Disclaimer

I am at best a generalist here. There are many other newsletters you should be reading if you want to better understand the fundamentals of O&G. I would recommend Nugget Capital Partners and Commodity Context.

OFS Basket in the context of the overall portfolio

Before getting too into the weeds on the specific companies, I think it’s valuable to explain the position as it relates to my overall portfolio.

I am a concentrated microcap investor. I consider minimum position size to be 5%, except in cases like this where I have a basket of companies that I think will benefit from a trend when looking at it from a top down standpoint.

I focus on OFS cos over producers as I am more comfortable with their businesses. I also like to focus on smaller companies where I feel there is less competition. This can to lead to the share prices lagging the industry activity at times.

So far my OFS cos have outperformed the index that I use, the XEG.to. They have underperformed the Nasdaq on the aggregate.

My Thinking at the start of 2024

As 2024 started, I was expecting to have activity pick up in the back half of the year. My thinking was that this would come from stable (and gradually rising) prices due to a fairly balanced market and capital discipline would continue across the industry.

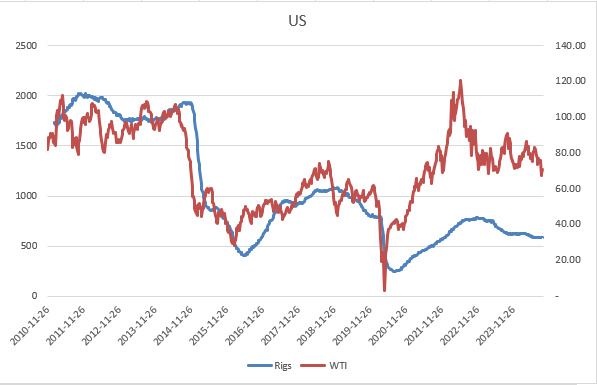

You can see the disconnect with the price of WTI and the rig count. This speaks to the efficiency gained in the rigs over time.

Macro

The macro backdrop has been weaker than I expected for several reasons.

Demand out of China has been weaker than I was expecting.

There are now calls for China petroleum product demand to continue to trend down into (and potentially beyond) 2025.

China has been purchasing a larger mix of EVs compared to what I was anticipating.

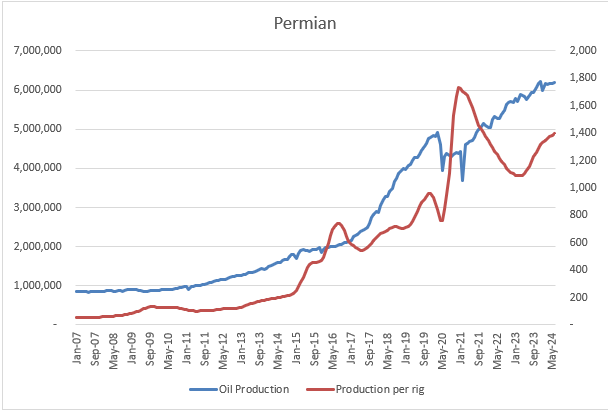

Production the US (particularly the Permian) has not trended down despite the lower rig count. This speaks to how much the rig efficiency has improved.

*the production per rig has a lag

Developed markets demand weaker after rise in interest rates.

I think everyone can agree that the economy is weaker than a couple years ago. The increase in interest rates has resulted in slower (or maybe negative) growth in developed markets. More and more articles like this are popping up.

