Pulse Seismic Company Profile - $PSD.to

A reprofile of PSD

*Disclosure: I own shares in PSD. I am not a professional. Please do your own due diligence.

Price: $2.28 CAD

Shares: 52.6 million

Market Cap: 120 million

Enterprise Value: 114.8 million (this removes the special dividend declared after end of Q4 2023)

Yield: 2.4%

1 year performance: +24.6% not including dividends

I originally profiled PSD way back in 2020. At the time, oil was not in favor. We were all becoming virologists and lockdown experts. Not to mention we were finding out how well masks worked or didn’t work. It was horrible.

I felt PSD was a low-risk way to get exposure to oil and gas activity. Though it has performed well, with hindsight I should have picked up something with some more leverage to the cycle than PSD. I still hold and feel it makes a nice addition to my portfolio in the basket of OFS cos.

Background

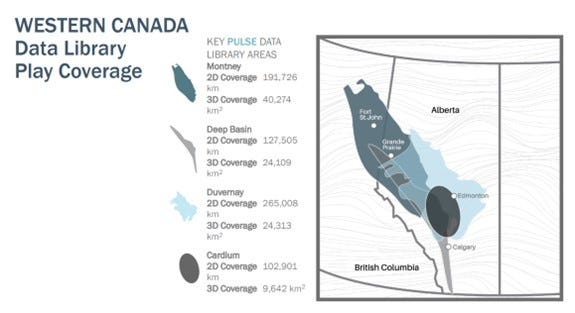

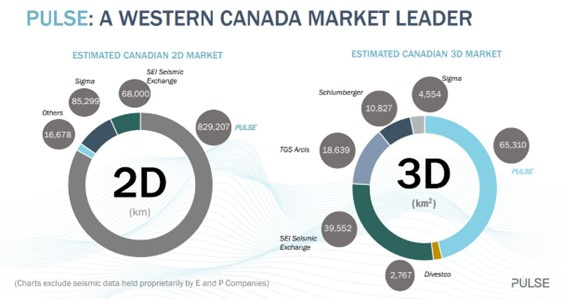

Pulse acquires, markets, and licenses 2D and 3d seismic data for energy sector. They have 65,310 sq km of 3D and 829,207 of 2D data located primarily in Western Canada. Pulse was incorporated in 1985 here in Alberta.

They have the largest set of data in Western Canada. Though there is little visibility quarter to quarter on revenue, the various players are not interested in a race to the bottom in prices.

The cost to license the data is almost immaterial to the drilling company. Another reason I am not worried about something like pricing for PSD.

Seismic Data

Seismic data aids the exploration of oil and natural gas by increasing the likelihood of a meaningful discovery while drilling. The companies will license the data from Pulse’s library. They do not have much overlap in the acreage of data.

The data is primarily used for the subsurface discovery of oil and gas, it can also be used as well as energy transition purposes like lithium and geothermal.

They can grow the data library by purchasing it from other companies or shooting new data. Purchasing it on the market has been far cheaper (more on that in a bit).

In 2019, PSD acquired a large amount of data from Seitel while in Seitel was going through some challenging times. This essentially doubled the data library that PSD had at the time. The price per km was about 1/3 the price PSD paid for a Divestco in 2010. The cost of the Seitel data was about 3-5% of the cost to shoot new data. So, despite the timing being right before covid, this acquisition was priced very well.

Types of Revenue

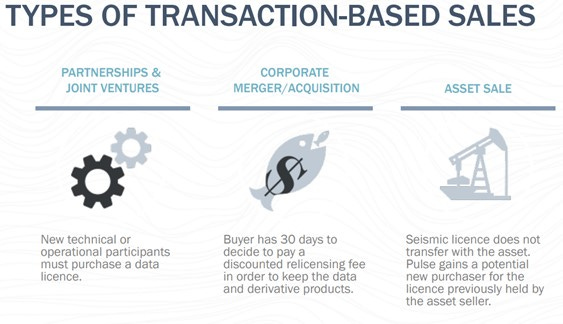

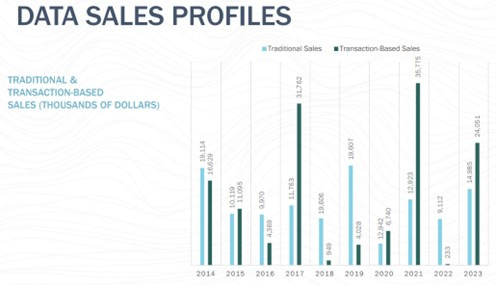

The company generates revenue from two sources. Traditional sales, which is a straightforward license from Pulse’s library.

They also have transaction based, which is triggered by a change in control of the assets in Pulse’s library.

The traditional sales are closely related to overall exploration activity in Western Canada. The transactional sales are larger and lumpy.

Some business highlights

PSD is essentially just a library of data that requires little to no capital to maintain. As such they have very high margins once the fixed costs are covered. They have very high margins one fixed costs are covered.

