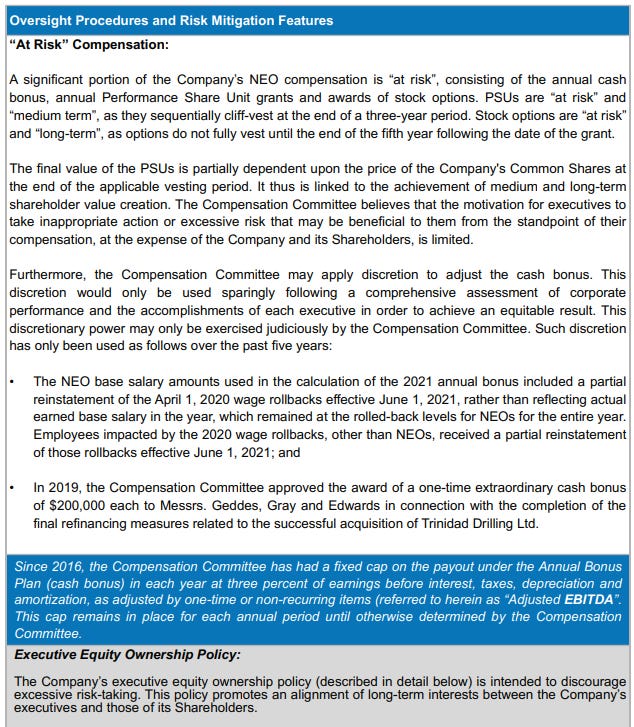

Management & Compensation

They don’t list anyone as CEO. I went as far back as I could to try and understand why they don’t have a CEO, but I couldn’t find anything. Robert Geddes is the President and COO. He has been with the company since 1991 and in this role since 2007. He owns just over 1% of the common and has more “at risk” than that. There is quite a bit of effort put forward by the compensation committee to align the executives with shareholders.

Geddes has around 1.5x his total comp from last year in value in the common. This is also over 5x last year’s salary.

The CFO is Michael Gray. He has been with the company since 2015 when he joined as the Corporate Controller. He has about 0.75x his salary currently in the common.

The other executives are well experienced. Of course, I wish they owned more of the common directly.

Board

Murray Edwards is chair of the board. As mentioned, he is quite popular among us Canadian investors.

The board consists of 10 members and brings lots of bench strength in the Canadian capital markets. Of course, this comes at a cost. Here is from the 2024 AIF:

Removing Edwards and the CEO from the calculation, the board owns about 3% of the common. Not bad for a company this size.

Risks

The largest risk is (obviously) drilling activity. This business will not do well if activity falls off a cliff. This could be due to some sort of economic shock or prices of oil or nat gas being too low to justify extraction. I think the largest risk to the economy in the short term is the trade/tariff risk from the orange man.

I think there is another potential take-under risk in this as well given the large ownership by specific individuals. I really hope we don’t get a repeat of STEP.

M&A risk is here. They could decide to take on a bunch of debt to purchase another business or assets. I don’t think this is a material risk, but I thought I would call it out.

I think a risk to ESI (and to the industry) is the players taking a big step back from the recent discipline they have demonstrated. If we get some sort of “race to the bottom” in day rates then I don’t know how ESI will perform. I don’t know the likelihood of this happening, but I thought it made sense to take note of it.

There is always the risk specific to the geographies that ESI operate in. There could be a favorable market where ESI doesn’t participate. They could redeploy rigs to other geographies, but I am not sure how much demand there would be for their specific rigs. At the time of writing, this isn’t a material risk.

Tariff/Trade risks are here. They would impact the entire industry and shake things up a bit. This could raise the cost of extraction for producers and hurt the rig count.

Lastly, there could be a risk from a capital markets standpoint. This would be them sitting their hands (and too much cash). I really like the deleveraging angle, but only to a point.

Valuation

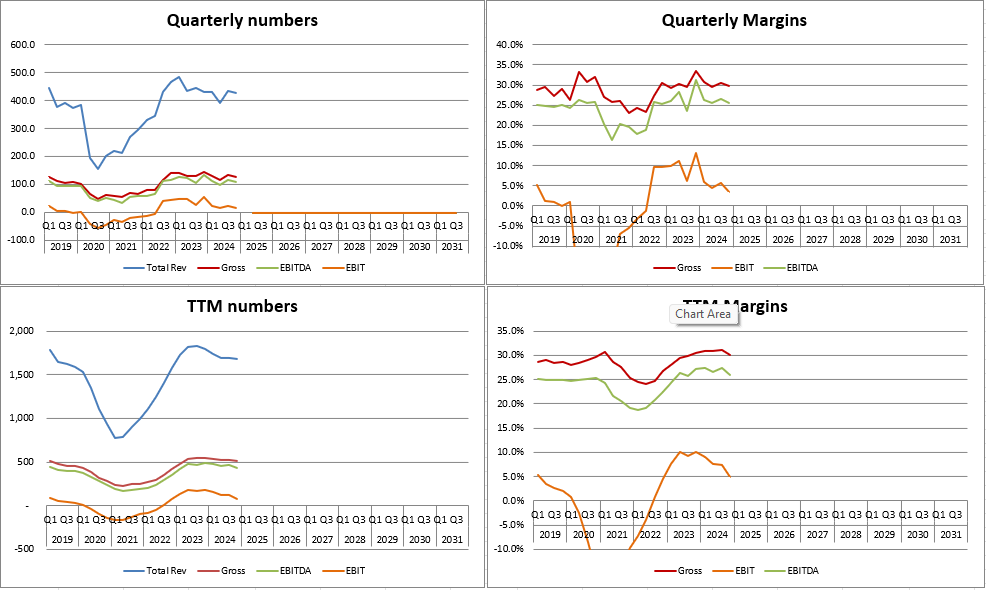

They are essentially trading at 1x EBITDA and 2-2.5x FCF. This includes interest payments for their debt, lease payments and capex. I have them at 3.3x EV/EBITDA and 7.6x EV/FCF, both on a trailing basis. At this point, I would just be happy if they repeat the 2024 numbers in 2025.

Most Recent Financials & Outlook

Like many other OFS cos, the income statement looks pretty decent. The business has performed better than overall activity levels.

The business does generate strong FCF as shown below. The FCF numbers below are after interest, lease payments and capital expenditures.

They noted that conditions are generally stable. They made note of how noisy things are with the on/off/delayed/increased/reduced tariff announcements. This tracks with what their peers have been saying as well.

Closing Thoughts

I think ESI makes a nice addition to my OFS basket. I like the exposure to activity in North America and other stable geographies coupled with them deleveraging. Edwards on the board helps me sleep at night when it comes to their capital markets decisions.

Thanks for reading my work.

Dean

*disclosure – long ESI.to

Look at TOT. Has much less debt and better profitability. Although I sold, as I'm too exposed to O&G.