Sorry for spamming you, I discovered an error in this post after I published it.

I've previously put some thoughts O&G activity internationally and in the USA, today I put some things together for Canada.

For those unaware, Canada has the 3rd largest oil reserves in the world (mostly) via the oilsands. There is also multiple LNG projects being commissioned and built in BC to send our natural gas to more expensive markets globally. These are highly complex, multi year, multi billion dollar projects.

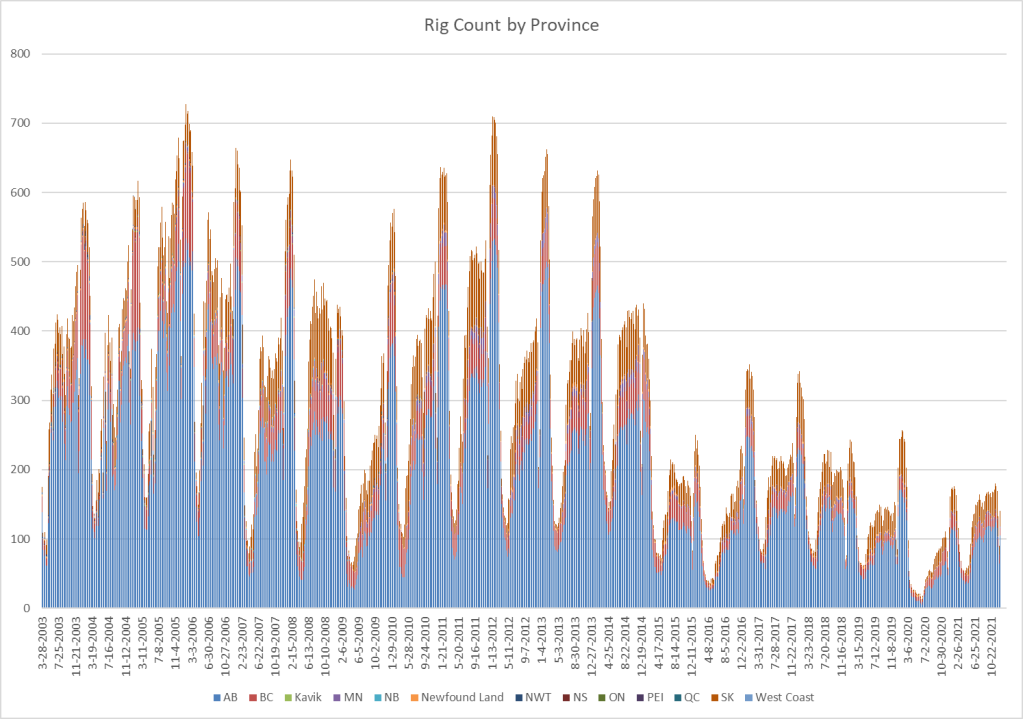

British Columbia, Alberta, and Saskatchewan make up the vast majority of activity, so I will focus on activity in Western Canada. Below is the rig count for Canada, it shows how much of the overall activity is based in AB.

With so much business activity based on cyclical demand for hydrocarbons, Alberta is known as a boom/bust economy. As an Albertan, I understand how important the oil and gas industry is to our local economy. Local businesses compete with the higher wages present during the boom times, but also benefit from the increase in household income. When activity is strong, I notice an increase in our infamous rig rockets around the streets. For those who don't know what a rig rocket is have a look below for a good example.

As a Canadian, I realize that our country's largest export is crude and refined petroleum products. Depending on the year and how you add up the various products, they make up 15-20% of our exports. Regardless of your political leanings or views on the impact on the environment, a sharp decrease in price or activity (or both) will be harmful for Canada's budget (at least in the short to medium term).

https://oec.world/en/profile/country/can#yearly-exports

Though WTIC is a decent indicator for global prices, for Canadians (and particularly us out west), we like to focus on Western Canadian Select (WCS) and a more localized Natural Gas price (say Alberta Nat Gas). WCS is a lower quality oil and it's further away from major markets than WTIC and trades at a discount to WTIC. It's also tends to be more constrained by pipeline capacity than other benchmark oils.

WCS wasn't established until 2004, so that is as far back as we can look.

You can see from the chart there were 2 big drops in the chart at the end of 2018 and during the initial days of the pandemic.

The WTIC and WCS spread makes headlines sporadically when it's at the extremes. The highest spread was in late 2018 when the difference was over $50. The spread has been as low as $5-7 but usually doesn't last long. $15-25 is a more typical difference between the two.

Production costs

It's hard to determine the exact marginal cost for a barrel of oil. It's obviously project specific as well it's tied to the available pipe or rail to transport it to a refinery. This may be an over simplification, but I think of Canadian oil as "more expensive" than many other sources. Having said that, it (at least historically) tended to be more "business friendly" out west. So these types of qualitative data points need to be considered if you are a large oil producer. Maybe it's more expensive to produce in Canada, but there may be more stability.

