I went over the performance of my OFS trades in a prior post below. Here I will go over a quick update on the specific companies and what I am thinking as of this point in the year.

OFS Basket Review Q1 2024 Part 1 (of 2)

I have mentioned a few times that I own a basket of OFS companies rather than my usual concentrated microcap positions. I thought I would write a post to hold myself accountable and potentially (and very selfishly) get ideas/feedback from my readers.

O&G Activity

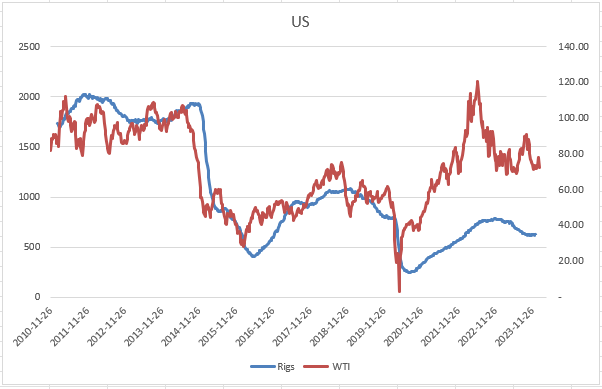

WTIC has had a strong start to 2024. At one point WTI was up 10%, but has now settled and is up about 3%.

The rig count in the US dropped from it’s peak and has been treading water here. The majority of the year over year declines have been from private operators.

In Canada things have been a bit more stable. The annual swings in rig utilization can be impacted heavily by weather during the cold season. The rig count is a bit less than last year. The next 6-8 weeks were quite strong last year with the rig count in the 240-250 range. The last two weeks have printed 230 and 232.

Globally things we have seen an minor uptick across the board.

My Assumptions for Activity

USA

I believe that the rig count has troughed out for the land market in North America. I think the producers in the US are at a point where they will need to drill to offset the decline rates. We have run through a good portion of the DUC (drilled but not completed) wells that can be brough into production quicker. The Permian is under 1,000 from the peak of over 3,000.

At these prices, I don’t think we see a run in rigs being deployed, but some stability in activity and day rates. The US production has surprised me to the upside so far.

Canada

Pretty steady here. Assuming a measured increase in activity mainly driven by take away capacity from the Trans Mountain pipeline. There is always the chance of further delays, so things can change like this news. The delays and cost overruns make my home renovation projects look well managed, which is sad.

Global

If I am at best a generalist in North America, then I would be even less so globally. My understanding is that this cycle the added supply will not come from the North America land market. Though supply may grow, it will not have the impact that shale had last cycle. I do have some exposure to International markets, but I am generally less exposed than I would like to be.

OPEC+

I don’t know what OPEC+ will do. I don’t have any special insight into what goes on at the meetings and who is winning the 4D chess battle. They are a wildcard for sure with around 5 million bpd estimated spare capacity.

Specific Companies

None of these companies have reported Q4 2023 numbers so we will get a better idea of how the businesses are doing in about 3-5 weeks.

McCoy Global (MCB.to)

MCB has been executing well. They have a small dividend that I could see getting bumped higher this year. As well the NCIB should be continued. The backlog has been stable to slightly down over the last 3 quarters which isn’t a bad thing given how large it is. MCB has been making inroads on their digital technology roadmap. At the end of Q3 2023 the had this in the MD&A.

During the nine months ended September 30, 2023, McCoy received orders from six (6) new customers and three (3) new geographies for its CRT technology. Looking ahead, we expect further growth in orders intake and revenue generation from this product line as we continue to gain market share with our product.

In 2024 I am looking for them to have inventory levels come down relative to sales levels. As well their largest shareholder Cannell Capital has been slowly selling shares. Though the position is not that material to Cannell (around 1.2%) it can put some pressure in the short term on the share price.

Jim Rakievich, President and CEO, was recently on the Planet Microcap YouTube channel.

MCB currently trades at less than 4x EV/ttm EBITDA.

Total Energy Services (TOT.to)

Nothing has really changed from my Q3 2023 update. They have kept profitability stable with some churn under the hood. Not expecting much from CPS from here. The CPS backlog continues to tick down so I’m assuming at some point revenue rolls over a bit from that segment. They have increased the capital budget to further invest in the rental fleet. Analysts (according to TIKR) are expecting a fairly healthy jump in EBITDA margins for 2024. I’m not sure it will be quite as strong, although trend in the right direction.

TOT trades at around 3x EV/ttm EBITDA, and under 7x FCF.

PHX Energy Services (PHX.to)

PHX is very shareholder friendly. They have a ROCS (Return of Capital Strategy) to return 70% of excess free cash flow to shareholders. Hence the over 8% yield (at one point was over 10%).

I am not what 2024 brings relative to 2023. If the US land market picks up then they should do well. Trading around 3.2x EV/ttm EBITDA and 5.5x FCF.

Pason Systems (PSI.to)

This one has a very strong market presence with their Electronic Drilling Recorder (“EDR”) and related peripherals being a high value add product to rig operators.

I am expecting some growth in 2024 over 2023 in the existing business but not a ton. Where there is upside is the their purchase of the remaining shares of IWS (Intelligent Well Services). They have stated that IWG could be as large as their North American drilling market, which is just under 300mil annually. This could be a big needle mover over the medium to long term.

PSI trades under 6x EV/2024 EBITDA (my estimates).

Step Energy Services (STEP.to)

Nothing new to report from my update after Q3 2023. The continue to delever the business. They have been active with the NCIB and I expect that to continue. I am not sure if they will continue to pay off debt until it’s 0 or pivot and potentially issue a dividend or pursue M&A.

STEP trades at 2.3x EV/TTM EBITDA.

Pulse Seismic (PSD.to)

It looks like PSD managed to buyback over 1% of the common back on January 18. Since my Q3 2023 update they also announced a decent sized licensing agreement and special dividend of 0.20 per share. This brought my total dividends per share to $0.51 on my initial purchase at $1.29. It looks like they had a huge Q4 2023. 2024 will have harder comps, but with a company this shareholder friendly I’m not too worried.

Given the lumpiness of the business, an investor is probably best looking at an average EBITDA level for a couple years.

Questor Technology (QST.v)

I have no comment. The position is smaller than my benchpress in high school.

Closing Remarks

Feel free to comment on any of these companies or share some of your own. I have not been successful with producers, so I tend to stay away from them other than some CNQ in my kids’ education fund. Having said that some of the cash flow multiples on the producers are pretty wild.

Thanks for reading.

Dean