*Disclosure: I own shares in OSS.v. I am not a professional. Please do your own due diligence.

Price: 0.84 CAD

MC: 103 million CAD

EV: 97 million CAD

1 year performance: -1%

In case you missed it, OSS announced that would be acquired by Irth Solutions LLC on August 12th. My initial thoughts were that the deal price of 113 million CAD or $0.88 per share is too low, but I wanted to wait until they had their Q2 call before making my decision on how I would vote.

*all numbers in CAD unless stated otherwise

First, let’s take a quick look at the quarter to see how the business is doing.

Quarter Recap

Revenue was up 24% to 3.1 million.

Gross margin was 76.3% vs 75.9% last year.

They ran an EBITDA loss of 647k (59k loss removing SBC).

This includes additional costs from the potential transaction.

There was some delays in the quarter that they felt would be made up in H2.

They kept 2024 guidance of 15 to 16 million in revenue.

The business seems to be moving along nicely. They continue to sign new customers and expand the revenue per existing customer.

The Transaction

From the press release:

OneSoft Solutions Inc. (TSX-V:OSS) ("OneSoft" or the "Company") is pleased to announce that it has entered into a binding arrangement agreement dated August 12th, 2024 (the "Arrangement Agreement") with irth Solutions LLC and its wholly-owned subsidiary irth Acquisition Corp. (collectively "Irth"), a Blackstone portfolio company, pursuant to which Irth will acquire all of the issued and outstanding shares of OneSoft (the "Shares") for $0.88 in cash per Share (the "Consideration"), representing a total cash equity value of approximately CDN$113 million on a fully-diluted basis (the "Transaction").

The Transaction will be implemented by way of a statutory plan of arrangement under the Business Corporations Act (Alberta). Completion of the Transaction is subject to customary conditions, including court, regulatory and TSX-V approval and the approval of (i) at least two-thirds of the votes cast by Shareholders by proxy or at the Shareholder meeting to consider the proposed transaction (the "Meeting"), which is expected to be held in October 2024; and (ii) if required, a simple majority of the votes cast by Shareholders by proxy or at the Meeting (other than the votes of Shareholders excluded for the purposes of any "minority approval" under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ).

They mentioned that 25% of the shares held by directors and officers of the company have entered into irrevocable voting support in the press release. I think the second criteria will be hard to get. I am not sure they will get the “majority of the minority” for this deal.

