$ISDR Quick Update

It's been about 8 months since I did my last ISDR update. You can find it here.

Shares of ISDR are flat to slightly up. Energy company's are up way more, the Nasdaq is down a bit, the "disruptors" are generally down, and (most importantly) the people's crypto is down about 30%.

Q4 2021 Update

The company reported quite strong Q4 2021 results. Top line growth of about 20% (depending on whether you measure ttm or year over year on a quarterly basis), strong gross margins and reasonable operating margins led to operating income outperforming my expectations by a slight margin. It should be noted that investment via the income statement continued during the quarter. I expect EBIT margins to improve modestly as they scale into the higher expense line.

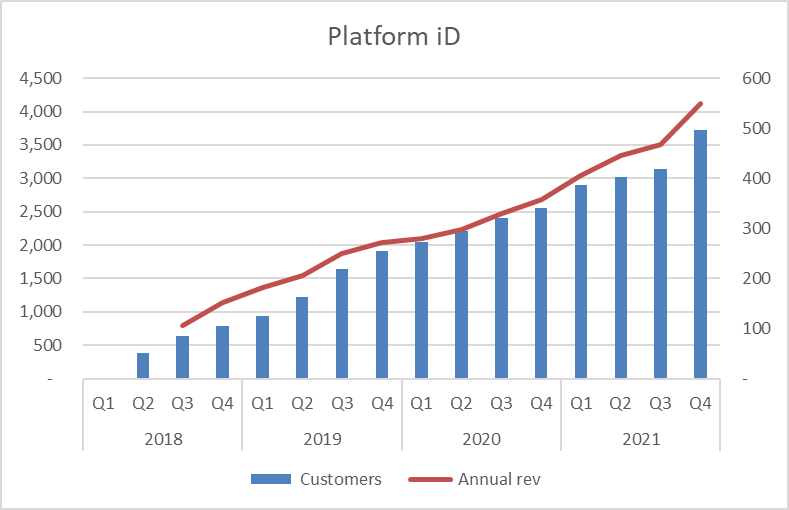

Customer count growth of 14% was nice to see. Platform id subscriptions came in a wee bit below their goal of 500 by 3. The ACV of the Platform id subscriptions is now 4.1 mil. Over half of the most recent quarter's new subscriptions were sold to existing customers who were only using 1 product or service. This is a nice win for them as they have a large customer base that's growing. They are anticipating customer growth of 20% in 2022. This bodes well for them scaling into the higher opex.

Accesswire grew revenue by 40% over the prior year's quarter and is responsible for the majority of their customer growth.

Looking Ahead to 2022

Though they anticipate to grow customers by 20%, I'm not expecting 20% growth in revenue. The compliance business revenue was 2 mil in Q4 2021 vs 1.7 mil in Q4 2020, and I am not modeling that kind of growth in 2022 and beyond. Originally I was expecting flat to slightly lower revenue from compliance over time, but have been pleasantly surprised. Having said that, compliance is a smaller part of the business and even smaller part of the total gross margins.

TTM EV/FCF (without WC and ee comp) is around 18x. To me, this isn't too expensive to warrant reducing the position. This also isn't sell-all-your-powertools-to-buy-shares cheap either. ROIC is quite good, organic per share growth is likely over 10%, the balance sheet is strong and management is aligned with shareholders. I wouldn't be surprised if ISDR makes an acquisition this year to further build out their product portfolio. They also announced a 5 mil NCIB and I believe it will get executed. I am going to maintain my position.

Anyone else own $ISDR?

Thanks

Dean

*long ISDR at time of writing.