I’ve rotated some capital that I have allocated in my O&G services basket into QST over the past few months. I thought it would be valuable to catalogue my thoughts. I said I wouldn’t put money into a company that I wasn’t sure how they would do with the resurgence in O&G activity, but I lied. I think the risk/reward warrants a (very small) position.

Price: $1.02 CAD

52 week high/low $0.77/$1.89

Shares Out: 27.8 mil

Market Cap: 28.3 mil

Enterprise Value: 15.5 mil

Insider Ownership: approx. 18%

Background

Questor Technology Inc., an environmental emissions reduction technology company, designs, manufactures, and services waste gas combustion systems in Canada and the United States. The company rents waste gas incineration systems. It offers its solutions for various oil and gas projects, as well as for landfill biogas, syngas, waste engine exhaust, geothermal and solar, and cement plant waste heat. The company was formerly known as Interglobe Gas Technology Inc. and changed its name to Questor Technology Inc. in September 1995. Questor Technology Inc. was founded in 1994 and is headquartered in Calgary, Canada.

Methane Emissions

According to the EIA, methane accounts for about 10-11% of greenhouse emissions in the US. This has decreased over the last few decades. Agriculture and Industry are the largest culprits. The burning of fuel for heat or power is the largest direct emission from Energy.

Questor has an interview posted on their YouTube channel with the CEO. You get a good sense of why she feels that methane emissions are low hanging fruit. There are more interviews with her if you search for them on YT.

Given the current energy shortage, I expect the production of hydrocarbons to increase moving forward. As well, there is a growing concern for the impact on the environment that the production of hydrocarbons causes to the environment. Right or wrong there is an ever increasing focus on reducing such emissions. Let’s not get into whether it’s the best emission to focus on, just accept that there are likely to be increased regulatory and “ESG” pressure from our elected officials to utilize QST products.

I expect the increase in fracking activity to be a tailwind for the company as well as additional upside with increasing focus on emission reduction/limiting during hydrocarbon production.

Management

Audrey Mascarenhas is the CEO. She has been with QST since 2005 and has 35+ years of experience with this type of technology. She is obviously well versed on the opportunity.

Ownership

The largest holder of shares is the CEO with 16-17%. This represents several multiples of her annual compensation on any given year. She is well incentivized to have the shares appreciate in value.

Claret Asset Management owns about 15% of the outstanding. Given the size of Claret and the dollar value of the position, I would assume that this position is not material for them and they are somewhat stuck due to the low liquidity. The rest of the board owns 1% collectively.

Balance Sheet

The balance sheet is super clean. The company has about $0.45 per share in cash.

Previous Cycle

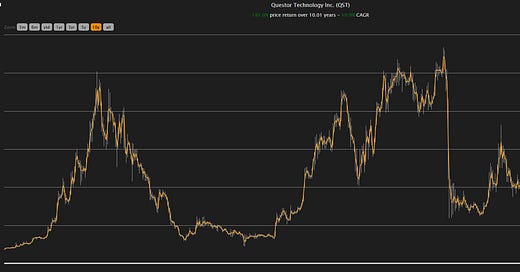

The cash was accumulated during the prior cycle(s). As with many of these O&G service cos when the times are good, they are really good for QST.

At the peak of the previous cycle QST generated it’s current market cap in revenue (about 2x current EV) and earned about half it’s market cap in EBITDA (or about 1x current EV).

Though the net value has dropped on the balance sheet, the company also took the prior cycles earnings and invested in equipment (mainly rental incinerators).

Looking Ahead

I don’t know where this cycle will stack up relative to prior cycles. So far the capital discipline of producers (and services for that matter) has been well ahead of prior cycles. I remember when the fixation on frackers was to replace reserves at all costs given Wall Street’s fixation on the depletion rates. Layer on a government(s) that seem to have little understanding of where the building blocks of our functioning society come from and you get a pretty big a big unknown with activity levels.

The market is worried about how bad the recession will be. How bad? I don’t know. I feel that regardless there will be a focus on energy independence or as much independence as possible.

The company could benefit from increased spending from the Inflation Reduction Act as well. As well the IRA will imposing a fee of $900 per tonne of methane produced starting in 2024 and increasing it to $1,500 per tonne two years later. I don’t know how much QST actually gets from this, but it is a possible tailwind.

Risks

As mentioned, I think the biggest risk is that O&G prices and activity continues to rebound and QST’s products are not in demand. This would leave the shares behind it’s peers in a bull market.

Another risk is the increase in equipment levels also means an increase in carrying expense. Their breakeven level is now higher than prior cycles and looking at things today, they would need more revenue that prior to match prior absolute levels of EBITDA.

There is also some execution risk here. They have had some delays in executing three waste water treatment facilities in Mexico. The most recent financials has 900k in long dated receivables related to this and they incurred an additional 500k cost on the income statement to finish the project. How much could the company control vs. what was out of their control is something I’m not sure of. Regardless, there is risk here.

They have filed claims in the against former employees around competing against QST using their own Intellectual Property. This is a risk as it can be a distraction, higher expenses (via legal fees), increased competition, or demonstrating that QST has a product that is (somewhat) easily replicated.

Lastly, it would be foolish of me to not mention liquidity. Though I am used to hunting for companies with little institutional following, QST is particularly illiquid. Getting filled is hard enough, getting out under less than ideal circumstances is worse than watching my dance moves when I wanted to be in a boy band in high school. It sucks.

Conclusion

QST downside seems quite low. EV/Rev and P/Tang Book are at levels below prior cycle troughs. If we do see an increase in activity, the company’s operating leverage will take hold and we will see increased profits. My prior mistake with CMG and the stock not appreciating as well as it’s peers was due to a high starting valuation, so that’s where I am trying something different here with QST.

The bulletin boards are full of fed up retail investors. Expectations are pretty low at these levels. I feel QST warrants a position as part of basket of companies with energy exposure.

Anyone else own or follow QST?

Thanks,

Dean

*long $QST.v at time of writing

I agree with your analysis of QST. Good Risk Reward at certain levels. If I could add a couple points...

1) You reference the rental assets on the balance sheet. Prior to COVID, this new rental strategy fully utilized this fleet and drove significant EBIT as shown in your chart because margins were better. Stock was north of $5. Oil Co's are always challenged to utilize OpEx for Drilling, Infrastructure De-bottlenecking (in the case of refineries), etc. Spending scarce budget for something that doesn't drive top line or improve middle lines rarely get approved. Turn it to a rental/lease makes it OpEx, which doesn't have as much scrutiny. That vast majority of that fleet was idled 2-3 years ago, but still being depreciated. Getting those assets back into the rental revenue will drive even higher margins on almost fully depreciated assets.

2). Read the Management remarks in the Q3 results. They say that post a number of industry conferences focused on solving O&G ESG challenges, QST has recieved numerous "Request for Proposals" from both Domestic (Canada) and International (likely US) OilCo's. RFP's are a very specific 1st step of a sale. OilCo's do not kick the tires with RFP's, they do it with approved budget and a plan with a project team to implement (one way or another). The pending 2024 ESG legislation is driving those actions. Since that time, two separate $1M sales have been made to the Canadian majors. These majors will requires tens to hundreds of millions in QST technology if it is proven out. Subsidies given be Canadian Gov and now with new US IRA legislation intent asset purchases (not rental) so we may see more sales in the near future.

getting a good balance between rental and sales is what I am looking for in 2023