MCB released Q2 2023 last week. The stock was up 6% at one point with some volume (at least for a microcap). I own this one as part of a basket. I like the exposure to the International markets and offshore activity.

Quarter Recap

There is no conference call, so all information comes from the new release, the MD&A and financial statements.

Rev up 26% to 16.3mil CAD

Ebitda up 25%

Order intake of 16.2mil for book-to-bill of 1.01

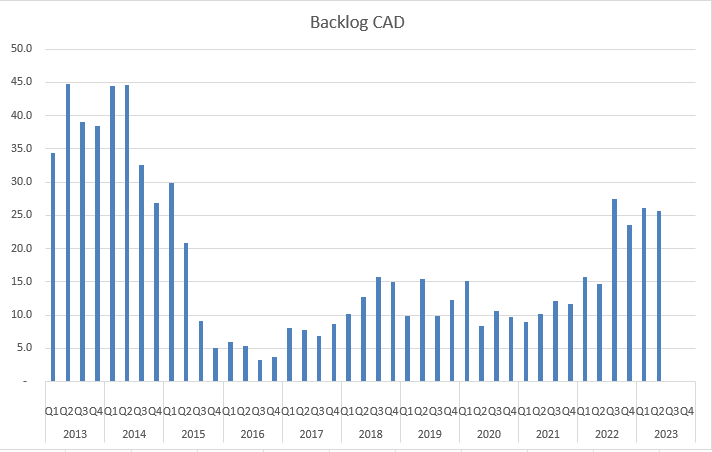

Backlog at 25.6mil

Technology Roadmap

1 sale and 33 rentals for Flush Mount Spider (FMS)

SmartCRT (casing running tool) had it’s first commercial casing job

Have finished development of smarTR and looking to commercialize in coming quarters

Purchased 88,200 shares

They noted some potential impact of shipments due to strike at BC port in Q3 but feel it will be resolved by Q4

Inventory growth this quarter (inventory at 25. mil) that should unwind somewhat in Q4

Anticipate about 2mil USD in capex for H2 2023

My Thoughts

Not much additional to mention from me. The thesis is still there in my opinion. I’ll be watching Q3 results and any comments on Q4 closely. The NCIB has been renewed. They are limited by daily liquidity, so I’m not sure it will be material. I can see them raising the dividend and seeking some M&A opportunity. The Technology Roadmap is a nice additional piece of potential upside that I think would be a good reason for a larger player to make an offer for MCB. They are trading less than 3x ttm EV/EBITDA at the moment.

There wasn’t mention of any significant new orders so I would expect the backlog growth to moderate over the next couple of quarters. Though it’s nice to see the backlog grow, having it grow fast than they can execute probably isn’t that great either.

I continue to hold.

Thanks for reading.

Dean

*long MCB.to