Q1 2012 Performance and thoughts on benchmarking

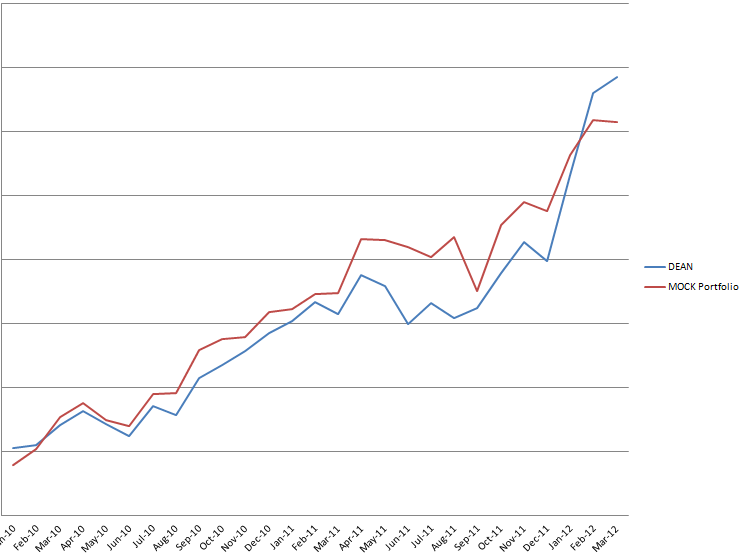

For a busy guy like myself I track my portfolio performance a little different than most. I compare my "active" self to my "passive" self. The biggest constraint to my performance (I feel) is time. It takes a long time to thoroughly look at a company and even longer to keep up with the ones I have. I wish I had more time to turn over more rocks, but I don't. Though I can measure relative to the TSX or S&P, I built a passive portfolio to track myself against. I think of it as racing my ghost in MarioCart.

The rationale was that if I am going to spend a ton of time researching companies, I better have something to show for it. The passive portfolio is what I would pick if I was simply to buy some ETFs and continue to contribute to my retirement savings. They are CBQ.to, XIU.to and SPY.

For the first 3 months of the year, the total return was just shy of 8% for the passive portfolio. My portfolio was up 24.5%.

Almost every stock has performed in line or above market. Though the time frame is too short to judge luck from skill.

You can see that when I stick to what I can quantify I seem to be OK. The performance YTD has erased all of my previous inept attempts at actively managing my money.

This is my portfolio's value in dollars. What is tough is that I am constantly adding to my savings. If I fail to find an idea, I end up with a ton of cash in no time. I inadvertently time the market is a sense.

At the end of the Q1 I had a total of 10 companies in the portfolio and 20% cash. The top 3 companies make up 43% of the portfolio.

One company that I have purchased and haven't written about is FTP.to. There is a great discussion here. I think the company is stupid cheap. I figure you are now paying fair value for only 2 divisions and getting 2 lucrative mills for free.

Dean