NutriSystem Update...Unhealthy?

I took a huge hit on NTRI over the last 6 months. The stock is always volatile after earnings as it usually has 30% short interest. The last time the company missed, I added more. This time I am not. I'm out as of today.

Why? Let me explain...

I bought NTRI because I thought it was a fast growing company that had a mis-step that was exasperated by the recession. It seemed that the company was making headway against competitors and the NutriSystem D line was just being launched. Lets keep in mind that NTRI has almost no moat. You can go buy healthy options from the store that aren't in little packages and honestly it is probably better for you. The internet is full of FREE healthy eating tips and how to monitor your progress. NTRI caters to guys like me...brain off dieting. All this doesn't mean that you shouldn't own NTRI, it means you should pay a certain price.

The tailwinds in the industry attracted me. But this industry is extremely competitive. Not only internally from Jenny Craig and Weight Watchers, but externally from pharmaceuticals. I think that all expenditures are being spent to simply maintain market share here. And that the dividend is probably excess cash and maybe even some return of capital.

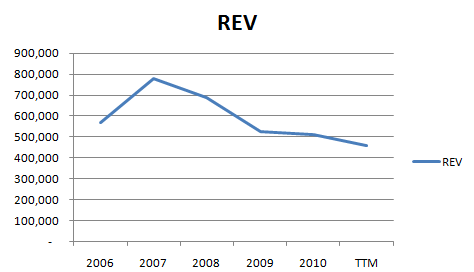

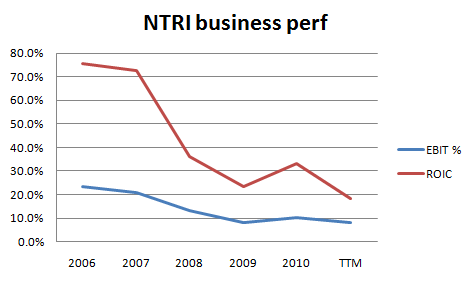

Some visuals always help...

The graphs show a company that has struggled to reach peak revenue levels. Management will tell you it is "the economy", and maybe they are right. But NTRI does not have a moat. Earnings beats typically have come from expense reduction, not increased revenue.

It is OK to buy a company with falling margins. Buying a cyclical company during the height of a recession is usually a good investment. NTRI is not a cyclical, and you can see that because revenue has continued to fall even after the recession has ended.

So that leaves you with using assets to try and value NTRI. With price to book at 4.5x, I don't really have a margin of safety here. I know, the customer relationships are worth something and all that money spent on advertising is worth something. I agree, but what? I don't know and I won't speculate.

I failed to realize the impact competitors have on NTRI. As such I have lowered my fair value to $14-15. Not leaving enough margin of safety, I have decided to sell in favor of better opportunities.

I think that it is tough to determine what NTRI will actually earn. It is possible to achieve the 33.9 million (or $1.18/share) in net income. But as witnessed by the company's last few quarters, if a competitor launches a new product, NTRI must cut prices drastically to maintain market share. Not something I want to pay a premium for.

NTRI also has healthy executive compensation and lack of insider ownership. Two things I am fond of.

I have a revised trigger of under $10 given the risk. As with anything, I would be flexible if there was some more clarity.

Dean

Disclosure: The author has sold NTRI. Given his impeccable timing, you should buy and expect a nice return.