McCoy Global $MCB.to (update)

Very quick update.

I'm no stranger to McCoy. McCoy Global $MCB.to.

The share price has not performed very well since then. I have owned a small amount of shares thinking that at some point oil and gas activity would bottom and McCoy would benefit from renewed interest in the industry. I have been wrong.

The market cap is now around 11.9mil with an EV of 12.4mil.

Update

purchased Draworks in late 2019

they assumed some backlog (2mil)

complimentary product to their portfolio that would not have been able to build in house

6 mil purchase, had about 6 mil in rev in previous TTM

they did release a new torque turn product in Q2 2019

they have been working on a remote monitoring solution for customers (Virtual Thread Rep)

sales in the TTM have been down due to lower activity (obviously)

there is stronger activity internationally than in north america

covid

salary and wage cuts across the board

cut capex by 80%

took 2.7mil in PPP loan at 0.98% due April 2022

much of this may be forgivin

their backlog was down to 8.3 mil

although order activity did pick up after the quarter ended

from a GAAP standpoint they are net cash neutral as the cash on the balance sheet in 2019 was spent on Draworks

Summary

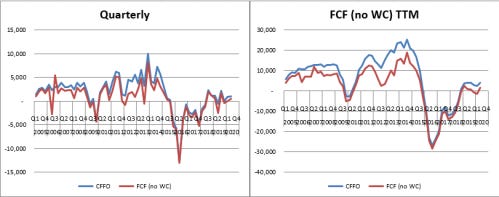

To me this fits nicely in a net-net basket. They business has been impacted and expectations are very low. In the meantime, management has pulled the levers they can in order to lessen the blow. The are not bleeding cash in a time when there is essentially zero interest in their industry.

Anyone else own this one?

Dean

*the author is long $MCB.to at time of writing