Here are my thoughts on the deal

1 - The price

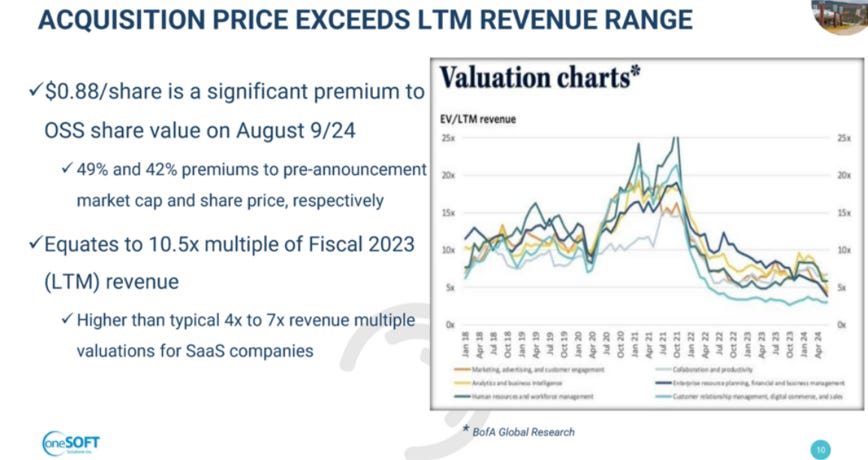

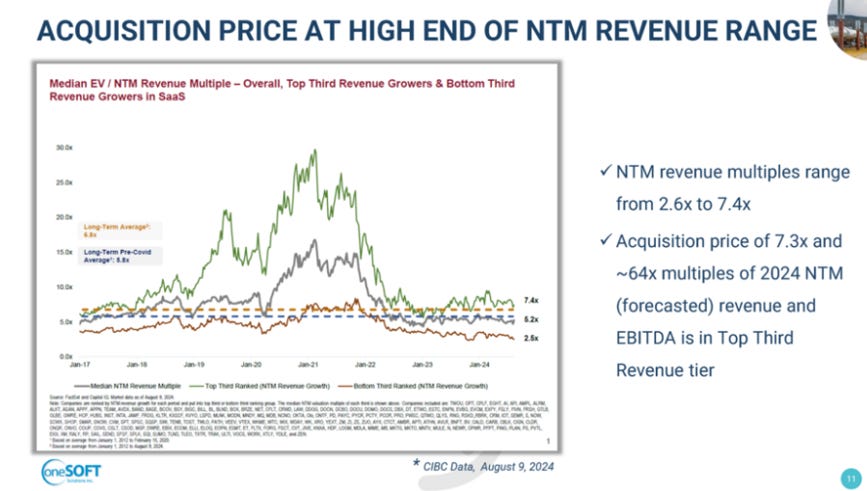

In their Q2 presentation they reference SaaS deals and their multiples. They mentioned that OSS will get near the top end of the valuations that other companies had. The 0.88 per share equates to 10.5x 2023 revenue. Well, we are halfway through 2024 and they are at 8.7x EV/revenue. Using midpoint 2024 (guided) numbers, the deal would be at 6.6x EV/revenue.

Though I think you need to look at comparable multiples for take outs, but you also have to think critically. I don’t know how fast these other companies are growing and if they have such a head start on competition like OSS does.

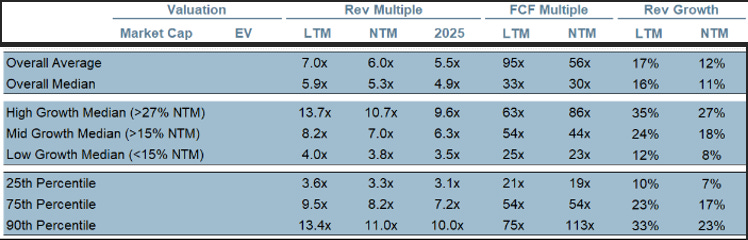

When I look at the multiples that Jamin Ball provides over at Clouded Judgement, I can easily draw a different conclusion. Below is the chart of larger public SaaS companies. Keep in mind this isn’t a premium that would be required to take these private.

OSS currently would fall into the “High Growth” and maybe the “Mid Growth” over time. I personally think they remain in the high growth category. The multiples for high growth and mid growth are 10.7x and 7.0x NTM EV/revenue and 9.6x and 6.3x 2025 EV/revenue. I know that OSS is a small venture listed company, so this may not be a great comparable. If OSS grows 30% over the midpoint of 2024 guidance than we are 5x EV/revenue for 2024 numbers which is below the average for the mid growth group. Hardly sounds like a sweet deal to me.

2 - Advisors

From the press release:

Grant Thornton LLP is acting as financial advisor to the Company. Parlee McLaws LLP is acting as legal advisor to the Company. John W. McClure Professional Corporation is acting as independent legal advisor to the Special Committee. RBC Capital Markets and Cantor Fitzgerald are acting as financial advisors to Irth. McGuire Woods LLP and McMillan LLP are acting as legal advisor to Irth.

On the call they were asked why they didn’t use an investment banker for the transaction. The answer provided (I’m paraphrasing) was that they don’t feel that they would have gotten a better price given they were already at the top end of the valuation range. Any prior conversations with Investment Bankers indicated that they would get a market multiple in a sale. They simply chose to “do it themselves”.

I have my reservations about this. I get that this management team is not promotional. It’s a quality that I like as a shareholder. But if I’m selling something I want some promoting done. I would have felt better with an investment bank involved here.

On the call they were asked if they had any inbound inquiries since the deal was announced and they said no.

Other Inconsistencies

There are some other inconsistencies that bother me or at least aren’t sitting right. Under normal circumstances they are much more forgivable, but given the proposed deal I am less forgiving.

