I have followed NEPH closely for about 3 years. I grabbed a tracker position early 2023 and have since filled it out to a full position. I didn’t follow the company closely, but up until the last 12-18 months NEPH seemed like it was a company with an exciting product(s) that was always “just around the corner” to getting profitable. The market has absorbed several financings over the years as the share count has gone from 6 million in 2018 to over 10 million today. I believe NEPH is not that same business and has enough potential to warrant a position in my portfolio.

NEPH is like most microcaps that end up in my portfolio: colorful history, little to no institutional shareholders, uncertain future, little to no current profitability, and sub 100 million market cap. NEPH does have a large chunk of the common owned by a fund, so the institutional holdings doesn’t exactly apply here.

At the start of 2020, NEPH traded at around $8.80. Through covid the share price was range bound from about $6 to $9.50. I’m not sure if NEPH would have been considered a “covid darling”, but the stock seemed to be buoyed by the stimmie excitement of 2020/21. After trading near $10 in mid 2021, the share price tumbled all the way to about $1 in late 2022.

Price: $2.47

Shares: 10.4 million

Market Cap: 25.2 million USD

Enterprise Value: 22.7 million

They recently reported Q4 2023 numbers. Unfortunately I was dealing with a sick kid at home, so I missed participating in the call. We should get some more context to the business on the Q1 2024 call in 6-8 weeks.

Background

Nephros was incorporated in 1997. The Company was founded by health professionals, scientists and engineers affiliated with Columbia University to develop advanced end stage renal disease (“ESRD”) therapy technology and products.

Beginning in 2009, Nephros introduced high performance liquid purification filters to meet the demand for water purification in certain medical markets. The Company’s filters, generally classified as ultrafilters, are primarily used in hospitals for the prevention of infection from waterborne pathogens, such as legionella and pseudomonas, and in dialysis centers for the removal of biological contaminants from water and bicarbonate concentrate. The Company also develops and sells water filtration products for commercial applications, focusing on the hospitality and food service markets. The water filtration business is a reportable segment, referred to as the Water Filtration segment.

When I started following the company they had 3 different product lines. I won’t get into too much technical detail of the discontinued segments.

Water filtration – the current business.

Pathogen Detection Systems (PDS)

In 2019, they expanded the portfolio of water solutions with the introduction of pathogen detection system (“PDS”) products and services. They acquired GenArraytion in 2021 to add to the capabilities of their PDS portfolio.

In November 2022, they sold all the assets of the PDS business to BWSI, LLC. (a private firm). There are some ongoing terms to the agreement, though I do not feel it is material to the thesis.

Under the terms of the PDS Purchase Agreement, BWSI made a nominal cash payment at the closing of the transaction and assumed certain continuing liabilities of the PDS business. Additionally, for a period of seven years commencing January 1, 2023, and ending December 31, 2029, BWSI will pay us an annual royalty equal to a specified percentage of gross margin received by BWSI from each of the sale and licensing of products developed by the PDS Business.

Specialty Renal Products (SRP)

They developed specific products for Hemodiafiltration (HDF) and In 2018, they spun-off the development of the HDF device into SRP. They raised $3 million of outside capital directly into SRP to fund the further development of the products. Nephros had a 62.5% ownership stake in SRP.

In March 2023 they wound down the SRP operations. There were no assets to distribute and the value of their ownership stake was written off.

As you can 2 of the 3 segments are no longer part of the business. PDS and SRP were not generating cash and were relying on outside capital to fund operations. I think narrowing the scope of the business and focusing on reaching profitability is a major positive for shareholders.

What do they sell?

They sell water filters into multiple markets.

Hospitals and other Healthcare Facilities

The filters have a 510(k) clearance for use in hospitals. The products have a life of 3-12 months and once installed have a high chance of being used again as part of a regular maintenance plan for the hospital. There are over 6,000 hospitals in the US and 20,000+ healthcare facilities that are required by CMS to implement formal water management plans. I believe they are in about 1,000 hospitals now.

