How the mighty have fallen...Hanfeng Evergreen

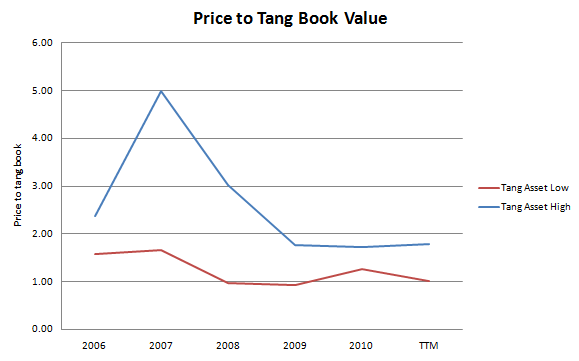

When you first start investing you go through a couple of phases before finding exactly what type of investor you are. Sometimes the phases take a few months, other times they take a few years. When I first decided that I wanted to learn how to pick stocks, I started watching lots of financial TV. Listening to the "experts" talk about what they thought was going to happen next was what I thought you were supposed to do. Everyone seems to believe that you have to be able to predict the future to earn a decent rate of return. There is very little focus on risk. Sometimes I comb over Stockchase.com to see what the talking heads have to say about the company I'm interested in. Here is the link for Hanfeng Evergreen (HF.to). It's funny that the higher the price (and higher the risk) the more bullish the comments. It's also nice to see that most portfolio managers say they sold out before a big crash, yet their fund underperformed. At the height of the leveraged economic expansion, commodities and China were the place to be. Hanfeng was a favorite, trading as high as 5x tangible book value or $15/share. Nothing seemed to stop the run in commodities...until Lehman went bankrupt. All of a sudden the "risk trade" was over, and everything was sold indiscriminately. It hasn't been until the last year or so that the real differences in good and bad businesses in agriculture (and China) have been brought to the surface. HF seems to be somewhere in between. Before I roll up my sleeves and get my hands dirty with HF, I want to take a quick look at the industry again.

The push for the large fertilizer producers has been to build bigger and more efficient plants. Production can easily be 100,000 mtpa (metric tonnes per annum) on newer plants vs. around 20,000 mtpa 10 years ago. The larger size has led to increased efficiency, but more volatile results quarter to quarter as a significant amount of production can be disrupted.

The demand for special mixed fertilizers is rising. This type of fertilizer is specific for every application, and produces maximum yield. Costs increase, so execution is key. Once the formulation is successful then customer retention is higher.

The rising demand for more food has led to higher input prices. The major inputs like potash and urea have been obtainable and costs (for the most part) have been passed on. To offset some of the costs the producers are focusing on were to place their plants geographically. This cuts down on transportation costs. There has been a push for joint ventures with the suppliers of urea, this helps share to costs and, more importantly, steady supply at reasonable prices. Also, ensuring a stable supply of potash is key, the contracts are usually a year in length. These relationships are important.

Pricing is key. There is usually a delay of a quarter or two before price increases can be passed on.

HF in particular: Hanfeng's primary fertilizer is SCR (slow controlled release). It has been proven to increase crop yields and appears to be more environmentally friendly. The two types of SCR is SCU (sulphur coated urea) and NPK (nitrogen, phosphorus, potassium). HF also sells CarbonPower in a joint venture with FBSciences. HF was once a favorite for investors. Trading as high as $15 on expectations of a bright future. Then the recession took hold. HF fell to just over $4, which is around tangible book value. Though many stocks have rebounded significantly, HF is only around 15% from its 2008-09 lows. Why the underperformance?

In fiscal Q1, HF had an issue at one of their plants. It was shut down for a couple of weeks due to hot weather.

Q2 numbers show increasing inventory. More on this later.

Price for SCR has been flat and costs have been rising. This is leading to lower gross margins.

Very poor communication between China and Canada offices.

CFO recently resigned.

Poor communication with shareholders.

A number of joint ventures that the outcome is not crystal clear.

Is this a permanent problem? Are these problems fixable?

The shutdown of the plant in Q1 was unfortunate. I think there should have been a press release to explain this before the quarterly number came out and surprised investors. Though this is the nature of their business, a little heads up goes a long way.

SCR prices have remained flat despite increasing costs.

Potassium Nitrate and Potassium Sulphate are Migao's two main products. As you can see both have started to trend up again. SCR is still the same price it was a year ago. You can see that some price increases happened in 2007-08, but nothing like that is happening now. This is a very big risk for HF. Management believes that they will be able to pass on costs in the next quarter. I excluded the specialty fertilizers.