1 - Needing Capital

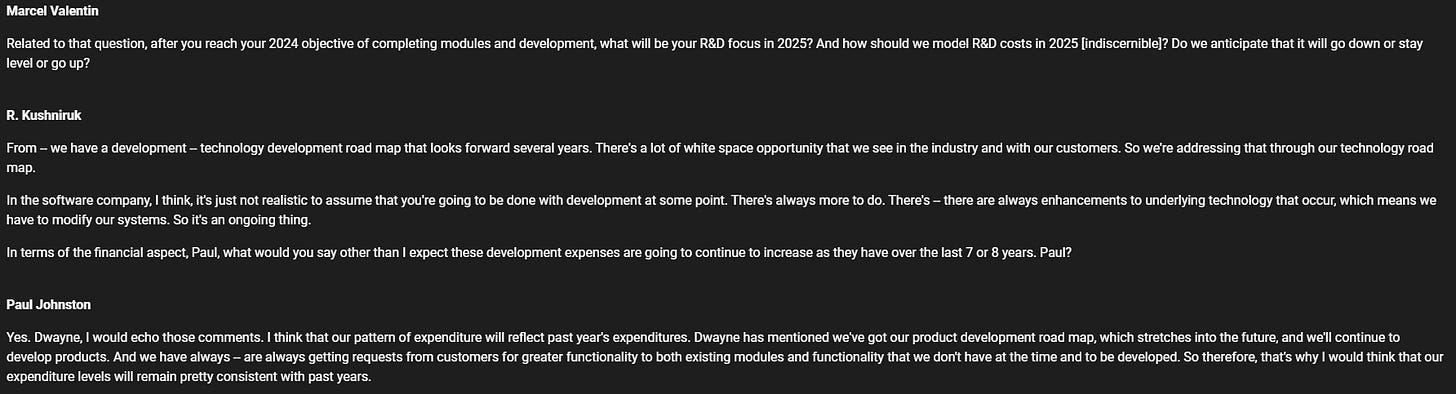

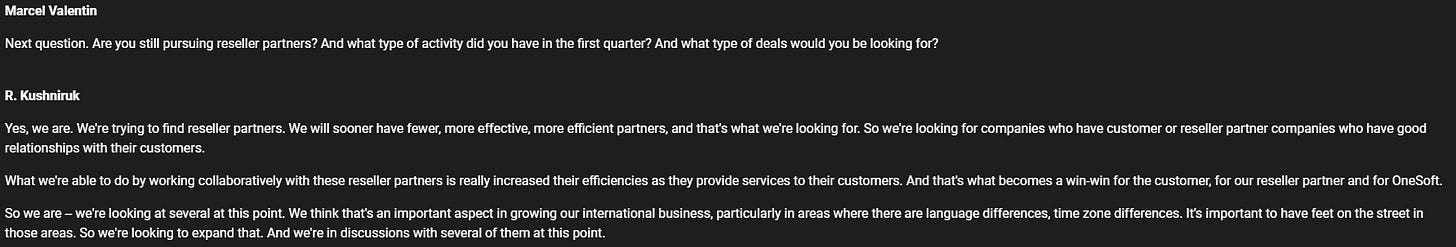

They mentioned that they were looking to continue this high growth rate by expanding into new geographies and that would require more capital. On the call they mentioned needing 15 million or so to go after the 300-400 mill TAM they identified. This was news to me. Of course I knew they would need more staff to hit the larger TAM, but I didn’t think they were in need of capital to that degree. I have not seen in any of the press releases where they stated they would need that large amount of capital or remember hearing it mentioned on a conference call. Here is screenshot from the Q1 2024 call. The question is in relation to R&D and it sounds like the requirement would track revenue over time.

They mentioned that they would need capital to really invest to grow internationally. To me that would mean hiring a sales force, but in the Q1 2024 call they mentioned resellers. I don’t think a ton of capital would be required using resellers, but I could be wrong on that.

So even if they did need capital there are other ways to do so without diluting shareholders. They could do a rights offering for example.

