*Disclosure: I own shares in FAR. I am not a professional. Please do your own due diligence.

Price: $1.78 CAD / 1.32 USD

MC: 132 million USD

EV: 199 million USD

1 year performance: -39.5%

Ooooof. FAR reported yesterday morning and held a call. Results were behind of my expectations and the stock ended down 3.3% yesterday.

*all numbers in USD unless stated otherwise

Quarter Recap

It should be noted that the company telegraphed a weak Q1 on their Q4 2024 call

55 million revenue vs 77.1 million last year

7 million ebitda vs 15.1 million last year

EBITDA margin at 12.5% vs 19.9% last year

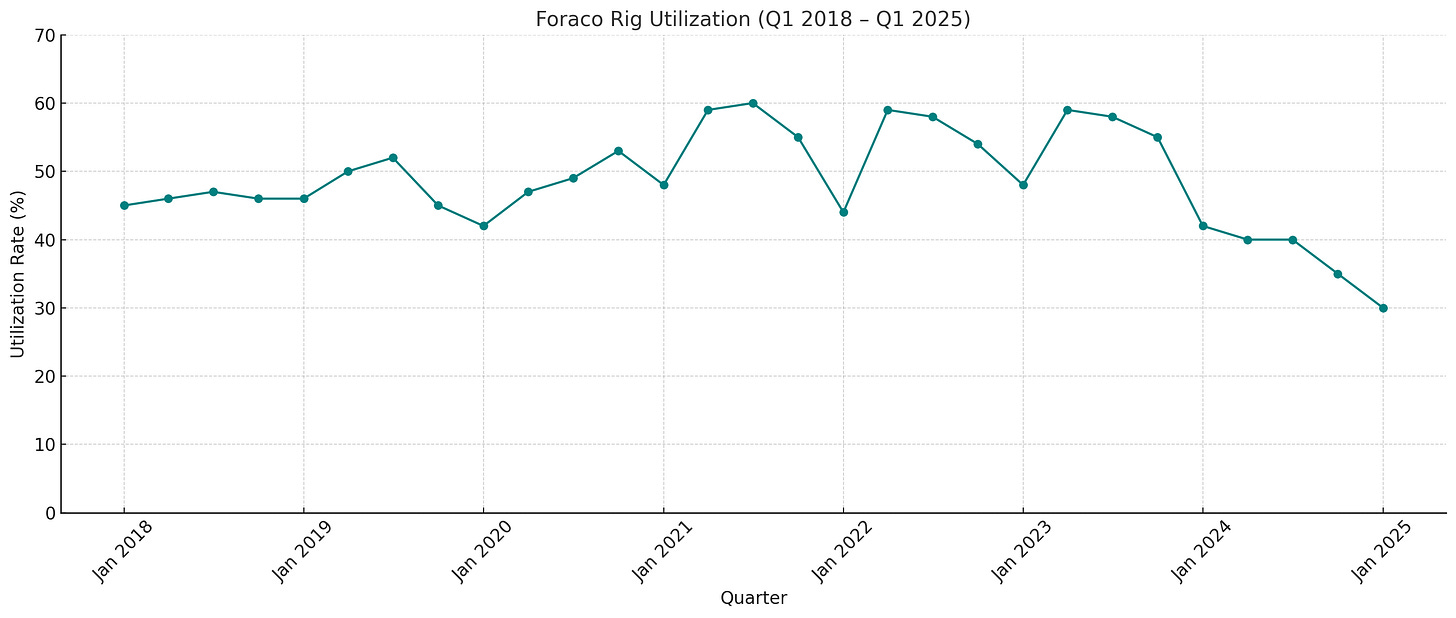

Utilization was only 30% vs 42% last year

this was the lowest utilization I have seen from the business

Geographical revenue

EMEA at 6.4 million vs 9.8 million

South America at 10.1 million vs 25.6 million

North America at 18.1 million vs 27 million

Asia Pacific at 20.4 million vs 14.7 million

Below is the ttm revenue for the different geographical regions

Call Notes

They went through some details on the slow quarter

Some contracts that expired weren’t renewed immediately in several jurisdictions

Some projects (South America specifically) were concluded in Q4

North America is not ramping as they had anticipated

Juniors were weak, though that has been the case for some time

Sounds like some rigs where idle all of January and February with some gradual return to work in March

This would be particularly hard on their utilization rate

There was lots of time and energy spent emphasizing that this quarter is not indicative of the year

They are still confident in the North America potential (specifically US) despite not wining a major contract

It sounds like South America is ramping up this quarter

Capital allocation will be the 14 million debt payment this year then equipment

Commodity mix is: water 21%, gold 18%, copper 24%, nickel 17%, iron 15%, coal 3%, other 2%, lithium 1%

There was mention by one of the analysts that Major Drilling was potentially seeking lower rates and hurting the market for FAR

This is the first I have heard about this

Valuation

They are trading around 4x EV/ttm EBITDA. Given how Q1 played out, I am not expecting growth in full year 2025 numbers, but the language on the earnings releases throughout the year will be critical.

Closing Thoughts

I’m still torn with FAR. It’s in between a full position and starter position for me. Like everything else, much of FAR’s business was “liberated” on Liberation Day. Since then there has been a bounce back, although no commodity is hitting new highs other than gold. Iron and nickel are well below the price they were 3 years ago, copper is up a bit, and gold is way up. So a mixed bag for sure.

I reread the MDI Q3 F25 call transcript again to see if there was something I was overlooking. They also noted a slower start to the calendar year and lack of activity from the juniors. There wasn’t mention of rates on the call.

Having said all that, expectations are low here in my opinion. If this is the bottom for the business and we can grind higher from here, I think it’s worth holding. I will give the business another quarter or two, unless I find a better bet for my capital.

Thanks for reading my work.

Dean

* long FAR.to