I purchased PHX early this year and never finished my original write-up. I’m up a little on the position without dividends, and I think this isn’t a bad entry point.

Price: $8.30 CAD

Shares: 50.8 million

Market Cap: 421 mil

Enterprise Value: 432 mil (approx)

Dividend Yield: 7.2%

Background

PHX was founded in 1995 and became public in 2002 as Phoenix Technology Services. They had a brief stint as an income trust (remember those?) and converted to a corporation in 2010. They are headquartered in Calgary like many of the Canadian energy companies are.

The PHX Energy Group provides horizontal and directional drilling services to oil and natural gas exploration and development companies principally in Canada and the US. In connection with the foregoing, PHX Energy engineers, develops and manufactures leading edge technologies. In recent years, PHX Energy has developed various new technologies that have positioned the Corporation as a technology leader in the horizontal and directional drilling services sector in North America.

They are very exposed to directional drilling activity in North America.

What do they make/sell or What sets them apart?

MWD or Measure While Drilling is what PHX started with. During the drilling process, the MWD system provides information to the operator regarding inclination, direction and toolface orientation, as well as reservoir information communicated through natural gamma ray radiation sensors. Operators use this information to guide the drill bit toward the target, reorienting the steerable performance drilling downhole motor and RSS as required.

RSS or Rotary Steerable Systems is the system used for directional drilling of wellbores. RSS tools are designed to drill directionally with continuous rotation from the surface, eliminating the need to pause the drill string rotation to steer the wellbore as is required with a performance drilling motor.

Purchased Schlumberger PowerDrive Orbit RSS in 2018 after being partnered for several years. This leapfrogged their development of RSS products.

Atlas Motors are downhole performance drilling motors (also known as bent steerable motors or mud motors) are utilized in most drilling applications and are powered hydraulically by drilling fluid to enable rotation of the drill bit with little or no rotation of the drill string. It is these motors that create the angle in the wellbore, as they can be set with a slight bend.

On May 3, 2023, PHX Energy entered into a sales agreement for the sale and licensed use of its Atlas High Performance Drilling Motors. PHX Energy will be providing a fleet of Atlas motors to a purchaser in the US market (referred to as the “Purchaser”). Under the agreement, the Purchaser must exclusively use components manufactured by the Corporation for the maintenance of their fleet of Atlas motors.

On July 27, 2023, PHX Energy agreed upon the sale and licensed use of its Atlas High Performance Drilling Motors to an existing international client.

PHX has and continues to spent R&D to continue to advancement of their technology and recently launched their High Performance Technologies. This includes the Velocity MWD, additional Atlas Performance Drilling Motors, PowerDrive OSS and At-Bit System.

PHX is vertically integrated supplier and control value chain. Their technology has a strong presence in the marketplace.

The 2022 AIF stated that they are present on about 10% of the US rigs.

Some business highlights

800+ employees.

Majority of revenue is US based. I would prefer Canadian, but given their presence in the marketplace I’m comfortable owning.

After the initial collapse during covid, PHX announced an NCIB and purchased 3.1 million shares at an average price of $1.58.

In 2021 they purchased 1.5 million shares at $4.50.

They have purchased 19% of the outstanding shares in the last 5 years.

Reinstated the dividend in early 2021 at 0.025/quarter. They have raised it aggressively since. At one point in 2023 the stock had a yield of 10%. The current dividend is 0.15/quarter and it yields 7.6%

As with most of the OFS cos, the initial capital budget has been increased throughout the year if the activity levels persist.

They have a ROC (Return of Capital Strategy) that targets 70% of excess cash flow to be returned to shareholders.

They have quite a bit of detail in the AIF regarding the industry, regulations and various players. I would encourage anyone interested to have a read.

Balance Sheet

They have a strong balance sheet with a 20 million CAD in cash and about 27 million in LTD. 23 of the 27 million comes from their syndicated facility and they have access to over 80mil if they want it.

They are in compliance with any related covenants.

The approved capital expenditure budget for the 2023-year, excluding proceeds on disposition of drilling equipment, is $61.5 million, which includes $11.5 million of carryover from the 2022 budget. Of the total expenditures, $38.5 million is expected to be allocated to growth capital and the remaining $23 million is expected to be allocated towards maintenance of the existing fleet of drilling and other equipment and replacement of equipment lost downhole during drilling operations.

