I’m a Time Glutton

Something about going full time

In the years leading up to my transition to full time investing, I started realizing I was missing out on areas and events in my life that were important to me. I also began to notice how much I had grown to dislike not having my own time or, at least, the ability to delegate where my time went.

Nowadays, there is so much positivity around making the jump to being a full-time investor from having a day job. Many feel their performance will go up due to having more time to look at potential opportunities or trade around positions better. While there is an immediate and drastic change in the time you can dedicate to investing, the increase in time can be harder to manage than one would think. Therefore, I thought it would be a good idea to provide some insight from my own experience.

Nothing hones your focus like a bit of scarcity. Depending on your circumstances, you may have been equipped with a solid foundational knowledge around finance. Similar to an athlete switching sports. If you are already at a high level of fitness, then making the jump from playing soccer to cycling is much easier than not being active at all. For me, I had zero business knowledge at age 20. Literally 0. I was in school to be a tradesperson (technically two different trades). Once I was inoculated with the value of compound interest, I focused on getting my empire as big as possible to hit escape velocity. It’s kind of weird looking back, now, but I was already more excited to leave a career than start one.

From Time Deprived to a Time Glutton

For the first 15 years of my journey, I was extremely time constrained. I was working a full time job and I was in the process of building a family. I was also trying to learn about accounting and business and facing other life stressors such as, moving/changing jobs constantly. During that part of my life, I got good at shoe-horning finance into all the nooks and crannies of my life. Here are just some examples of how I did my best to make time for finance:

Staying up later than everyone to input data into my spreadsheets.

Reading annual reports on my lunch break (even as a mechanic).

Listening to conference call replays and podcasts in the gym.

I was always reading something while waiting. Whether it was a book or an annual report. I would read whenever I had a long wait, such as at the post office, DMV, airport, doctor’s office, etc.

I even sold my house and opted to rent as a way to reduce time on the day to day upkeep and maintenance of being a homeowner.

Going Full-Time

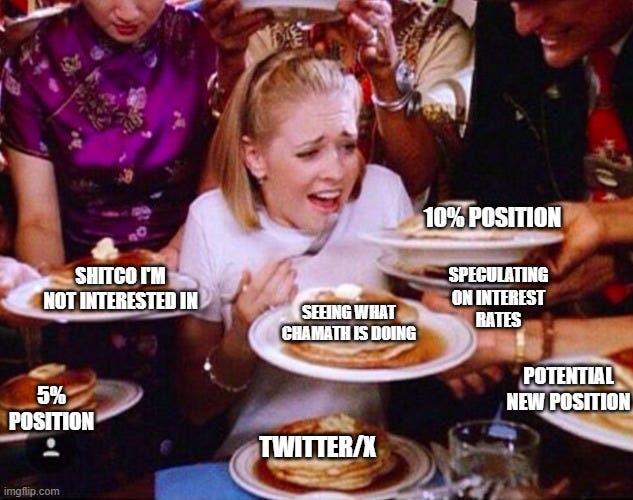

When I made the jump to full time, I made sure to keep up the intensity with investing. Naturally, I tried to fill my time with things that added value to my portfolio. I would look at more companies, spend more time on Twitter talking to fellow investors, and read books that I was putting off. This all seemed fine at the time but it can also be a slippery slope going from things that are productive to things that are not. Before I knew it, I was looking at companies I would never really invest in, sh*tposting constantly (or reading others unproductive comments) and reading books I didn’t enjoy. To be honest, sometimes I still do these things. Much like neglecting your diet, the consequences weren’t much at first. However, I started to notice my portfolio wasn’t what I wanted it to be and my mood wasn’t as chipper as someone who had the autonomy that I had. Something had to change.

As Cal Newport points out in his book, Deep Work, you can only do so much deep work in a day. Having 3x or 4x the amount of time your brain can handle for optimal work, didn’t help me. I started doing things that on the surface looked productive but really weren’t.

I, eventually, had to learn (and am still learning) to unwind some bad habits and build up better ones. For instance, I have taken stock of what I can accomplish in a day as an investor. I have intentionally increased my time in hobbies that I enjoy. These aren’t “new” hobbies but they are deeper and more fulfilling than prior to making the switch to full time, such as woodworking, reading non-investing books, playing with Lego, going more in depth in my lifting journey, and volunteering at my kid’s school.

As of today, things are more balanced or at least they feel that way. I can ratchet up my involvement, as needed, and keep my sanity. I enjoy writing more than I ever did in the past, and I feel more comfortable with my portfolio than I have in previous years. Additionally, now, I get to go have lunch with friends without it being rushed or on a schedule. At the end of the day, everyone is on their own path but making the leap to being a full time investor was definitely the right choice for me. I am a time glutton, after all.

If you are full time, did you have a similar journey? Let me know in the comments.

Thanks for reading.

Dean

Great post.

I find that investing in our own evolution and "quality of mind" becomes paramount as we grow in wealth and ability. We are the foundation of our portfolios, after all. We decide what and when to buy or sell, so it makes sense to guard and grow our minds, our decision-making machines, with absolute care.

So much of this has to do with what we choose *not* to do more than what we choose to do. The biggest way I can see this compounding over time is in providing conviction at the crucial moments: when a stock on our watchlist hits all-time-lows. Everyone else might be screaming "sell!" but the work we've carved out allows us to see deeper than most into why they're all wrong.

Good example: $META decline starting in Sept '21 and continuing almost until 2023. META bottomed at 90 dollars, a level not seen since 2015. Now it's over 500.

The hardest work is being able and willing to ask ourselves "Is everyone else wrong or am I stupid or crazy?" If you're smart, saying to yourself "there's a good possibility I'm right and everyone is wrong" should scare the fuck out of you. It means a greatly increased *probability* of a crucial blind spot.

Love where this is going. Quality > quantity in all things.

Just wanted to say thanks for writing. Just found your substack and appreciate the sharing of your experience. I find your thoughts informative and refreshing in your honesty.

My current goal is to one day become a time glutton through full time investing. And if I am able to become a full time investor, going to figure out a good answer when people ask what I do. Maybe researcher?