*Disclosure: I own shares in MCB. I am not a professional. Please do your own due diligence.

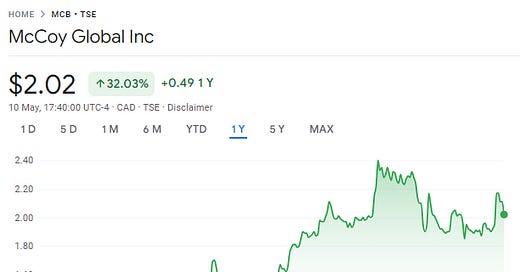

Price: $2.02 CAD

MC: 58 million

EV: 48.5 million

Yield: 4%

1 year performance: +32%

MCB reported Friday last week. Results were in line of my expectations and the stock ended down 4.3% on the day. They don’t have conference calls, so the information is pulled from the news release and financials.

Quarter Recap

Revenue was down 2.4% to 16.5 million.

EBITDA was down 0.1 million to 2.3 million.

Book to Bill was 1.13.

Backlog at 25.2 million.

They gave an update on their digital technology roadmap. (Copied from the news release).

Advanced its Digital Technology Roadmap:

Delivered fourteen (14) of McCoy's Flush Mount Spider (FMS) during the first quarter of 2024 (Q1 2023 – 4 tools). With a growing number of tools operating in-field, operators are recognizing the benefits of McCoy's FMS, which has in turn led to more widespread adoption resulting in robust order intake. McCoy's FMS is a hydraulic rotary flush mounted spider that when fully connected (smartFMS™), handles casing while providing information on the state of the tool to the driller's display in real-time as well as the ability to integrate with McCoy Smart Casing Running Tool (smartCRT™).

Progressed in-field trials with our partnering customer in North America for the smarTR™, McCoy's integrated casing running system. Field trials are a critical stage to full commercialization and the process continues to provide valuable data which has led to continued refinement our technology. We expect further advancements toward commercialization and look forward to reporting our progress on key milestones.

McCoy completed the design for an enhanced smartCRT™ that will address the new tool specifications introduced by National Oil Companies (NOCs) and major operators in certain key regions. With product prototyping scheduled for Q2 2024, McCoy's enhanced smartCRT™ will not only address the new contract requirements, but also provide an intelligent, connected enhancement to conventional casing running tool on the market today, offering superior safety, efficiency and simplified operating procedure, with real-time data collection and analysis capabilities.

Outlook was pretty solid. They have a decent backlog to support the remainder of 2024.

Valuation

I have them at about 3.7x EV/EBITDA and under 9x EV/FCF. These are both ttm numbers and I expect them to be higher in the coming years.

Closing Thoughts

MCB is slowly transitioning away from being dependent on drilling activity. Though I think the medium term drilling activity will support the business, I like the added benefit of their technology roadmap. The market didn’t seem to like the results for Q1, but I was fine with them. I think the book-to-bill ratio is what matters more right now for MCB,

I continue to hold in my basket of OFS cos.

Thanks for reading.

Dean

* long MCB.to