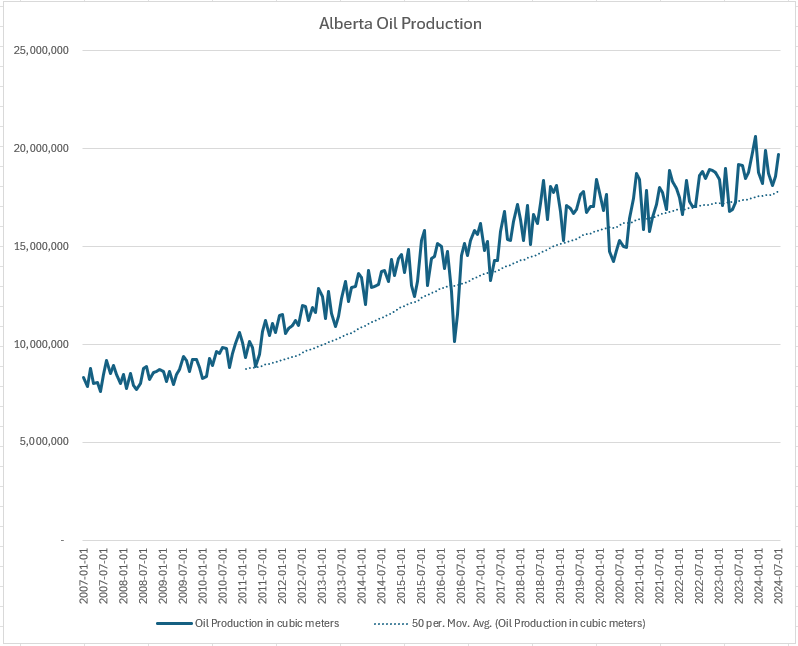

Higher production from Canadian and International Markets.

Canadian activity has remained strong relative to the US. The recent completion of the Trans Mountain has allowed Canadian crude to access additional markets.

