Price: $2.50 CAD/$1.72 USD

Shares: 100.7 million fully diluted

Market Cap: 173 million USD

Enterprise Value: 249 million USD

All amounts in USD from here.

The company was mentioned on BNN yesterday so it popped by 10%.

FAR was brought to my attention from the IR firm Bristol. Bristol covers VMD (which I own) and HTL (which I follow somewhat closely).

Background

Foraco International SA, together with its subsidiaries, provides drilling services worldwide. It operates through two segments: Mining and Water. The company offers its drilling services to the mining and energy industry, such as exploration, development, and production related drilling services. It also drills wells for drinking, irrigation, and industrial water; and undertakes a range of projects, including village water drilling programs, specialized drilling projects to access mineral water using sanitary protection methods, and large diameter well fields for residential supply in urban environments, as well as provides inspection, servicing, and rehabilitation services for existing wells. In addition, the company offers drilling services offered to the environmental and construction industry such as geological exploration and geotechnical drilling. It serves mining, geological, and hydraulic drilling sectors. The company was founded in 1961 and is headquartered in Marseille, France.

Some highlights of the business:

Third largest drilling services contractor worldwide by number of drills. (According to them, I didn’t verify this)

Leader in ground water drilling and monitoring.

Global presence, operating across all mining regions including Canada, Australia, Chile, Brazil, West Africa and CIS.

Over 2,900 employees and 302 rigs.

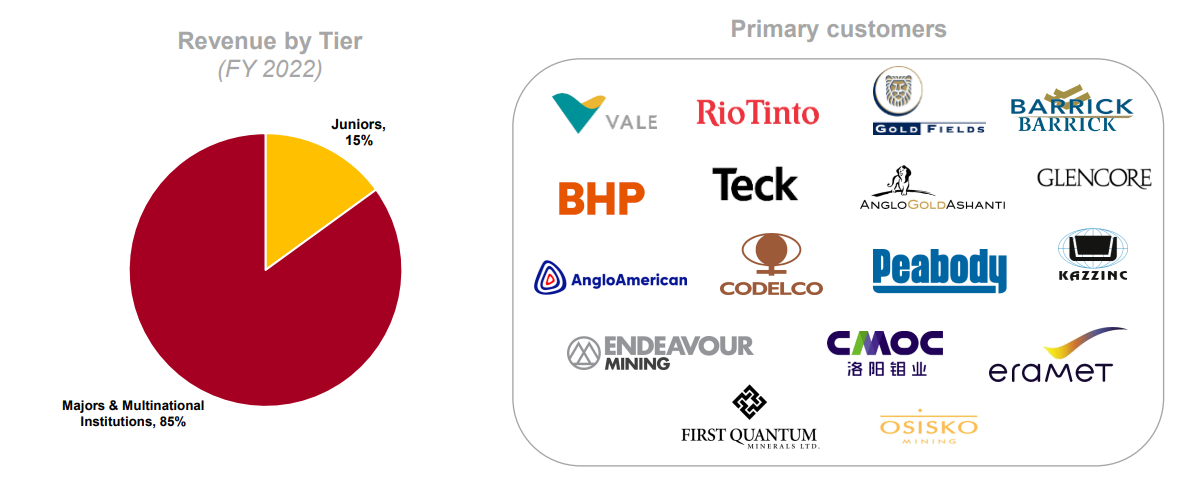

Customer base includes Vale, Rio Tinto, Teck and BHP among others.

Having a worldwide presence reduces the seasonality of the business.

They target larger players or Tier 1 customers with more stability and less exposure to the capital markets. The larger customers are likely to have a performance portion (likely in the form of meters drilled) of the contract, which incentivizes FAR to perform for the customer. The juniors are more exposed to the capital markets and typically rely on raising capital to fund drilling.

Segmented Results

Mining covers drilling services offered to the mining and energy industry during the exploration, development and production phases of mining projects.

