March 2022 Update – $OSS.v, $ISDR, $PSD.to, $ISV.to, $STC.to & $SANG, $FTG.to, $VMD.to & $VMD, $SYZ.to, $MCB.to, $PZA.to, $MCR.v, $KUT.v, $CPH.to, $GEO.to

Busy this time of year with earnings in full swing. For those of you new here, I like to put out a quick monthly update on companies that I am closely following that I have written about. Feel free to add anything I may have missed or ask for some more detail.

Thoughts on Market Activity

Nothing material to add as usual. Lots of bullish commodity investors out there.

I ended the quarter up about 3% after taking it on the chin like everything else at the start of the year. This is better than US based indexes and essentially on par with the TSX.

What I’m Reading

OKRs – measure what matters. I just started so can’t comment on it yet.

Podcasts I Enjoyed Over the Last Month

I’ve decided I would share some of the podcasts I found valuable during the month. Feel free to send me your favorites.

Given how busy it was this month, I wasn’t as present as I would have liked to be when it came to listening to podcasts. This one with Dan McMurtrie on Frederik’s Insecurity Analysis pod probably resonated with me the most. I was thinking of writing some of my thoughts down and putting it out there, but it will have to wait a bit until I get through the backlog of earnings reports.

I also thought this article about ESG and the situation in Russia was pretty thought provoking by Aswath Domodaran over at Musings on the Market.

Posts this month

ISDR update

VMD update

CPH update

Developments on Companies Mentioned

OneSoft Solutions - $OSS.v

Not a ton of details at this point

Reported Q4 2021

Not much new

MD&A has a fair bit of detail as usual

I’m hoping 2022 is the year we see revenue accelerate as they are burning cash and adoption has taken way longer than anticipated

They signed an agreement with a the largest North American O&G pipeline operator who has 100k in pipe (around half is piggable)

I believe this has yet to hit the income statement

Issuer Direct - $ISDR

Reported Q4 2021

Was better than I expected

See up date post

Pulse Seismic - $PSD.to

The President and CEO released his annual message to the shareholders

I’ve been following PSD for many years and I like the conservative approach of management

You can see the letter here

Information Services Corp - $ISV.to

Reported Q4 2021

A little ahead of my expectations

Guidance going forward

168-173 mil rev

48-53 mil in EBITDA

This is a contraction from the 60.5 mil in 2021 (67.8 mil in adjusted EBITDA)

Expected ebitda margins for 2022 are toward the low end of the company’s historical range

This may indicate that the guidance is conservative

The company is currently yielding 3.7%

The company has a history of raising dividends and likely makes a good fit for income focused investors

Sangoma Technologies Corp - $STC.to

Announced the acquisition of NetFortis

This is their 11th acquisition in 11 months

Priced at about 1.3x rev with some potential earn outs

5-6% dilution depending on how you count the S2S shares

It seems like a pretty smart move from my vantage point

The MSP part of NetFortis looks to offer some long term potential for STC to offer a broader suite of products to customers

As usual they are taking a cautious approach and not relying solely on the MSP part of the business to justify the valuation

The last time I can remember an acquisition relying so much on post integration synergies was Digium

I’m still digesting this a bit and will be interested to hear how things are going after they release their next earnings

Firan Technology - $FTG.to

Robert Beutel, executive from Oakwest rejoined the board

Oakwest owns 18% of FTG shares

Viemed - $VMD.to

Announced Q4 2021 early in the month

Was better than I expected and guidance was strong

See the update post for some more details

Sylogist - $SYZ.to

The company released the results of the AGM

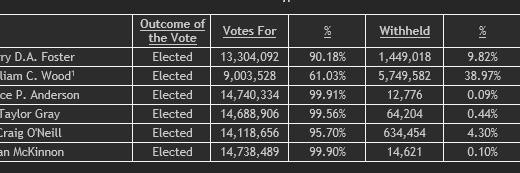

The only thing that stood out to me is the CEO only received 61% “votes for” of the 14.8 mil (61.74% of total outstanding) represented

The other director nominations had more typical results

McCoy Global - $MCB.to

Reported Q4 2021

A bit weaker than I was expecting

Backlog and orders looking strong

No material update from the special committee

Pizza Pizza Royalty Corp - $PZA.to

Reported Q4 2021

Was better than I expected given the cold weather and lockdowns in Canada

There is some concern in their franchise partners having higher input costs (food and labour) and consumer spending given the run in inflation

Macro Enterprises - $MCR.v

Announced an update to the go private transaction due to an unexpected death of a participating shareholder

There is quite a bit of information about the timeline of the transaction in the release which is worth reading if you haven’t already

I think this price is way too cheap

Sentiment is/has shifting on our reliance on hydrocarbons and we could see increased activity for many years

RediShred Capital - $KUT.v

Announced a small acquisition of $200K/year near Chicago

This will help with route density in the Chicago area for KUT

Will be accretive immediately

I’m assuming it’s the typical 5-6x EBITDA price paid

Cipher Pharmaceuticals - $CPH.to

Good news for them to continue to get some revenue associated with Absortica

Announced Q4 2021

Was ahead of my expectations by a small margin

Outlook is positive

Update on MOB-105 which is in their pipeline

Moberg has submitted regulatory filing to start phase 3 trials

350 patients over 52 weeks

Enrollment to start in Q2 2022

Cipher holds exclusive Canadian rights to MOB-015

75 million CAD market with one product having over 90% share

See up date post for more

Geodrill - $GEO.to

Reported Q4 2021

Was a decent q

Outlook looks strong

Looking to increase rig count by 7 this year

Radius recently did an update video

*Long $OSS.v, $ISDR, $PSD.to, $STC.to, $VMD.to, $MCB.to, $MCR.v, $KUT.v, $CPH.to, $GEO.to at time of publishing

Thanks

Dean