From the 2022 10-K:

In 2022, the Center for Clinical Standards and Quality at the Centers for Medicare and Medicaid Services (“CMS”) expanded its requirements – originally implemented in 2017 – for facilities to develop policies and procedures that inhibit the growth and spread of legionella and other opportunistic pathogens in building water systems. In this 2022 update, CMS requires teams to be assigned to the development of formal water management plans (“WMPs”), as well as detailed documentation regarding the development of the WMPs and their execution. CMS surveyors regularly review policies, procedures, and reports documenting water management implementation results to verify that facilities are compliant with these requirements. We believe that these CMS regulations may have a positive impact on the sale of our HAI-inhibiting ultrafilters.

Dialysis Centres – Water/Bicarbonate

There are over 6,000 dialysis clinics and over 100,000 hemodialysis machines in operation that require a NEPH or competitors’ product. They also have a 510(k) clearance to sell their products to Dialysis Centers. As with hospital they have a range of 3-12 useful life.

From the 2022 10-K:

To perform hemodialysis, all dialysis clinics have dedicated water purification systems to produce water and bicarbonate concentrate, two essential ingredients for making dialysate, the liquid that removes waste material from the blood. According to the American Journal of Kidney Diseases, there are approximately 6,500 dialysis clinics in the United States servicing approximately 468,000 patients annually. We estimate that there are over 100,000 hemodialysis machines in operation in the United States.

Medicare is the main payer for dialysis treatment in the United States. To be eligible for Medicare reimbursement, dialysis centers must meet the minimum standards for water and bicarbonate concentrate quality set by the Association for the Advancement of Medical Instrumentation (“AAMI”), the American National Standards Institute (“ANSI”) and the International Standards Organization (“ISO”). We anticipate that the stricter standards approved by these organizations in 2009 will be adopted by Medicare in the future.

Commercial and Industrial

They have a variety of filters that fir the commercial and industrial market sold under the NanoGuard brand.. This includes use on beverage machines, ice machines, fountains, and dishwashers. In 2023 they signed an agreement with Donastar to be the exclusive master distributor for Nephros commercial filters in the food & beverage and hospitality markets. Donastar supplies foodservice and beverage equipment as well as water filtration. They have a high touch service model that supports the customers with a variety of products from over 500 service partners.

The company doesn’t manufacture the hospital products. They have a License and Supply Agreement with Medica (which is based in Italy). The agreement expires at the end of 2025. They do manufacture some of the commercial products in their Las Vegas facility.

Some business highlights

The business has the majority if it’s sales as recurring in nature.

The one-time or emergency revenue averages about 15%.

Gross margins should range from 55-60% moving forward. It will bounce around due to mix.

They have been bouncing around breakeven EBITDA for the last 4 quarters.

