One That Got Away - Boyd Group (BYD.to)

If you think kids are expensive, listen to this one about Boyd Group…

I have a couple of posts in progress, but I still want to put something out this week. I chose a funny story from my personal life. Hope you enjoy it.

I complain all the time at how expensive it is to raise kids. If you hang around me long enough you will hear me say things like “what you’re hungry again, didn’t you just eat this morning?” or “what do you mean your clothes don’t fit anymore, it’s almost like you need new clothes every year.” Obviously, I am kidding when I say these things. I didn’t have kids and expected to keep my expenses down. Today’s post I’m going to talk about how much money I missed out on when I passed on Boyd Group. It makes for an interesting story.

The year was 2009. The market was tanking (well had been tanking for 18 months). I’m ticking along on my investment journey. I am still at the front end of my journey and learning where to allocate money. I heard about Boyd Group through a friend. He says it’s a boring business but growing and profitable. I remember that my dad works at one of the Boyd locations and had recently become the shop foreman.

Some Background on my Father

My dad is a fairly typical 1970s blue collar dad. He grew up dirt poor and his only post secondary education is his trade that he started when he was 16 or 17 when he left the farm. He is one of those dads that has an insane amount of mechanical aptitude. He can fix pretty much anything on your house or car. He was the best technician in whatever shop he went to (as evidenced by him getting head hunted by other shops constantly). It wasn’t until I was well into adulthood that I realised how smart he is. Anyway, he isn’t a “business” or “finance” person. He really only saw what was happening in his work bays. At that point in time, he put away the tools tried a stint as shop foreman. When I asked him about BYD, he was about 6 months into the new role. It wasn’t a good fit for him (he quit a month later and went back on the tools).

BYD Since 2009

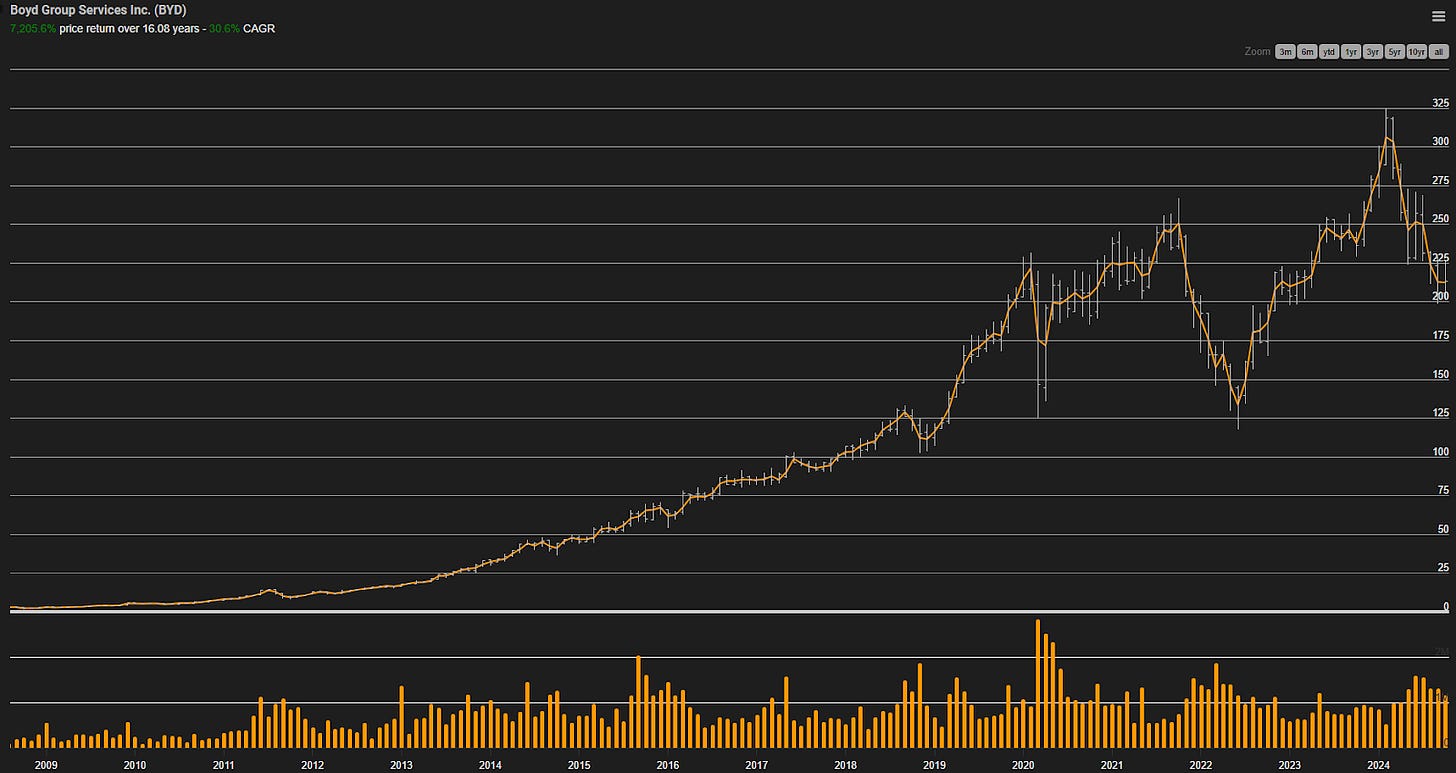

I asked my dad about BYD. He said something like “They can’t make any money given how much of a gong show my shop is”. And it was enough to scare me away from the stock. Below is a chart of BYD since then.

Yeah 30% CAGR without dividends included. $10,000 invested 16 years ago would be worth $665,000 today. That hurts.

What I Missed

What I didn’t think about was the context at which my dad would say such things. I didn’t dig deeper. I could have asked for more detail on what he meant. I could have asked to take a tour of the shop (which I had washed cars at as a part time job during the summer of high school) or speak with someone higher up in the organization. Yeah I read the financials, but I convinced myself that the business was about to fall off a cliff in the next quarter or two. My friend who mentioned Boyd was an investor for over 15 years at this point, I could have asked him some questions. I literally stopped after 15 seconds of research.

Wrapping it all up

I want to emphasise that it was my decision not to buy BYD and therefore I cost myself the money. Not my dad. As you go along in life you get good and bad advice this is particularly true for investing. I should have dug deeper and used some perspective to think of things through my father’s eyes. Oh well. Live and learn. Onto the next one.

Hope you enjoyed this post. Thanks for reading.

Dean

*no position in BYD.to