Pethealth Update

To be honest, I am kind of uneasy posting positive updates about companies on the blog. I always feel that as soon as I post something about being correct, something unforeseen will happen.

On that note, I will provide an update on Pethealth (PTZ.to).

Full year 2011 numbers were reported and everything seems to be on track. The reader should feel free to review my previous post on PTZ.

Insurance

The company finished the year off with relatively strong insurance results.

Improved results vs. last year were driven by improved conditions in the UK and restructuring in the US finally showing fruition.

I have modelled a run rate EBITDA of 6.5 million.

Non-Insurance

As promised the company has turned EBITDA positive in Q4 2011 (though barely). 2012 should continue this trend, as ERP expenses wind down and continued traction leads to higher non-insurance revenue.

This has been driven by increased revenue coupled with the decline in expenses.

The company is executing as promised. Though I am impressed with the results, I hesitate to give too much value to this side of the business. PTZ will be going against some intense competition online.

That being said there is a unique company here. They have really done some interesting things with their interactive adoption site. Also the data they collect from the RFID chips could prove to be valuable. They are actually able to have some large customers finance expansion. This is happening now in Petpoint, a management application for animal welfare organizations.

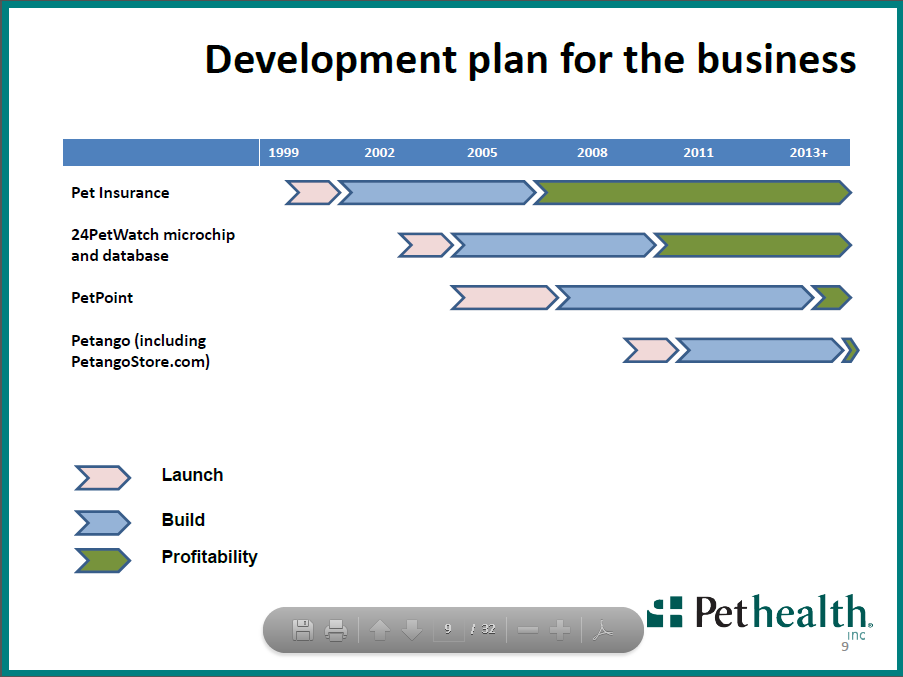

I stole this slide from the most recent investor presentation.

Valuation

I put fair value of the insurance of 6x EV/run rate EBITDA and add a conservative value for non-insurance. Last go around I felt that non-insurance had not proved itself and gave it a value of $0.

This time I give insurance a value of $1.09/share based on mean reversion and no growth. Non-insurance gets $0.25-0.35/share. Based on revenue multiples with comparative companies and a crude asset value. This gives me a very conservative fair value of $1.35-1.45.

I have not sold any of my original shares of PTZ despite the run. Ongoing capital inflows to the portfolio along side a run in other holdings has prevented becoming too overweight PTZ. I will hold on and see what the non-insurance side of the business can produce.

Dean

Disclosure: The author is long PTZ at time of writing.