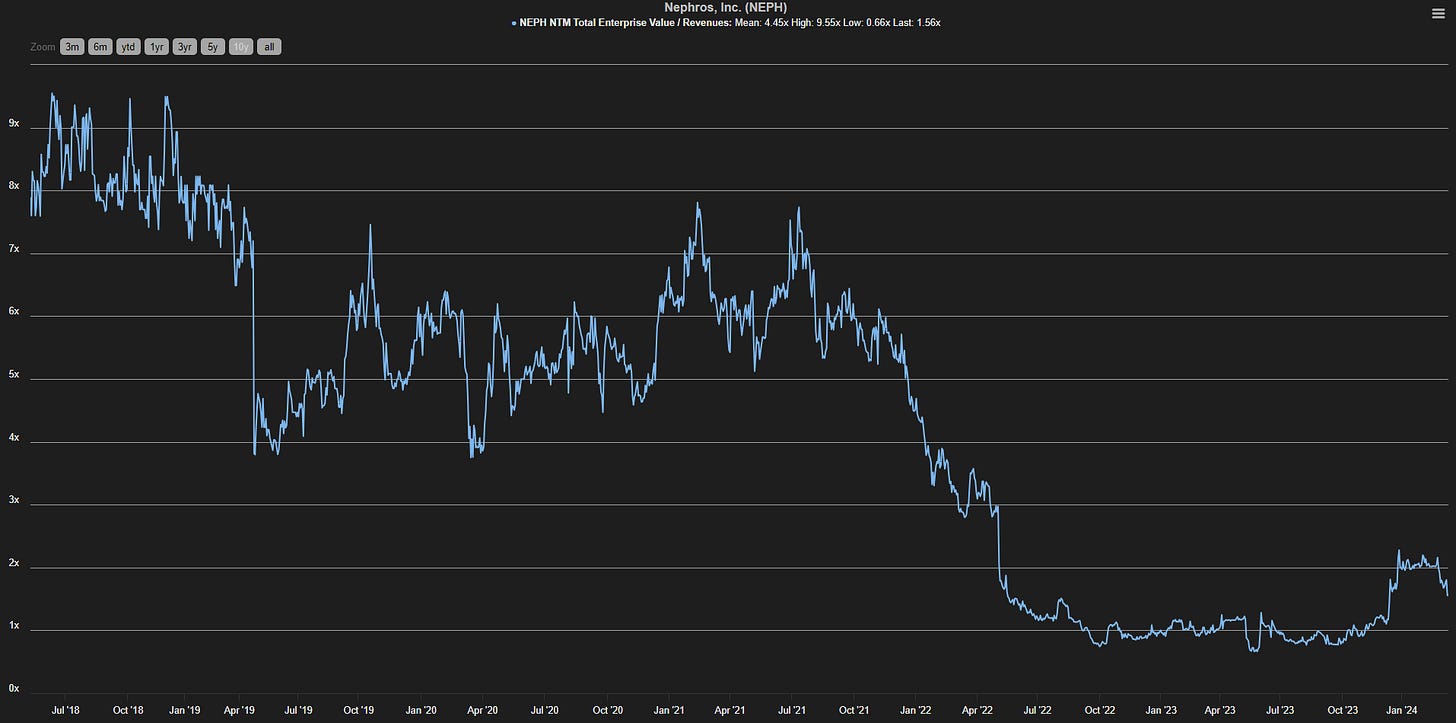

At one point in the past they were growing 40-50% yoy consistently and fetched a much higher multiple.

In March of 2023 they partnered with Donastar to be the exclusive distributor for commercial filters in the food & beverage and hospitality markets.

They had been working together since early 2022.

The filters are competitive in the marketplace. They are low cost relative to the high risk they prevent. I have to admit that my product knowledge is lacking. My understanding is they offer a high quality product in the marketplace with low churn. Nothing has been formally disclosed, but these are pieces I have put together over the last few years.

Balance Sheet

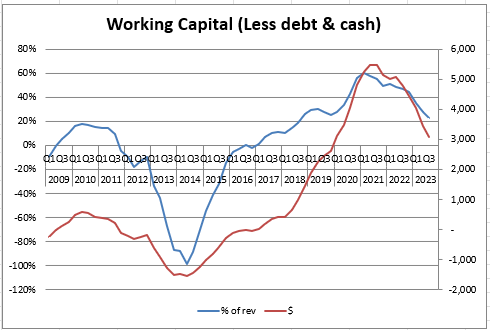

The balance sheet has about 2.4 million in cash. Working capital sits at about 6 million. As they shifted focus to filters and driving revenue, the working capital balance relative to revenue has come down.

Share Structure & Ownership

I like the company’s low share count. They have just 10.3 million shares outstanding.

The largest shareholder is Wexford Capital. They have been a shareholder for years and haven’t sold any. They have board representation (Arthur Amron) and play a collaborative role within the company. I expect them to remain a large shareholder until there is sufficient liquidity in the shares. This holding is essentially a rounding error for Wexford.

Members of the Pessin group own about 8.6% of the common. I am not sure how material this position is for the group, although they haven’t sold shares.

The interim CFO (Astor) owns 1.4% of the common. Outside of Wexford and the CEO, the other members of the board own 1% of the common.

