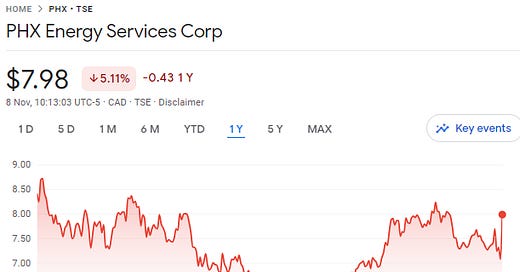

Price: $7.98 CAD

MC: 400 mil CAD approx

EV: 406 mil CAD

Yield: 10% (yes 10%)

1 year performance:

PHX reported Q3 after the close yesterday. Results were quite a bit ahead of my expectations and the stock sold was up 13% this morning.

Quarter Recap

There was no conference call so all information is from the news release and financial statements.

Revenue was up 19%

US was up 12% to 123.8 million

Canada was up 44% to 44.1 million

This was a record quarter for their Canadian operations

Adj EBITDA of 43.5 million

up 59%

They upped the dividend by 33% to 0.20 per quarter

5th increase since they started the dividend in December 2020

Capex budget for 2023 upped to 80 million from 61.5

45 million for growth

35 million for maintenance

Initial capital budget of 70 million for 2024

42 million for growth

28 million for maintenance

They have a ROCS (Return of Capital Strategy) to return 70% of excess free cash flow to shareholders

YTD 2023 excess cash flow was 70.5 million

49.5 million is allocated to shareholders

19.1 million has been used to purchase shares

22.9 million in dividends

7.3 million remaining

Closing Thoughts

The quarter was very good. I like the exposure to directional drilling. I was not expecting them to maintain this level of profitability in the US given the rig count change yoy. The expansion of the Atlas motors sales and rental is a nice kicker to overall activity exposure. As well they are expanding their portfolio by adding the Haliburton developed iCruise RSS (Rotary Steerable Systems) to compliment the fleet of Schlumberger PowerDrive RSS.

I am a bit nervous as I am not sure if margins can be maintained if the activity levels take a meaningful drop from here. Even if we see another 12-18 of sideways activity I would expect margins to come in for most OFS cos.

I hold PHX in my OFS basket.

Thanks for reading.

Dean

* long PHX.to