The last time I did a dedicated post on McCoy was September of 2020 here.

At the time MCB was trading at or near net-net territory. I had (re)purchased MCB in mid 2019 thinking that 2020 would be the year when we realize we have under invested in O&G and would see a bit of a resurgence in activity. I was wrong/early, then the pandemic hit and we started trading dogecoin and fighting about whether or not to wear masks for 2ish years. Today there is more investment being deployed in the discovery and extraction of fossil fuels. This bodes well for MCB.

Quick Capital Allocation Note

Just to remind anyone who hasn’t been following (or has been following but not paying attention) I take a top down approach to allocating capital for this portion of my portfolio. I keep position sizes small and shoot to get between 10-20% of my portfolio exposed to this idea (O&G activity). I don’t always allocate capital to this idea, only when I feel like we are have several years of increasing activity in front of us and the risk/reward set up is in my favor.

Business Update

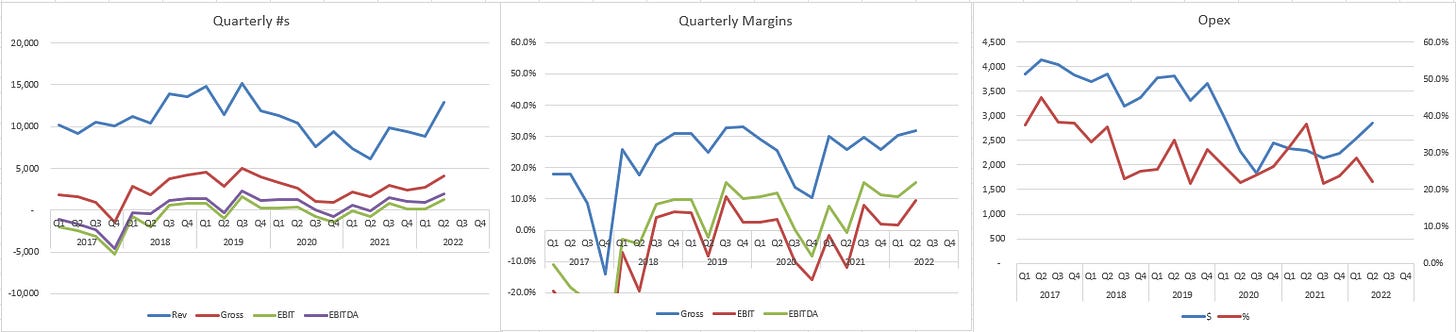

Since bottoming in Q2 2021, revenue has been increasing each quarter on a year over year basis. The last quarter has seen the most revenue since 2019. This has translated into increased profits and free cash flow as well. This verifies the thesis that increased activity will lead to into increased profits when taking a top down approach to allocation of capital.

Increasing in tubular running operations are quite delayed from the increase in the price of oil itself. Here is a look at the backlog:

Looking ahead

Despite the recent pullback, hydrocarbon prices are trading high enough to encourage investment in future production. We are seeing the rig count grind upwards consistently and producers are slowly increasing capital spends.

New Products

They continue to invest in their Digital Technology Roadmap. They have now commercialized the smartFMS. They completed some trials for the smartCRT. They do continue to see interest in the smartCRT. They have disclosed new product revenue in the past, but as they new products become integrated into their product suite, they are removed the “new products” bucket and thus it’s not easy to compare the overall trend longer than 18-24 months.

You can get some more information on their new products from their latest investor presentation. Or from their site.

Valuation

MCB currently trades just under 5x EV/EBITDA on a ttm basis. I do think that they will earn more in the coming years given the activity levels and their backlog. How much? I’m not sure to be honest, but I believe it will be substantially higher that the last 12 months.

Anyone else own MCB.to?

Thanks,

Dean