*Disclosure: I own shares in MCB. I am not a professional. Please do your own due diligence.

Price: $2.76 CAD

MC: 76.3 million CAD

EV: 60.7 million CAD

Yield: 3.6% (after recent dividend increase)

1 year performance: +29%

MCB reported this morning. Results were ahead of my expectations and the stock has been up about 13-14 %.

*all numbers in CAD unless stated otherwise

Quarter Recap

Q4

Revenue at 25.2 mil

Up 28%

EBITDA at 6.5 mil or 26% of revenue

Up from 4.0 mil last year

Full Year 2024

Revenue up 11% to 77.5 million

EBITDA of 16.2 million or 21% of revenue

Up from 13.1 mil or 19% of rev

Upped dividend from 0.02 to 0.025Revenue came in at

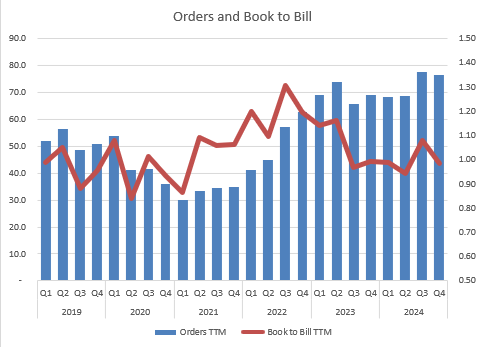

Order bookings at 16.8 million.

Leaving the book to bill ratio at 0.67.

Backlog at quarter end at 23.5 million.

Other Noteworthy Items

Seeing continued strong penetration for the Flush Mount Spiders (FMS) in North America land market.

Secured contract for 4.3 million for smart casing running (smartCRT) in the Middle East.

Continuing in-field trials for smartTR. From the press release:

Due to the challenges securing rig availability with our current in-field partner, McCoy expanded the in-field trials to include an additional three partners in separate regions, including both US land and the Middle East.

Awarded contract of 3.7 million for deep-water offshore integrated casing running system in Latin America and an additional 1.8 million in Brazil.

As usual, they are muted in expectations. I imagine that all the tariff noise has many customers sitting on their hands. From the press release (emphasis mine):

With $23.5 million of backlog reported at December 31, 2024, and continued momentum of smartProduct technology adoption, we are confident in executing our strategic and financial objectives in 2025. However, timing delays experienced on certain customer purchase commitments, shifts in product mix, and greater than anticipated book-and-ship revenues that positively impacted Q4, 2024, may result in quarter-to-quarter fluctuations in revenues and gross margins, particularly in the first quarter, with revenues and earnings more heavily weighted toward the second half of 2025.

Speaking of tariffs, here is a blurb from the press release:

“Overall, the tariffs are not expected to have a material impact on McCoy's financial performance, however, circumstances remain very dynamic, and this assessment may change.”

Valuation

I have them at 3.7x EV/EBITDA on a trailing basis and just under 6x FCF before working capital. I am expecting growth, though it will be lumpy.

Closing Thoughts

This was a particularly strong quarter. Sequentially I am not expecting Q1 to be close to this revenue number. H1 2024 had 36.5 million and I think that they can match or beat that in H1 2025. H2 2024 was 41.1 million in revenue. As long as things don’t fall off the rails in the economy, then I think they beat that number as well. As customers continue to adopt the new products, MCB should see revenue continue higher and (I hope) get a better multiple.

Things I am watching closely for MCB:

The book to bill and/or backlog. If we don’t see strong orders in Q1 and Q2 then I will ratchet down my assumptions for H2 2025. Both orders and revenue recognized can be lumpy quarter to quarter so it may make sense to look at the book to bill ration annualized.

Working capital, particularly inventory. I do understand that they need to build inventory in anticipation of the new products being adopted. Even if revenue continues to climb, but inventory climbs faster then I would dig deeper.

I continue to hold my shares of MCB. I have been in the name since 2019 and feel excited about what the future holds for this business.

I own MCB in a basket of OFS cos. MCB is the largest position in the basket and I am looking to add on weakness.

Thanks for reading my work.

Dean

* long MCB.to

hpw much have they invested in the smartCRT ??

Starter position initiated today. Was just going back and forth last week about starting a position. Saw enough in today’s report.