As well they have an investment in DEEP. In July 2021, the Corporation announced it made a strategic equity investment of $3 million in geothermal power developer, DEEP Earth Energy Production Corp. ("DEEP"), with a provision for another potential $3.5 million of equity injection upon exercise of share purchase warrants held by PHX Energy. DEEP is currently developing a geothermal power facility in southern Saskatchewan which has the potential to become the first major geothermal power facility in Canada. I’m not giving much value to this at the moment.

Share Structure & Ownership

GMT Capital owns 6.3 million shares. Although this is less than 1% of GMT’s disclosed positions, so I am not sure how material this is.

The CEO is the next largest holder with 5.3 million shares or 10.5% of the outstanding.

The independent board members hold about 700k shares or 1.5% of the outstanding.

I found this interesting from the MIC.

They have a minimum share ownership policy which was adopted in 2016. The Chief Executive Officer is required to own and to maintain, directly or indirectly, a minimum number of Common Shares representing the value of not less than three (3) times his annual base salary. In the case of the President and Senior Vice Presidents, the threshold is two (2) times annual base salary, and in the case of the other Vice Presidents, the threshold is one (1) times annual base salary. Each nonmanagement director is required to own and maintain, directly or indirectly, a minimum number of Common Shares having a value of not less than three (3) times the annual cash retainer payable to such directors for services rendered to the Corporation.

Management

CEO is John Hooks who has been with the company since 1955. Other than the CFO, the remainder of the leadership team has been in the industry with PHX for several decades.

Compensation has several elements. The base salary is the smallest part of their compensation. There is a large percentage of total compensation that is variable. Variable compensation is tied to EBITDA targets and various Personal Objectives.

Board

CEO is chair of the board.

There are 7 board members. 6 are considered independent with some familiar names in the industry. It is fairly unusual to have this many directors be independent.

Risks

Of course they are tied to the O&G activity levels. A prolonged downturn will hurt them.

Investor sentiment for so called “dirty” or fossil fuel based companies may change. PHX (and other cos) may not be included in larger portfolios due to their perception. Whether you agree or not, many institutions and family offices have ESG mandates for marketing purposes and to make them feel good on the inside.

There is a change in control clause that may deter potential suitors for PHX.

Valuation

Full year 2023 estimates have them trading at about 3x EV/EBITDA. Depending on if you include working capital additions and some seasonality, they are 7-8x FCF (maybe less depending how you count the disposal of assets and maintenance vs growth capex).

Q2 2023

The last quarter has seen revenue increase by 23% which is a good sign given the lower rig count in the US compared to 2022. Adjusted EBITDA was up 39% on an easy(ish) comp from last year. The outlook was somewhat optimistic with increase in prices from their technology offsetting lower activity to some extent.

My Thoughts

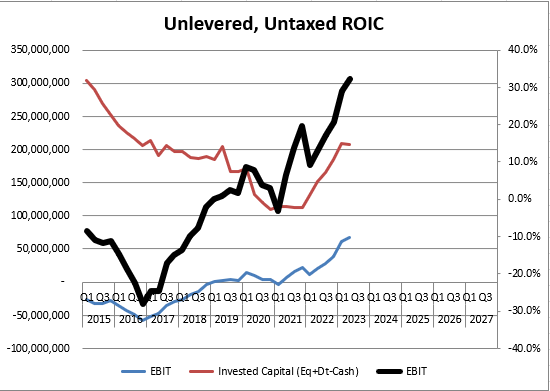

This company has positioned itself well in the marketplace. They boast very strong a very strong ROIC profile that I would expect should garner a premium valuation over time as the cycle continues. There are only so many OFS cos and even fewer with this strong of a product portfolio.

The recent run up in oil supports my thesis around stable margins for OFS cos through the rest of 2023.

Thanks for reading. Hat tip to Yasir for the idea.

Dean

Latest Presentation (Sept 13, 2023)

* long PHX.to

Share this post with someone if you think it will be valuable.