The poor communication with shareholders and within the company is probably why the CFO resigned. I think that these are issues that need to be addressed in order for HF shares to move higher.

The biggest joint venture right now is the deal with Beidahuang. The newest (production JV) is to build a 150,000 mtpa SCR plant. HF has committed to selling Beidahuang 200,000 tonnes of fertilizer during the first year of operation. The inventory commitment is not a great deal for HF. HF has set a large amount of inventory aside to show Beidahuang that it is capable of supplying them. In the last quarter 70% of sales was to Beidahuang at a reduced price. This was part of the initial trial process, and the CEO said that Beidahuang will be paying full market price after January 2011. This is part of the reason for lower selling prices of SCR this quarter. If this partnership works out, Beidahuang will be HF's largest customer. The capex required by HF is around $7 million. HF may have risked losing some customers as their biggest focus has been Beidahuang.

Another JV that wasn't executed properly, in my opinion, is the CarbonPower product JV with FBSciences. This will utilize infrastructure already at the Jiangsu facility. Expenditures are low, but HF didn't even have importation permission. The question isn't even if the product will work, it's about permission to actually sell the product in the province. One would expect the paperwork to be done before signing a joint venture. In the latest conference call, the CEO said that provincial permission has been granted but they are waiting for permission at the federal level. Apparently, provincial permission is tougher to obtain, but it takes longer federally. The CEO said that he expects this to be resolved "shortly".

More of Beidahuang

Operates 104 state-owned farms.

Annual fertilizer usage about 1,400,000 tonnes.

Supplies crops to Beijing, Shanghai, and the military.

Since they are a state-owned company, there is a big push for "safer" food. They really want to make sure that the food is safe for consumption and the fertilizer is not tough on the environment.

The CEO of Beidahuang says that he is impressed with HF's products.

Beidahuang has a 300,000 tonne urea plant (a major input for HF). This can help spread some of the higher costs between the two companies.

Current Valuation (based on a $5 share price)

P/B and Price to tangible book at 1.1x.

Assuming a long run EBITDA of $40 million and EV of $280 million, EV/EBITDA at 7.

FCF numbers are tricky as there has been investment in working capital and large expenditures for capacity expansion. I will stick to asset value and GAAP earnings.

P/E of 13.5 and EV/E of 12.4.

Other notes

The CEO owns about 20% of the company. His compensation has been higher than MGO's. It would be nice to see a purchase or salary reduction until the ship has been turned around.

Agrium owns about 20% as well. They have two directors on the board.

Director compensation is modest.

There have been no material insider buys or sells.

Other potential catalysts

HF was awarded the National Environmentally Friendly Ecological Fertilizer Certificate. This is a big step if HF is to serve the state-owned farms. This will also set some guidelines for other fertilizer companies.

HF has completed construction of JV SCR plant in Indonesia. The two partners, the Makin Group and Sejahtera, are going to purchase the first year's production. The plant has capacity of 150,000 mtpe. The Makin group is expected to consume around 80% of production going forward. The Makin Group is the largest domestic tobacco producer. Sejahtera is the largest agricultural distributor in Indonesia. This JV could lead the way to increased expansion in the South East Asia. This JV increased costs for the quarter but, not production.

HF is now in the second round of trials with the Malaysian government. This is quite promising and, like the Indonesian JV, could lead to increased expansion into other parts of Asia. Though it will take time for this to show any real tangible positive results.

There is some major expansion plans in the making. See the chart below which was taken from the latest investor presentation.

Summary HF has made some poor decisions, and their share price reflects that. I think there is quite a bit of uncertainty, and an investor should price the shares accordingly. I would be a buyer of HF at tangible book, or $4.42. If management provides some clarity, then I would pay as high as 1.2x tangilble book, or $5.30. I don't want to try to price upside as I don't have a good idea. I would think normal mean reversion pricing gives you fair value of $7-8. With successful execution of the joint ventures, you HF should see well over $10. As noted earlier, around tangible book is where HF traded at the market lows in late 2008 early 2009. I think this makes it a good indicator of the expectations (or lack there of) that the market is placing on HF. Though the recession lows were an economic fear and the current lows are company specific (see chart below). I believe this is low risk, high uncertainty. HF is a buy under $4.50. I will try to let you know if I end up taking a position in HF.

Dean Disclosure: The author is not long HF.to....yet. HF's website