McCoy Global Q3 2024 Update - MCB.to

Quick update after Q3 2024

*Disclosure: I own shares in MCB. I am not a professional. Please do your own due diligence.

Price: $2.93 CAD

MC: 85.1 million CAD

EV: 75.7 million CAD

Yield: 2.7%

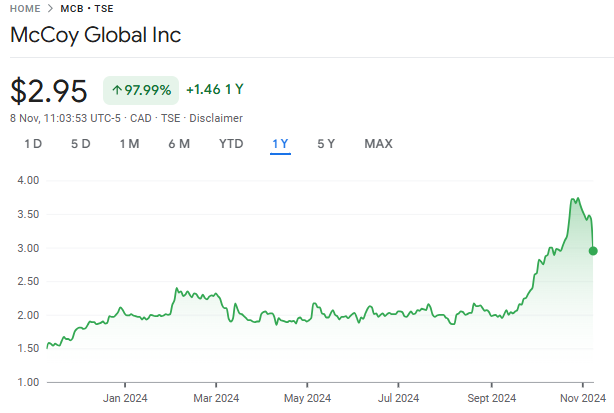

1 year performance: +98%

MCB reported this morning. Results were behind my expectations and the stock is down 13-15% this morning. It should be noted that MCB is still up nearly 40% in the last 6 months even after the drop.

*all numbers in CAD unless stated otherwise

Quarter Recap

Revenue came in at 15.8 million vs 16.9 million last year.

EBITDA was 2.7 million vs 3.9 million last year.

Order intake was strong at 24.1 million.

This resulted in a backlog of 30.1 million. The highest in a decade.

Book to bill was 1.5 for the quarter.

They noted that they delivered 42 of the FMS tools in the first 3 quarters this year. They were only expecting 40 for the full year so this is quite positive to the narrative.

Valuation

I have MCB at 4.8x EV/ttm EBITDA.

Closing Thoughts

Given the strong order intake and adoption of their new products, I am more forgiving on the inventory line.

I am a bit surprised by the market reaction. Even with strong order intake and backlog, the results each quarter are lumpy. It’s been that way for as long as I can remember. Having said that, I don’t know if the move from $2 to nearly $4 was warranted. Microcaps gonna microcap.

The move is is a good demonstration of why I own a basket of these companies.

Why does it feel like when the stock moves up the market is “discovering” my companies but the stock moves down the market is being irrational?

Thanks for reading.

Dean

* long MCB.to