Q3 2023 Portfolio Review

The picture is my technical analysis of PTON. Hope you enjoy.

Instead of putting this update into my physical journal (which I have recently transferred over to Journalytic), I thought I would put it out there into the internet. I write this letter to myself with my thought and feelings at that point in time. Not sure if I will do this each quarter, but this has been a rough year full of lessons.

Market Thoughts

You will get nothing insightful from me here. Will we have a recession? High interest rates? High inflation? Visited by aliens? Ever have affordable housing in Toronto and Vancouver? For all of these questions, my answer is “I don’t know”. Having said that, my portfolio definitely leans into the higher for longer narrative. There is definitely the feeling of large cap growth being the only game in town at the moment. Too bad I don’t have any.

Overall Performance

I am a believer that you can’t judge your portfolio performance over a timeframe any less than 2ish years. In my mind 3-5 years is appropriate. As a reminder I am a full time investor and use my capital to pay for my day to day living expenses and various addictions (gym equipment, power tools, cereal, etc).

YTD my portfolio is up 3.5%. At one point it was up 12%, but the last couple months have been tough. This compares to the Nasdaq, S&P 500 and the TSX at +27.3%, +12.1% and +0.5% accordingly.

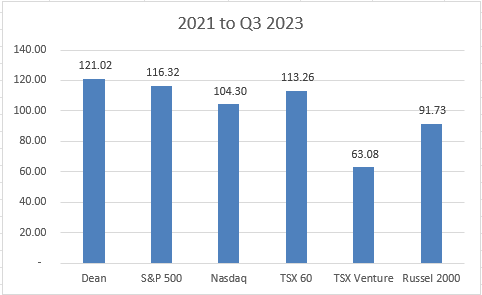

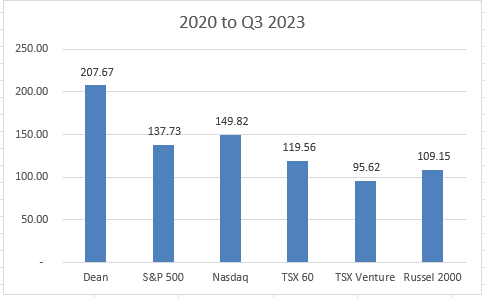

Below are the results from beginning 2021 and 2020 starting at 100.

I have some mixed feelings about this. 2020 was a banger, but there have been many missteps along the way that have been bailed out by a couple winners. The portfolio hasn’t changed much over the last 2-3 years.

Everyone knows that microcaps are cheap relative to large/mega cap and that a handful of companies have been the majority of the index returns YTD. We have seen many investors reference this. Many private investors will tell you that you can go anywhere given you have no mandates from an institution. This is usually mentioned when they take large positions in small companies, but this also means you can go into the large companies as well. So really I don’t see a reason why you shouldn’t be aiming to beat a reasonable index over time. Flexibility works both ways.

What has worked so far this year? Not much to be honest.

2023 Performance of Positions

Links to the most recent post on each name is provided.

Viemed (VMD.to) -11%

The business has performed above my expectations this year. They have officially resolved the OIC claims, purchased a complimentary business, and have grown organically. Perhaps there is more concern with the competitive bidding process than I am anticipating. They are trading at 6.5x EV/est 2023 EBITDA and 5.2x EV/est 2024 EBITDA.

Cipher Pharmaceuticals (CPH.to) +12%

CPH was flat YTD until they announced the tender offer. CPH is very cheap on a ttm basis and very cheap if they obtain anything close to their 2025-27 numbers given their pipeline. Of course, there are lots of uncertainty in the meantime. About 4-5x FCF at this price.

Sangoma Technologies (STC.to) -21%

Ugh. So many opportunities to sell. I will give the new CEO some time to share the strategy for the business before acting. I am in the process of coming up with my formal kill criteria for the position. About 4.5x EV/EBITDA here and 2.5x EBITDA.

Redishred (KUT.v) -14%

The underlying business is performing well. They are subject to swings in the price of recycled paper. With the drop in paper prices and uncertainty looking forward, the multiple has contracted substantially. 5.3x EV/my est EBITDA.

OneSoft Solutions (OSS.v) +88%

OSS has performed as expected. They are growing quickly and adding to their TAM. They have also seemed to catch a bid with the AI hype. As such, I took the opportunity to bring my position down. I’m not sure exactly how much they grow in 2024, but I’m estimating they are trading at 5-6x revenue.

Geodrill (GEO.to) -10%

The business had a tougher 2023 than I was expecting given some frictional costs on the last quarter as they exited Burkina Faso. About 5x my estimated FCF.

OFS basket +15-20%

It’s a bit hard to track how the basket is doing given I have been adding to it and rebalancing. Overall, I’m ok with the picks I made. I have been keeping pace with the XEG. Current holdings are STEP, TOT, CET, PSI, PHX, MCB, PSD, QST (all Canadian listed).

High Arctic Energy Services ($HWO.to) -5%

My merger arb is meh. They just announced the delay in filing the circular. This means that the timelines have been pushed out (negative), but it may address some of the key concerns shareholders had (positive).

Closing Thoughts

Not included are a few positions I’m conducting research on or building a full position in.

I run with a low cash holding. I generally have to sell one name to purchase a full position in another. This has it’s own nuances on performance of course.

Thanks for reading. Feel free to comment.

Dean