*Disclosure: I own shares in MATR. I am not a professional. Please do your own due diligence.

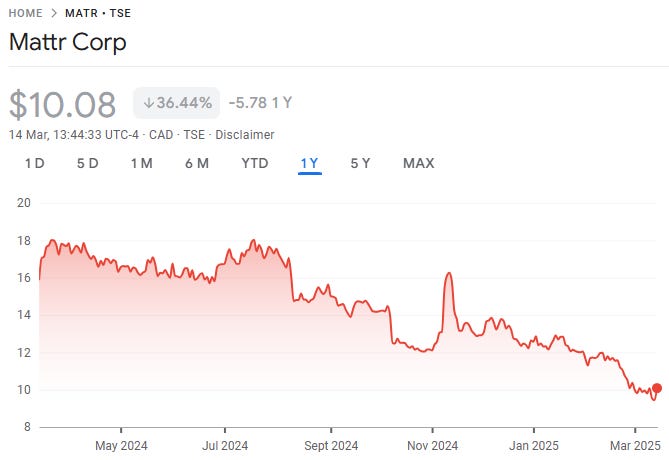

Price: $10.08 CAD

MC: 662 million CAD

EV: 1040 million CAD (my estimate after the AmerCable acquisition)

1 year performance: -36%

MATR reported last night and held a call this morning. Results were ahead of my expectations and the stock is up 6-7% at time of writing.

*all numbers in CAD unless stated otherwise

Quarter Recap

Reminder that the AmerCable acquisition closed subsequent to quarter end.

Revenue came in at 208 million for the quarter.

Adjusted EBITDA came in at 13 million.

The quarter had restructuring and some other one time costs. Here is the explanation from the news release:

The fourth quarter of 2024 results also include $4.9 million of restructuring costs associated mostly with organizational changes and right-sizing of the Company's workforce, $2.6 million of non-routine provisions associated with a specific customer order, $2.2 million in non-recurring pension related costs, $1.7 million in costs associated with the acquisition of AmerCable, $1.0 million in costs to pre-position finished goods in the US ahead of potential tariff implementation and $0.6 million of severance costs associated with executive management changes. In contrast, the fourth quarter of 2023 included $18.5 million in impairment charges related to the closure of the Anaheim manufacturing facility and $2.5 million of restructuring costs.

The company made some statements regarding cross border activity:

On a pro forma basis, inclusive of the AmerCable acquisition, approximately 30% of the Company's 2024 Continuing Operations revenue would have been tied to cross-border sales of finished goods and approximately 45% of its Cost of Goods Sold would have been tied to raw materials that crossed at least one North American border prior to incorporation into finished goods.

On the outlook for 2025:

During 2025, the Company expects year-over-year revenue, Adjusted EBITDA and Adjusted EPS growth versus 2024, driven primarily by new customer capture, new product adoption, increased customer activity, progressively rising production output from newly established sites, progressively improving cost absorption as new site activity rises, significantly lower full year 2025 MEO cost recognition when compared to 2024 and the addition of AmerCable. All previously existing business lines are expected to contribute to year-over-year revenue growth, with the exception of Flexpipe, where the Company is expecting relatively flat revenue performance in 2025.

Regarding the integration of AmerCable:

The Company expects AmerCable to incur non-routine onboarding expenses of up to $5 million over the course of 2025. In addition, the revaluation of AmerCable's inventory to fair value as part of the purchase price allocation process is expected to temporarily impact gross margins as the inventory is sold. In combination these factors are expected to impact AmerCable results during the first three quarters of 2025. The recognition and amortization of acquired intangible assets may affect reported earnings, though these non-cash expenses do not impact the Company’s underlying operational performance or cash flow. The impact on gross margins resulting from the revaluation of inventory is expected to be added back in the calculation of Adjusted EBITDA.

The Company has successfully completed multiple initial integration actions to onboard the AmerCable business and currently anticipates that its overall financial performance in 2025 following the acquisition of AmerCable will approximate its expectations.

And go forward capital allocation:

While the Company expects to maintain its “all of the above” approach to capital allocation, with the acquisition of AmerCable and the majority of its large organic MEO projects completed, the Company's capital deployment in 2025 is expected to focus more heavily on debt repayment and activity under its NCIB. The Company currently anticipates total full year Capital Expenditures will be $60-$70 million, with approximately $15 million of such amount allocated to maintenance capital, and the remaining amounts allocated to growth projects, including completion of the remaining MEO projects.

Call Notes

Normal capex of 40-50 million per year for 2026 onward.

They expect the legacy businesses outside of Flexpipe to hit the 10%+ revenue growth target.

The Xerxes backlog is strong at double what it was this time last year.

MEO costs for Composites is done. Expect 7-8 million in MEO costs in 2025 in Connections segment.

AmerCable onboarding going well.

They mentioned the potential cross selling opportunities with AmerCable and Shawflex that they will be pursuing once integration is complete.

AmerCable sounds like a 65-70 mil EBITDA business in 2025.

There was lots of discussion trying to quantify the various moving pieces of the AmerCable non-cash inventory expense post integration, MEO expenses for 2025, restructuring expenses in Q4 2024, proactive inventory movement in advance of tariffs, etc.

They mentioned that the Auto sector is likely to get hit with tariffs. Not their supply chain specifically but their customers supply chain. This tracks with comments I have been hearing from other companies.

Valuation

I have MATR at about 5x EV/EBITDA on a run rate basis. As the continue to integrate AmerCable and grow the other businesses, I expect that 2026 EBITDA will be higher. This is of course with no quantified tariff impact.

Closing Thoughts

I can tell the company is quite sophisticated at communicating with investors because I could copy and paste a bunch of items from the press release regarding how the business is performing and what they expect. The amount of disclosure for each business segment is very helpful. All look to have a better 2025 vs 2024 with the exception of Flexpipe being flattish. Even Flexpipe being flat with land completion activity in North America to be down is a win. I do think there is a chance that the rig count ticks up this year due to the exhaustion of DUC wells and depletion rates (finally) impacting any net new production, but that is not my thesis for MATR.

The Capex number is a tad higher than I was expecting, but they noted 15 million in maintenance capex which is in the range of the 10-15 million they guided for long term.

2025 will see the completion of the MEO expenses and will set the stage to see how this business performs after all the tune-ups.

The business will be impacted by the tariffs, but exactly how much I don’t know. Nothing happens in a vacuum so I am reluctant to try and quantify the impact. MATR is run by top notch operators and a CEO who can understands the capital markets. As with any investment, you need to trust the management team.

For those interested, here is a slide from the Q4 earnings presentation that goes over what they are expecting.

I continue to hold my shares and have been adding on weakness.

Thanks for reading.

Dean

* long MATR.to