Water segment covers all activities linked to the construction of water wells leading to the supply of drinking water, the collection of mineral water, as well as the control, maintenance and renovation of the existing installations. This segment also includes drilling services offered to the environmental and construction industry such as geological exploration and geotechnical drilling.

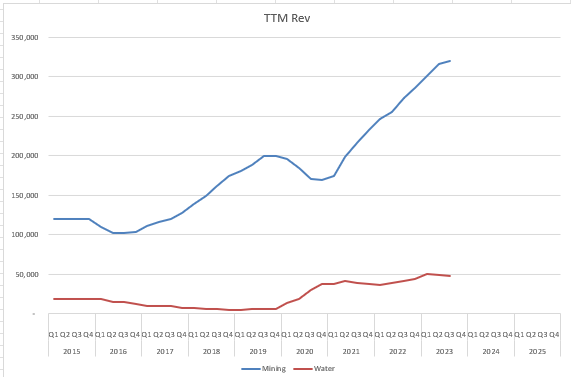

Revenue from the Mining segment is roughly 4x the Water segment. Mining has been the growth driver of the business while Water has stagnated over the last few years.

Though it’s more volatile and cyclical, Mining now has similar metrics to Water. Water has been less volatile in activity.

The company splits up it’s revenue by geography as well. As you can see strong growth from North and South America has more than offset the decline in EMEA, which has exposure to CIS (Commonwealth of Independent States). The CIS has seen a decline from it’s peak in 2021. I think the CIS activity may be at or near a bottom from here.

Finally the breakdown by commodity type. They are mainly exposed to gold and EV metals (Copper, Nickel, Cobalt and Rare Earths).

I’m not going to insert a bunch of gold and copper charts here showing supply/demand. If you own FAR, you will need to be comfortable with the exposure to these commodities.

Some Business Highlights

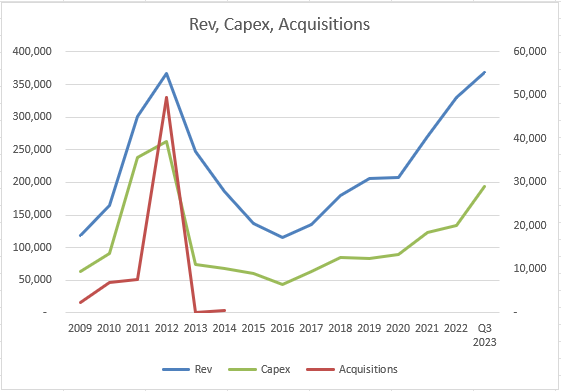

The company has been working on a turnaround since 2017. As you can see they bumped around EBITDA breakeven. They were getting to well above break even EBITDA as the pandemic set it. As renewed interest it the sector continued after the initial shock of the pandemic, FAR has scaled it’s operations better.

The rig fleet has remained consistent in numbers. As older equipment retires they have been replacing them with better or upgraded rigs.

Despite the increase in activity in the industry, there has not been a huge influx of equipment coming to market and thus their contracted rates remain consistent.

Balance Sheet

The balance sheet in the past looked quite different than today. Here is a quick look at the obligations at YE.

The company was acquisitive during the stronger market in 2012/13 or roughly 1.5 lifetimes ago. This peaked in 2012 with 49.4 mil spent on acquisitions. Which (with hindsight) was poorly timed. Note the Capex and Acquisition numbers are on the right.

Since then the company has been more conservative with capital allocation. The debt overhang was reduced with a financial reorganization in 2021 that included a slug of capital (9.3 mil shares at $1.80) to fund early redemption of their euro-denominated bonds. These bonds were bonds raised in 2017 from affiliates of Oaktree Capital Management, L.P. (“Oaktree”) and Kartesia Securities IV S.A. (“Kartesia”).

The company further reduced their cost of debt in November 2023 with the early redemption by securing new long-term bank financing from Desjardins and Caisse d'Epargne. This should reduce annual financing costs by 7 million or about 50% compared to ttm.

Capital Structure & Ownership

As of the time of writing there are 98.6 million shares out, with the fully diluted count standing at 100.7 million. The company has been buying some shares via an NCIB.

