Geodrill - $GEO.to

For some reason pretty much nobody on Fintwit has been talking about the recent rise in inflation (sarcasm). This has led many investors to look at ways to provide a hedge against inflation. Many gold bugs will tell you that gold has been a good hedge against inflation. Some also claim that it's a good hedge against several apocalyptic doomsday scenarios. If we do have an apocalypse and I happen to survive, I would probably rather have a hen then a rock, but I digress.

If you believe that gold provides and inflation hedge and you feel that inflation will continue to run above trend, I have a company that may interest you.

Goedrill - $GEO.to

Price: $2.38 CAD

Shares: 45.8 mil

Market Cap: 109 mil CAD

EV: approx 75 mil CAD

Insider ownership: 48%

I actually used to own GEO way back before we even knew what the word disruptor meant.

Background

Geodrill Limited, together with its subsidiaries, provides mineral exploration drilling services to mining companies in West Africa, Zambia, and Peru. It offers reverse circulation, core, air-core, deep directional, reverse circulation grade control, water borehole, underground, mine blast hole, and horizontal drilling services. The company operates a fleet of multi-purpose, core, air-core, grade control, and underground drill rigs; boosters and auxiliary compressors; and various support vehicles, such as pick-up, MAN, and other trucks, as well as purpose-built crawler-mounted support vehicles and bell tractors. As of December 31, 2020, it operated a fleet of 68 drill rigs. The company was incorporated in 1998 and is headquartered in Douglas, Isle of Man.

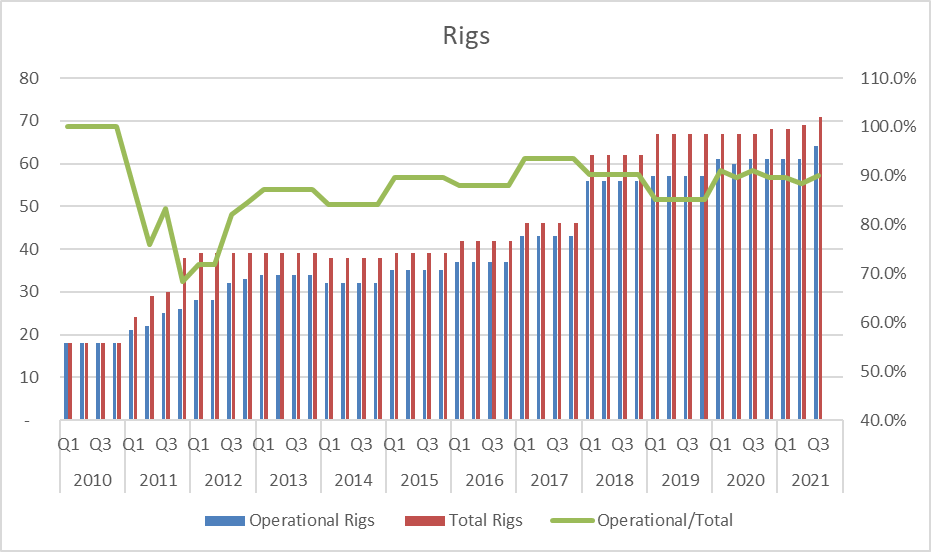

The company has been through a few cycles and has been managed well enough to survive and increase their rigs steadily. The company produced cash every year (before working capital adjustments) since 2015. Obviously they are tied to activity in the precious metals markets.

Rig Fleet

As mentioned, the company has added rigs consistently over the years.

Maintenance on the rigs is primarily done during the wet season, which is in Q3 or Q4 each year. The company has worked hard to standardize each the fleet of rigs to reduce complexity in operations and support increased uptime. They have a large maintenance facility in Africa to support the rig fleet.

Management

The company was founded by the CEO, Dave Harper. He has been through a few cycles and his interests should be aligned with shareholders as he holds 40% of the shares outstanding. The COO owns about 5% of the outstanding shares.

Risks

This is a driller tied to a commodity. For the last 10ish years, it's been fashionable to avoid these types of businesses. They are capital intensive, subject to inflation, and reliant on miners getting reasonable financings to drill for more of the stuff in the ground. As well, there is no guarantee that how gold performed in previous cycles will happen this cycle. They also have heavy exposure to markets that are not always hospitable to businesses, so there could be disruption at any moment.

Mariusz Skonieczny did a whole series on why he hates gold miners, and even mentions a former peer to GEO. This corner of the market is not for the faint of heart. As many have pointed out, there is a tendency for cyclical companies to invest heavily in expanded their equipment at the same time the forward ROIC on such assets is at the lowest. Not saying that's what happens here, but it is a risk.

There is always the risk that gold has lost it's luster with the rise in crypto assets.

Valuation

At today's price you are paying about 5x FCF for GEO. If we are entering the peak of the cycle then 5x earnings is as good as it's going to get.

The company recently announced a couple of contract wins that demonstrate that the top line should continue to grow in 2022 and 2023. This also demonstrates some geographical diversification.

US $45 mil for 15 rigs until Aug 2023

US $54 mil over the next 5 years

Summary

Shares are cheap looking backward and cheap on estimated 2022 numbers. The company has done a good job of reducing their reliance on junior miners who need to access the capital markets consistently. The balance sheet is conservative and management is aligned with shareholders. Gold tends to behave differently than much of my portfolio so I like the position from a portfolio construction standpoint. Of course, position size needs to be managed. It needs to be stated again, you are making a bet on gold here.

Here is a recent interview with the CEO on Radius Research.

Here is their most recent investor presentation.

geo-investor-presentation-jan-2022Download

Anyone else follow GEO?

Thanks,

Dean

*long GEO at time of writing