*Disclosure: I own shares in FAR. I am not a professional. Please do your own due diligence.

Sorry this is late. Life has me pretty busy over here.

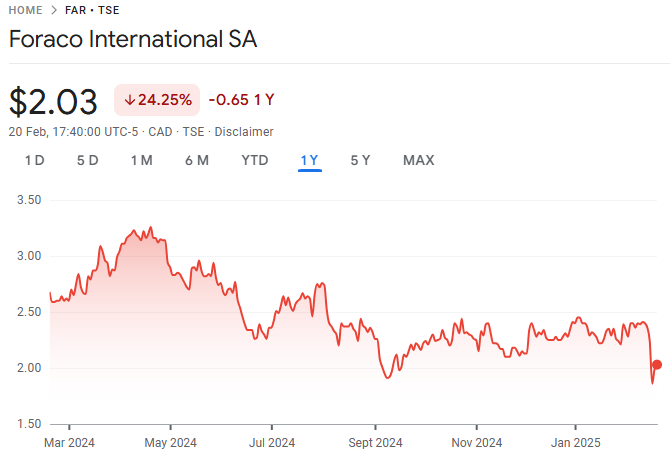

Price: $2.03 CAD/$1.56 USD

MC: 156 million USD

EV: 215 million USD

1 year performance: -24%

FAR reported yesterday morning and held a call afterwards. Results were well behind my expectations and the stock was down 16-17.% on the day.

*all numbers in USD unless stated otherwise

Quarter Recap

Revenue came in at 60.8 million vs 86.6 million last year.

Rev drop of 25.8 million resulted from:

continued decline in Junior activity due to lack of financing (US$ 7.0 million),

the exit from Russia (US$4.8 million),

phasing of contracts with Majors (US$11 million) and

(iv) negative foreign exchange (US$ 3.0 million).

EBITDA came in at 10.4 million vs 18.7 million last year.

North America revenue decreased by 10% to 23.5 million.

Due to contracts phasing out.

Asia seen a strong quarter with 28% increase in revenue to 22.4 million.

South America revenue was 9.9 million from 31.8 last year.

EMEA revenue was down to 5.1 million from 12.4 last year.

Utilization at 35% vs 55% last year.

Call Notes

The year is starting off slower than typical.

They had a 10 million receivable delay that has since been resolved after quarter end.

Sounds like improvement in the business will be in the back half of the year.

The debt terms dictate that they can only pay 14 million per year.

There will be some impact from tariffs, but it sounded like it would be an industry wide issue. So they would not be at a disadvantage.

The tone for Q1 was pretty muted.

Valuation

I have them doing about 300-310 million and 60-65 million in EBITDA in 2025. This puts them at about 3.4x EV/EBITDA. It’s toward the lower end of the valuation range from the last 3 year.

Closing Thoughts

That quarter was not what I was expecting. Given the tone on the last call, I was expecting muted performance. FAR has essentially half of their revenue coming from “battery metals” or copper, nickel and lithium. They have around 15% from gold. We all know that gold is doing well, but the juniors have not kept pace with the performance in the metal. Here is the last 5 years of gold performance (GLD) relative to the miners (RING).

The charts for copper, nickel and lithium are shown below.

The copper chart looks much better than nickel. And nickel looks much better than lithium. In order for FAR to work from here, I think we need to see copper and nickel trend higher and for lithium to at least stop dropping. This is something you will have to get comfortable with.

Thinking about this from the geographical mix standpoint, I think the bar is low for EMEA and South America here. They may not have a massive rebound in revenue, but their impact on consolidated revenue today is much less than a year ago.

FAR was not a big position, so I am debating adding here or giving it a couple quarters.

Thanks for reading my work.

Dean

* long $FAR.to