Management & Compensation

NEPH has a newish CEO (Robert Banks) who joined a year ago. The CEO base salary is 350k until the business has revenue of 15 million (in a fiscal year) at which it increases to 400k. At 20 million in revenue, base salary will be 450k. Banks spend 20 years at GE in a variety of commercial and engineering positions.

They also announced a new CFO last year, Judy Krandel. She seems more than adequately qualified as well. She brings experience from asset management, investment and financial reporting. The was CFO of Recruiter.com from 2020 to 2023 (don’t look at the price chart on that one). She is stated as being part time for Nephros.

There is a performance bonus with several executives. It was targeted at 30% of base salary on the last proxy, so I’m assuming it will be similar to that for the incoming CEO.

There is also some stock option compensation, though it doesn’t seem excessive.

Board

The company has 5 board members with 3 of them being independent. The representative from Wexford is not considered independent. They rotate board members on 3 year terms.

Risks

They rely on suppliers to make some of their products.

They utilize resellers for their sales efforts.

The company is not gushing cash, so the business may not be able to fund future growth.

Though they have patents for their technology, it may not be enough to protect their products from larger companies.

Valuation

The stock had a strong 2023and has pulled back recently. It’s currently trading at about 1.6x EV/Revenue and 2.7x EV/Gross profit. Due o the low EBITDA numbers currently, I don’t think using EBIT or EBITDA is a way to value NEPH. Below is the historical EV/Sales. I would not expect NEPH to trade at those multiples anytime soon.

Most Recent Financials

Due to the previously mentioned raises and removal of costs associated with PDS and SRP business lines the business is in much better shape than a couple years ago. The focus on growing top line, working capital relative to sales and on an absolute basis is welcome. You can see the sharp run in revenues has aided them in getting to breakeven. The chart below shows raw CFFO (before working capital).

ASHRAE 514

The company has mentioned ASHRAE 514 on the last couple of calls. Below are some details on ASHRAE 514.

What is ASHRAE?

ASHRAE was formed as the American Society of Heating, Refrigerating and Air-Conditioning Engineers by the merger in 1959 of American Society of Heating and Air-Conditioning Engineers (ASHAE) founded in 1894 and The American Society of Refrigerating Engineers (ASRE) founded in 1904.

The state or city can mandate the standards that ASHRAE recommends. My understanding is that insurance companies can require it as well. Even though a state or city may not adopt a code, that doesn’t’ necessarily mean that they won’t be working toward becoming 514 compliant.

What is Standard 514?

514 piggybacks and broadens the scope of 188. 188 was focused on Legionella, where 514 scope includes illness and injury from physical, chemical and microbial hazards. 188 is prescribed for buildings with 10+ stores and occupants over age 65. 514 includes 6+ stories, buildings where surgeries are performed, housing occupants under 2 and over 65 among other.

I couldn’t find a ton of information on where 514 has been mandated. What I did come up with is that voluntary compliance of the full 514 standard is low. I could understand that given how much documentations and controls are required. Again, that doesn’t’ mean there wouldn’t be an increased demand for NEPH products.

I’m going to follow this closely to see how well adopted 514 is.

My Thoughts

The recent partnership with Donastar seems to be gaining momentum for NEPH. The hospitals and dialysis revenue is also growing. ASHRAE 514 is another potential tailwind. So my expectations are that NEPH will be growing 10-15% and around break even. In the immediate future I just want to see the revenue growth and gross margins being maintained. There are some potential opportunities to utilize their technology in other markets as some point so I think there is lots of white space here.

I think the new CEO & CFO coupled with the sale of Pathogen Detection and wind down of the Specialty Renal brings focus for the business. They can no longer rely on going to market and getting capital, so they need to grow and show some profitability. How profitable, I’m not 100% sure. It may make sense to invest more in the business more once they consistently generate cash. No more side quests, just focus on moving some filters.

I see this as low(ish) risk with some uncertainty.

Thanks for reading.

Dean

*disclosure – long NEPH

ASHRAE 514 links: