*Disclosure: I own shares in GEO. I am not a professional. Please do your own due diligence.

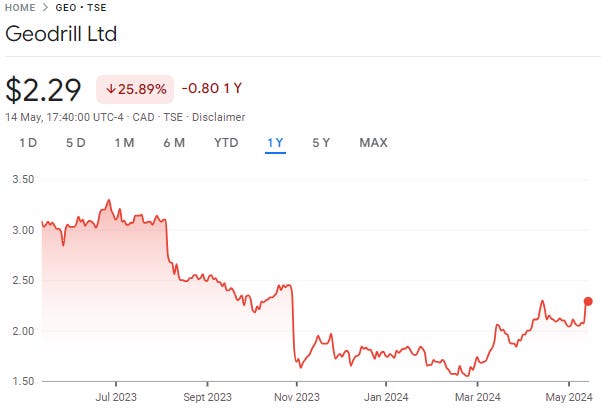

Price: $2.29 CAD / $1.64 USD

MC: 83.6 million USD

EV: 86.4 million USD

1 year performance: -26

%

GEO reported Monday morning and held a call. Results were ahead of my expectations and the stock was up over 6%.

*All results are in USD unless stated otherwise.

Quarter Recap

Revenue was 34.7 million vs 37.6 million last year.

Down 8% yoy.

Gross Profit was 27.2 million vs 25.4 million last year.

Up 7% yoy.

EBITDA was 6.7 million vs 10.5 million last year.

Down 36% yoy.

They mentioned that they have secured long term contracts in West Africa for 150 million over 3-5 years. This includes from a new customer as well.

They spent much more on capex this quarter than I was anticipating. They mentioned that it’s to support multi-year contracts.

Capex was 4.8 million compared to 3.1 million last year.

This included purchasing 5 used underground rigs and ancillary equipment for 1.9 million.

0.6 million was for purchasing ancillary drilling equipment for multi-rig, multi-surface equipment.

They now have 89 rigs.

They mentioned continuing to shift towards majors.

Call Notes

The tone and outlook was positive.

January started slow but the quarter ended with some nice momentum.

There was nothing else on the call and there were no questions from investors or analysts.

Valuation

On a ttm basis I have GEO at about 3.9x EV/EBITDA and 15x EV/FCF. Not cheap. Having said that, 2024 estimates have them at about 3.2x EV/EBITDA.

Closing Thoughts

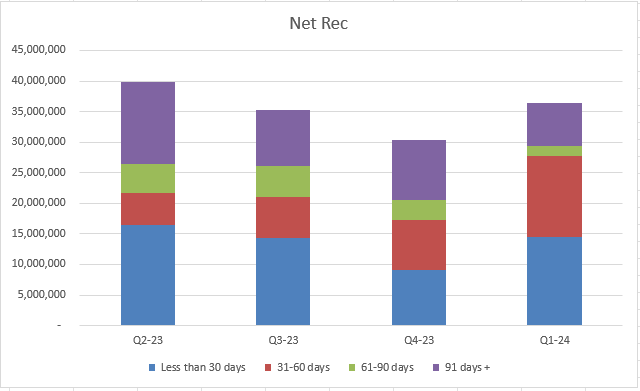

The company continued to make the shift to majors and get the receivables under control. It will take time, but progress is progress. The provision was 5.6 million, which is up slightly from 5.5 million last quarter. It’s down from 6.2 million in Q3 2023. I’m hoping that in 4-5 quarters we are back to a low provision number.

I’m not a fan of the share count continuing to rise on a diluted basis. The market really doesn’t like gold miners (or drillers) at the moment. So there could be a narrative shift.

Thanks for reading.

Dean

* long GEO.to