Pulse Seismic Quick Update - $PSD.to

The last post on Pulse was about 18 months ago, so I thought I would do a quick update. Rewinding back to July 2020, the pandemic had been on for 3 or 4 months and uncertainty was in the air. We were finishing our epidemiologist certificates and crash course in predicting the length and severity of the next lockdown. Since then, PSD has done reasonably well against some indexes and the stocks that my gym friends told me to buy.

To be fair, one should really consider the opportunity set at that specific moment in time. PSD may look like it's done well, but there was carnage in the energy space and one could have picked something with a little more leverage to oil prices. As well, 18 months may not be the appropriate amount of time to grade capital allocation decisions.

Income Statement

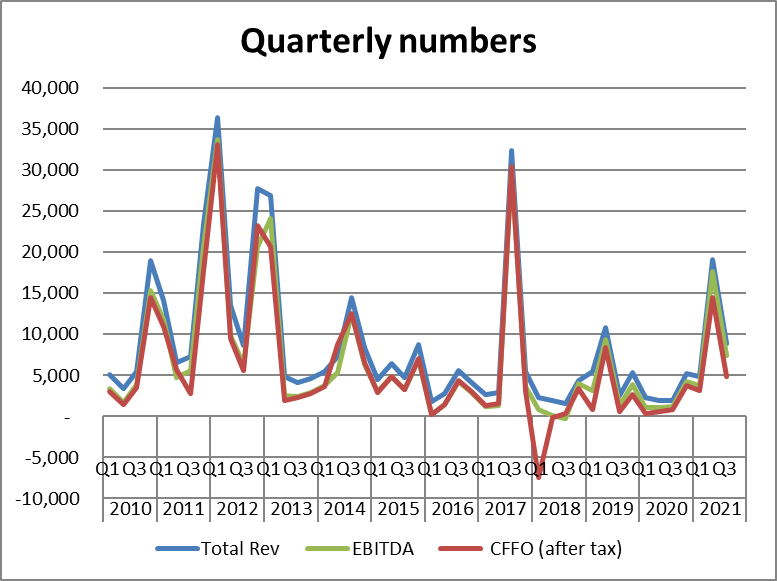

After the historical low activity during the onset of the pandemic, activity has slowly started to rebound. The chart below gives some context to the volatility in their quarterly income statement.

In May and June 2021 they announced some big licensing agreements. Looks like the entire 17mil license deal announced in May 2021 will be recognized in 2021. 2021 will be a very successful year for PSD.

Balance Sheet

PSD has always been run quite conservatively. The low visibility in business activity does not lend itself well to a ton of balance sheet leverage. They have now paid off all the high cost debt related to the Seitel acquisition.

Valuation

The company trades at less than 5x ttm FCF based on Q3 2021. It will look cheaper after Q4 2021 is released. I'm not sure 2022 will be as strong as 2021 given the lumpy nature of the business. Average quarterly EBITDA from 2010-2018 (right before the Seitel acquisition) was 7.4 mil and CFFO was 7mil. The data library has effectively doubled given them a potential of 55-60 mil annually. Current market cap is 108 mil and EV is 112 mil, although EV should be less than market cap after Q4 2021 is reported. So we get around 2x average CFFO. I know there is a ton of debate on the use of EBITDA. If you look at PSD's ability to convert EBITDA to CFFO and subsequently to FCF, I think using EBITDA is fine here. I also think that there is upside to the valuation given the renewed interest in O&G.

Shareholder Friendly

The company recently paid a special dividend of $0.04 and reinstated their quarterly dividend. It currently yields 2.5%. Buybacks are on the table again with the balance sheet being so pristine. PSD has done a good job returning capital to shareholders in the past and I don't see that changing.

Looking ahead

There are a few reasons why I continue to hold my investment in PSD. The world has recently remembered that we still use a ton of hydrocarbons and will for quite awhile. Activity in WCSB has started to pick up again after a long period of being in the doldrums. Though the rig count is up, it's still below where it has been in prior cycles given the price of WCS.

As well, I feel PSD has been (and likely) will be good stewards of my capital. I don't see a ton of risk with PSD, although there is no guarantee that their specific business responds to higher oil prices.

Anyone own PSD?

Dean

*long PSD.to at time of writing.