McCoy Global Q1 2023 Update - $MCB.to

I’m going to try one of these quick and dirty posts updating the company. I’ll push an update out each day for a different company until I run out of new updates.

MCB held an AGM and reported Q1 2023.

I attended the AGM in person here in Edmonton. It was weird wearing dress pants again. Anyways, the AGM didn’t have a ton of new information. I did want to meet the director (Alex Ryzhikov) who received the performance shares. The shares have a multiplier based on the share price starting at 0 at $2.00 and going all the way to 4 at $4.00. He answered my questions and does seem to bring a capital markets presence that is lacking in most microcaps. I think there is some opportunity for tuck in M&A, stronger organic growth with the recent and upcoming launch of new products and returning capital to shareholders.

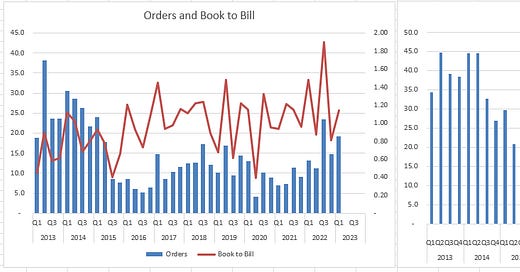

They also reported Q1 2023. Results were in line with what I was expecting given the large backlog announced in the prior quarters. They announced the return of their quarterly dividend after the reduction of capital was approved at the AGM. The stock currently yields about 2%.

MCB’s valuation is attractive if they can maintain or grow from here. MCB currently trades at less than 3x EV/ttm adj EBITDA and (more importantly) less than 5x EV/FCF before working capital changes. The backlog and order book gives me some confidence.

I continue to hold.