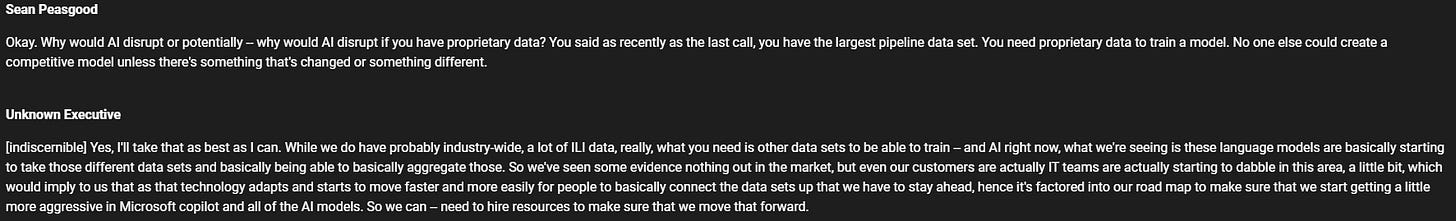

2 - AI is now a threat

Here is a screenshot from the call when they were probed about AI being a threat.

What doesn’t sit right is that these IT teams are the same ones that OSS has replaced with CIM. They were a team of several engineers comparing excel data changes and trying to predict the largest areas of concern for OSS’s customers. They were slow to change and adapt to machine learning and doing things via excel. In other words they archaic and inefficient for modern times. Now all of a sudden they are experimenting with data sets to train to the point where OSS is concerned about them? I am having a hard time seeing this.

As well, does this mean the team at OSS is now not as innovative as I have been giving them credit for? Are they truly concerned with the customers IT departments to build something remotely competitive to CIM? I can see the idea that there is lots of capital pouring in AI at the moment and we don’t know what it will all look like in the end. That also means that given the market cap of OSS, they would likely be a decent size takeout for a business that wants to show meaningful progress in a short time. Why build it, when you can buy it because you have a bunch of extra cash looking for an (AI) home.

3 - Pricing

They have been probed on pricing by many investors over the years. They may be getting the best price that they can, but I am having a hard time getting on board with this. They continue to win new customers and increase revenue from existing customers as they roll out new modules. They have never lost a customer due to them leaving, only due to M&A. So at the very least they are not underpriced. On the call they mentioned they are getting all they can out of pricing and that if they were to increase pricing they would get “pushback” from customers. The CEO mentioned that he thinks anyone who thinks they are underpriced are not plugged into the industry. This may be true. I am not plugged into the industry at all. The reasons are just hard to believe given other statements of them being so far ahead of competitors and where they are on the S curve of adoption. I mean we all grumble about prices, but that doesn’t mean we switch or that we are unhappy with the product. Trust me, every time I pick up a Lego set I can’t believe the price. But I still buy them and am happy with the product.

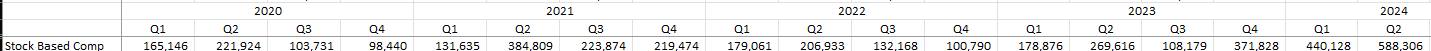

4 - Increase in SBC

OSS has gradually increased the SBC line over the last few years. It was something that I was willing to accept given the fast growth in the business and that they were not generating cash. Here is the last 14 quarters of SBC on the income statement.

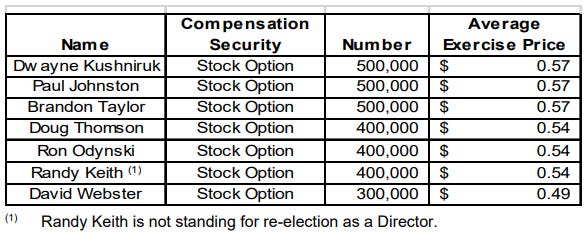

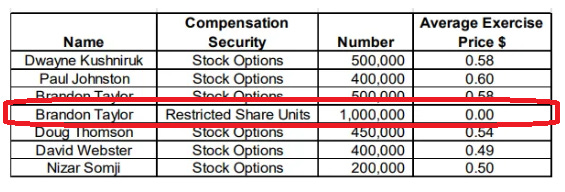

This is from the MIC dated April 23, 2023. It’s the options that each of the executives and directors own at the end of the prior year.