Given the limited room for growth and lumpiness of the business, PSD has been very shareholder friendly by buying back shares, paying off debt, initiating a regular dividend and issuing special dividends once they have a large amount of excess cash. In August of 2023 they paid a $0.15 per share special dividend and in January 2024 they paid $0.20 per share.

Balance Sheet

As mentioned previously, the balance sheet is strong. They had debt from the Divestco transaction way back in 2010 and then again after purchasing the Seitel data. They quickly pay it off and return excess cash to shareholders.

Share Structure & Ownership

There are currently 52.6 million basic and diluted shares.

There are two large institutions that own shares. Ravenswood Management at 8.7 million or 16.8% and EdgePoint Investment Group at 13.2 million or 25.5%.

Famous investor Robert Robotti is a manager at Ravenswood. They have owned shares for many years and haven’t sold.

EdgePoint has also been a shareholder for many years. They increased their stake via a private transaction in late 2020 for 3.1 million shares. EdgePoint provided some short-term financing during the Seitel acquisition as well.

Management owns about 1.5% of the common. The independent board members, not counting Ravenswood/Robotti own 0.4%.

Personally, I would like to see both management and independent board members with more common. But I’m pretty sure that’s something all investors want regardless of the company.

Management & Compensation

The company’s CEO (Neal Coleman) has been with the business since 2004 and has been CEO since 2012. The CFO (Pamela Wicks) has been with PSD since 2002 and has been CFO since 2010. The only other member of the management team that I can find much information on is Trevor Meier (VP Sales and Marketing). He has been there since 2006 and in the VP role since 2013.

Compensation is fairly typical. A reasonable salary and share based payments via STIP and LTIP. For the last 3 years salaries have risen steadily, and total comp has moved around with business performance. For 2023, base salary was around 35% of total compensation for the management team.

Board

There are 6 directors on the board. As I mentioned, Robotti is on the board. The only non-independent member is the CEO.

Robotti is the chair and has been for years. He is on the audit and risk committee, compensation committee and corporate governance committee.

Board compensation is a mix of cash for retainer and some shares. I would not consider the director compensation excessive as it ranged from 30-70k in 2023.

Risks

The company faces the typical business risks with doing business in the oil ang gas industry. There are some additional risks that I consider worth noting:

Federal Political risk. To be blunt, Canada is a political basket case in my opinion. Though the federal government can’t do much in the way of approving which work gets done inside the province, anything that is crosses provincial borders needs federal government involvement in some degree. This is not a substack that focuses on politics, but I would view the Trudeau Liberals to be counter productive to say the least when it comes to Canada’s businesses. I feel that the Conservatives have a reasonable chance of at least a minority Federal government in the next election. This is important due to the hydrocarbons being landlocked here in Alberta. Getting our oil to International markets would require a pipeline or some sort of infrastructure that crossed provincial borders.

Provincial Political risk. Alberta (where most of PSD’s business is conducted) is an interesting political petri dish. We tend to be even more polarized than the rest of Canada with our two largest parties being Conservative and NDP, which is more left than our Liberal Party. We had a bit of an experimental phase with the NDP winning an election in 2015. Though the UCP (conservative party) won in 2023, there is always a chance that we see more representation from the NDP in the future, which I would as a negative for PSD.

As mentioned, Alberta oil is landlocked and requires pipeline to get to international markets. The infamous Trans Mountain will increase our takeaway capacity, but there is always risk to Alberta relying so heavily on pipelines to getting our oil to international markets.

Though I feel that the large institutions owning so much common helps align me as a shareholder, there is always risk that they are looking to exit an illiquid stock that could drive the price down.

Valuation

PSD is tricky to “value” for me. They are trading at less than 5x ttm FCF off a very strong year. I’m not sure that looking back at prior cycles is as informative as I once thought it was. Much of the drilling of the last cycle may not return. As well, the last cycle PSD had about half the size of the library.

Most Recent Financials

PSD has yet to report Q1 2024, but they when they released Q4 2023 numbers they stated that they were at 8.3 million in revenue as of February 15, 2024. This compares to 8.4 million for the entire quarter in Q1 2023. This is a positive sign. Having said that, without large transaction-based revenue they may not eclipse prior years’ revenue. 2023 quarterly revenue was 8.4, 8.7, 5.1 and 16.8. These are tough comps. It’s not a perfect proxy for traditional revenue but looking to the rig count for Alberta we can see that it has bounced off the lows during covid but is not near the volume in the prior cycle. We did not have the takeaway capacity we have moving forward, but I still don’t believe that we will see the same amount of activity here in Alberta.

My Thoughts

PSD only works if they are shareholder friendly. There is a large amount of “engineering” required by management to get a decent return. The lumpiness of the business means that it likely never gets a big multiple, so they can’t sit on their hands with excess cash if I want an above average return. So far they have not sat on excess cash for any length of time.

PSD fits into my basket of OFS cos. They have been very shareholder friendly in the past and I expect that to continue. They are exposed to the cycle but in a more muted way, so having a position reduces the volatility of the basket.

Thanks for reading.

Dean

*long $PSD.to

Good article!

Great work Dean!