I grabbed this chart from a 2017 IMF Working Paper. I also attached the paper below.

History

The history of oil production in Canada is colorful. Here are just some of the more memorable recent events I can recall related to activity in Alberta:

"Bitumen Bubble" and subsequent impact on Alberta's budget in 2013.

WCS spread reaching $50/barrel in 2018.

WCS trading under $10 (and lower on a daily basis) in 2018 and 2020.

WCS trading over $100 in 2008 when we were "running out of oil".

The rig count in Canada peaking over 600 during the cold season (2004-2008) and (2011-2013).

Production limits mandated by the NDP government in response to the increased spread between WTI and WCS due to mainly to limited pipeline capacity.

Keystone pipeline (important for taking AB crude to refineries in the US) commissioned in 2010.

Keystone pipeline rejected by Obama administration in 2015.

Keystone pipeline production resumption with UCP gov taking an equity interest in 2020.

Biden revoking the permit for the Keystone pipeline in 2021.

Many others being commissioned, started, stopped, re-started, etc.

For some additional context Alberta is typically a Conservative province (except our recent NDP stint) with our national leadership tends to swing more Liberal. I'm not going to into detail, but the oilsands and hydrocarbon production are always topical. There is a very wide dispersion of public opinion regarding the oil and gas industry, more specifically the oilsands and production of oil. It has been labeled "dirty oil" by many.

Investing Implications

If you managed to make it here, you are likely saying to yourself "ok already... get to the investing stuff, I'm here for the rocket ship emojis not some history lesson on Canada". This is all just background for anyone interested in investing in O&G companies, albeit it can be boring.

Given the price of oil, the rig count is too low compared to previous cycles. Similar to other parts of the world, large producers have been reluctant to deploy significant amounts of capital to replace the declining reserves. It should be noted that many large producers in Canada have 30+ year reserves, so they may not have a large sense of urgency.

The ESG movement and transition to EV has taken center stage for many firms (especially those who look to gather more assets). My opinion is that we will be tied to hydrocarbons longer than we think and this last cycle(s) coupled with covid has left us underinvested relative to our demand picture.

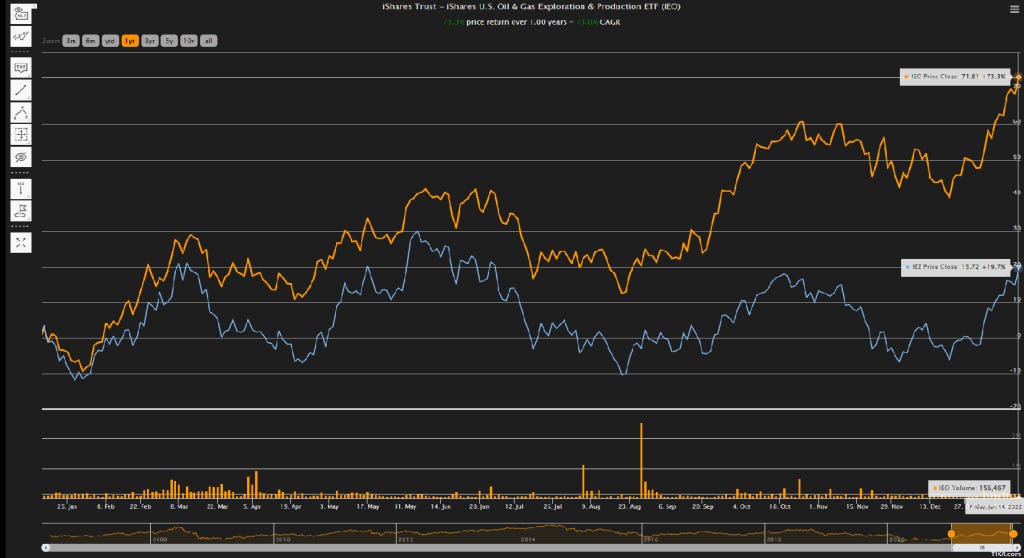

This of course can be misleading. Who knows if I picked the appropriate times to compare these. You could go back longer and come to a different conclusion, so be warned. In reality we should be looking at valuations on an absolute and relative basis along with the share price and fund flows.

Having said that, I believe that there may be an opportunity to invest in companies tied to O&G market activity (not production alone) that will produce (in aggregate) reasonable returns relative to risk.

For my portfolio, I look at investing in O&G companies as a top down bet. I don't know all the nuances of each cycle, so I take a basket approach. I try to be diversified geographically and by product/service. This does leave me with more companies to follow and can stretch my bandwidth at times. I currently own McCoy Global ($MCB.to) and Pulse Seismic ($PSD.to) that are directly tied to oil and gas activity. As well, I have a position in Macro Enterprises ($MCR.to) that benefits from overall investment in oil and gas infrastructure.

I'll go over how I benchmark this trade/investment in a future post.

Anyone else follow the rig count or have anything to add?

Thanks,

Dean

*long $PSD.to, $MCB.to, $MCR.to