The founders of the company own a combined 33% of the business. Daniel Simoncini (former CEO) owns 13% and Jean-Pierre Charmensat owns 20%. Neither has sold a share in the last couple years.

Another firm owns nearly 4% of the outstanding (Rutabaga Capital Management). This represented about 3.6% of the reported assets for Rutabaga when last reported. They are a fairly concentrated fund with a focus on turnarounds.

Management & Compensation

The founders have stepped down from their operational roles. In 2023, Tim Bremner was promoted from within the company. He has been with the business since 2006. He owns about 421,975 shares or 0.4% of the outstanding.

Fabian Sevestre has been promoted to CFO. He has been with the company since 2001. He owns 173,700 shares.

As well another additional announcement was Olivier Demesy as SVP Latin America, Europe, and Africa. He has been with the company since 2011.

I view these changes as positive. I think this brings some new life into the business. I like the internal promotions for a company that is looking to be run conservatively. I am interested to see how they deal with allocating capital and the capital markets.

Board

Not a ton to report here. Collectively outside of the founders the board owns about 1% of the company. Kartesia still has a representative on the board (Jean Diercxens).

Risks

Cyclical business.

Balance sheet is still somewhat levered at around 1x debt/EBITDA.

The founders could decide to exit their position and there may not be a market for the large amount of shares.

The narrative around gold regardless of the spot price may mean the business performs well, but the stock never catches a bid.

Outside of the founders, the board does not own many shares.

The conservative capital allocation may mean they should increase capital deployed into the equipment more than they have been.

A bit over 50% of the workforce is unionized and there could be labour disruptions.

The long term contracts rolling off in the near term may have been priced at better day rates that aren’t repeatable. I don’t think this is the case, but it is a risk nonetheless.

Valuation

TTM P/EBITDA and EV/EBITDA at 2.0 and 2.7.

It looks better using analyst estimates for 2024.

P/FCF and EV/FCF at 4.8 and 6.9. I have lowered the interest expense for this to reflect the most recent debt financing.

*Some of these are estimates and approximations by me.

My Thoughts

I think it’s important to ask “why does this opportunity exist?” or “what does the market see that I am missing?” I can think of a few reasons why FAR is trading here at this valuation.

Cyclical and the market isn’t sure of the activity moving forward.

Many institutional funds have little interest in drilling companies.

The balance sheet expansion at the top of the market cycle in 2012/13 has some investors tepid.

It’s a Canadian microcap.

There are not a ton of free shares outstanding to take a position.

They have gold exposure and gold is yucky to millennials.

It’s not one of the MAG7.

When I look at the above, I can use my imagination and conjure up a potential narrative shift for FAR and similar companies.

As I mentioned, the recent management change is welcomed by me. I think they are solid operators with a conservative mindset. I expect the company to continue reducing the amount of debt outstanding and/or buyback shares. Regardless of what is mathematically optimal, returning capital is welcomed. They were burned in the past and I can’t see them repeating it. They could also pursue a listing on an exchange that is more welcoming for drillers.

I like the exposure to the different commodities with FAR. Regardless of what you believe with the transition to a “greener” future (and I use this term very loosely), FAR stands to benefit as many of the commodities they are exposed to are key inputs for the focus on renewables. They also have a fairly high gold exposure, which is something I expect to do well from here.

In order to own this you have to be a believer that activity levels haven’t peaked and that the market participants are not going to bring on equipment that is supported by cheap capital. This is a cyclical business of course. FAR replacing retired rigs rather than just expanding their rig count is an example.

I know FAR may not be a sexy business, but it makes money and has some narrative headwinds that I think may change as they execute. However you look at it, ROE, ROA, ROIC are all high and trending in the right direction.

Thanks for reading.

Dean

*disclosure – long FAR.to

Nice timing on the write-up!

To what extent do you think the margins from the last two years are sustainable? What has driven the increase in margins?

Interesting company, thanks for sharing the write-up.