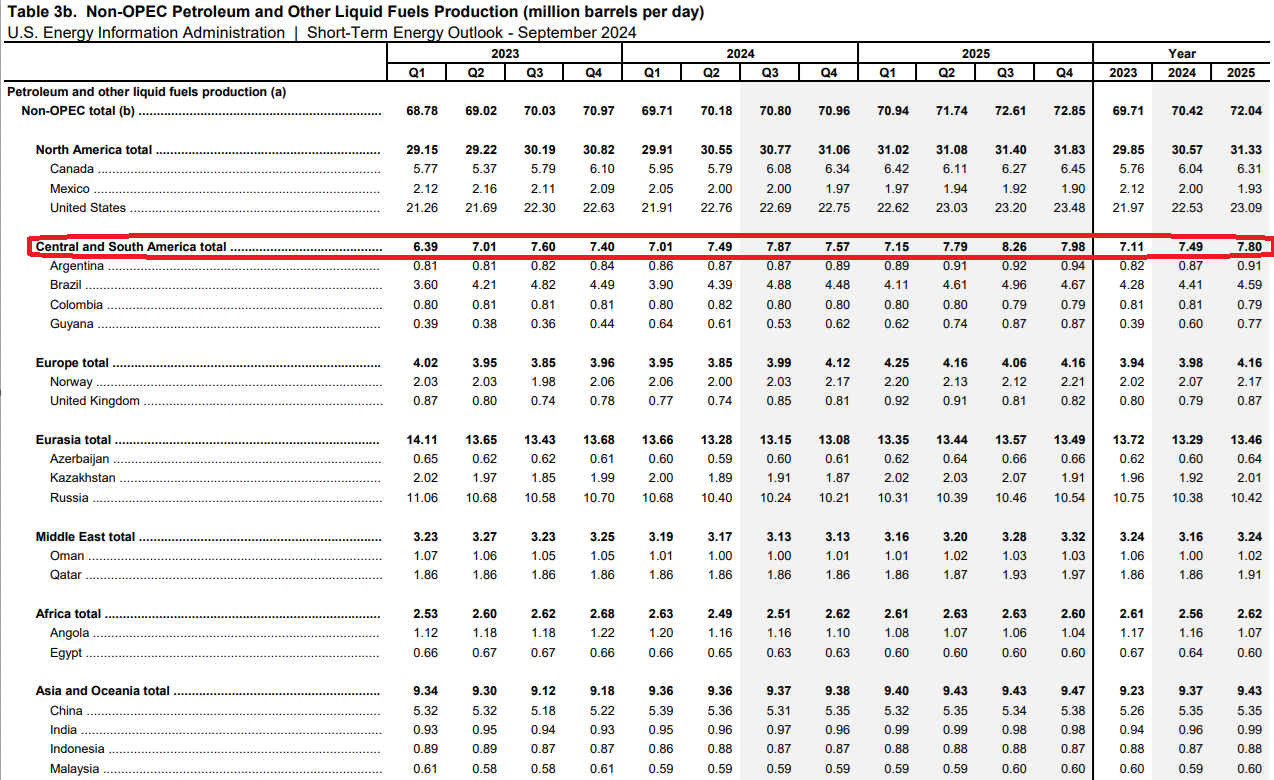

Current and expected production from Central and South America looks to increase.

*FWIW I think the EIAs estimate of production in North America is too optimistic here.

Some things that are supporting oil prices

OPEC+ delaying production increases.

Though adherence to production cuts has never been a synonymous with OPEC, they are keeping their word at this point.

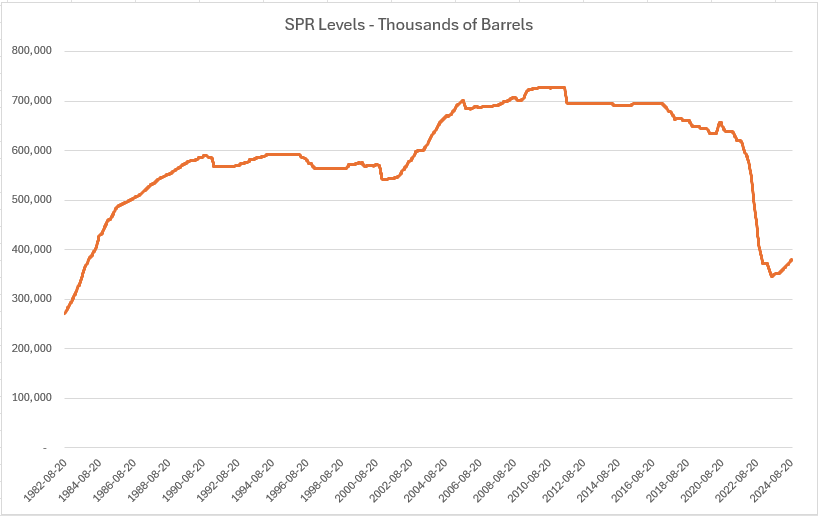

US SPR needs to be refilled.

At this point in time, the SPR is well below it’s long term average and I would assume at some point it gets refilled.

LNG facilities coming online in 2025.

Though this should support nat gas prices more than oil (obviously), I think it still bodes well for the industry overall. Nat gas has taken it on the chin as many company’s have hedges at higher prices.

Looking Ahead

You don’t make money reporting the news, you make it by finding mispricing in the market. All the points I’ve made tell you why oil has done what it has done, not what it is going to do. In my opinion there are less and less investors interested in the energy markets. Two years of at best sideways share prices with Mega Cap Tech doing well will do that to a person. Given the headlines, election uncertainty and slowing economy it’s hard for the marginal investor/institution to increase exposure here. And why would you, when you can buy mega cap Technology companies that have had much better returns.

I think in order for some real money to be made here, we need a narrative shift. A sustained shift in our realization on how much we rely on hydrocarbons likely coincides with a rotation out of big tech.

Positions

I won’t go into detail on each company as I put out my thoughts after they report quarterly results. I will link to my latest thoughts on each. I will say that these all have unique characteristics that provide varying degrees of leverage to the cycle. I am looking at a couple of names that I think would make a nice addition to this basket.

Thanks for reading.

Dean

what are perspectives of Independent contract driling?

https://www.cnbc.com/2024/09/26/oil-prices-little-changed-as-us-stockpile-drop-offsets-global-demand-woes.html

careful with oil........