And here is the MIC dated March 28, 2024.

It shows that Brandon Taylor was awarded 1 million RSU while they were investigating a sale of the company. At best, this looks poor on the company and the board.

5 - Major Shareholders support the idea

On the call the CEO said “We've overwhelmingly got very positive reaction on the multiples and the transaction stuff.” in regards to major shareholders and their approval of the deal. I am really curious what shareholders he spoke with. I have not seen the same when I have engaged shareholders myself. I have chatted with or messaged several shareholders and most were not happy with the price.

6 - Capital Market presence on the board and the deal

I would like to see more capital markets presence on the board. The recent addition of Nizar Jaffer Somji looks like a step in the right direction, but falls short in my opinion. He is chair of Kanvi Private Equity, but I see them focusing on real estate more than anything else. I can’t see anything on their site or his LinkedIn profile that would indicate experience in SaaS company M&A. This is a screenshot from the KV site:

He also owns ZERO shares and was the head of the special committee for the sale, but does have some options. I don’t really feel like our interests are aligned.

Risks if the Deal falls through

I can be as upset or frustrated as I want with the price, but I need to think critically about this deal. I do not want to suffer from the Endowment Effect. Having feelings related to the deal does not bind my actions. It’s important to take a step back and ask what do I have to gain from voting “no”.

You have a management team that is happy to see an exit to the public markets. I have a hunch that some of the senior leaders are looking to transition out of the workforce. This indicates that if the deal falls through, the business may be run suboptimal. They have proven themselves strong operators in my opinion. I honestly would want them to stick around if the deal falls through, but have some strong capital markets presence on the board. I am sure that there are some SaaS executives that would love to take OSS to the next level and have the energy to run through the gauntlet.

The other risk that I think most are not aware of is that these may be peak multiples for this cycle. There is a chance that OSS is every bit as successful as I think it can be, but the market doesn’t give it a multiple near what the deal price is.

Closing Thoughts

Given my initial reaction was that the price was too low, I want to scenario plan what happens to the stock. If the deal falls through there is a good chance shares sell off immediately. How far do they fall? I don’t know for sure. I would expect 0.65-0.70. Let’s call it a $0.20 drop. The question to me is if they deal is voted down, is there $0.20 (or more) upside potential here within a reasonable timeframe. At $1.08 we end up with 8.1x EV/mid point 2024 numbers and 6.3x 2025 numbers (assuming 30% growth).

I have been a shareholder since 2017 and have stuck by the company since then. I believe in the long term potential of this business. Having spoken to them several times, I feel the management team is strong. I do however feel that we are not getting a fair price. Something like 8x revenue is fair for OSS in my opinion. That would equate to $1.05 (using 2024 numbers and $1.37 using 2025 numbers (assuming 30% growth over 2024). This would be a 130-165 million dollar deal.

Irth is owned by Blackstone. Blackstone purchased them in December 2021 from Gauge Capital. Blackstone is publicly traded and has a market cap of 171 billion USD. They pay out over a billion in dividends per quarter. They have some deep pockets. I think the board owes it to shareholders to put pressure on them for a higher price.

Lastly, the deal price of 0.88 is actually below the 52 week high for OSS. And it’s not like they reported a bad quarter and the stock sold off. It traded at 0.90 in February 2024.

For all the reasons listed above, I will vote against the deal. I reserve the right to change my mind with new information. I am open to new information and welcome any conversation from other investors or management regarding the sale.

What do you think? You for or against the deal? I would love to know. You can respond in the comments or email me at dean.pettycash@gmail.com.

Thanks for reading.

Dean

* long OSS.v at time of writing

Well stated. I agree with pretty much everything you said. I am newer in the name, although I have followed them for years. Mostly I’m just disappointed on missing the chance to ride with the business as it grows.