Sangoma Technologies reprofile - $SANG & $STC.to

I’ve been involved with Sangoma longer than many of you have been investing. lol.

TL;DR

Coming off the back of a ton of covid hype, an overpriced acquisition and the chairman selling a bunch of stock (only to be adding to his holdings at this point in time) is Sangoma. The company has a colorful background to say the least. Its balance sheet is (somewhat) debt heavy and its new CEO has been on the job for like 15 minutes (jk, it’s been a year since he was hired). Despite all this STC trades at a reasonable valuation (yeah I know the v-word), has strong EBITDA to CFFO conversion, generates lots of cash and insiders have been buying. Oh did I mention the business is sticky, with little churn and about 80% of revenue is recurring. The most recent news release has them targeting under 1.5x EBITDA leverage by over the next year. Also it’s a Canadian microcap so it currently has a high ick factor for many.

Price: $7.15 CAD / $5.00 USD

Market Cap (fully diluted): 237 million CAD / 169 million USD

Enterprise Value: 334 million CAD / 238 million USD.

EV/EBITDA: 5.6x (using midpoint of 2024 guidance)

EV/FCF: 8-9x (my estimates)

1 year performance: +34%

5 year performance: -35%

*All amounts are in USD unless stated otherwise.

Background

STC provides Communications as a Service (CaaS) for businesses of all sizes. The story started about a decade ago when STC was a net cash with a lumpy and declining phone card business. They brought in a new CEO to deploy the capital and turn around the business. They have made acquisitions along the way, raised capital several times and now look completely different. More recently, they have pivoted from growth via acquisition to refocus on their services and clean up the balance sheet.

The last major acquisition was Star2Star in early 2021. The valuation they paid was (sky)high. They brought on the CEO of Star2Star (Norm Worthington) to be the chair of STC. Part of the arrangement was to issue Norm shares each quarter for several years. For many quarters, Norm was a regular seller of the common as soon as it was issued to him. STC tried to do some damage control by stating the sales where for tax reasons, but the market rarely responds well to the combination of a lofty valuation, high inflation, slowing growth, management churn and insider selling. When they pivoted, they replaced the senior leadership team. A new team has been set-up and the company has refocused the business on profitable growth. The initiative has been labeled as Project Diamond.

What sets them apart?

More and more businesses are outsourcing their IT needs and having one company to rely on for your IT Communications is valuable. As your business needs become more complicated, you will outgrow the more basic solutions you started with. STC offers customers reduced complexity, increased scalability and reliability to fit their needs.

They focus on small and mid sized mid-market businesses where the accounts are generally too small for the large players to focus. They offer competitive individual solutions as well as bundling for larger customers with more complex needs. Unlike most of their larger competitors, they also focus on on premise (or on-prem) products rather than only focusing on Cloud based solutions. Though this is a smaller portion of their revenue, it does give customers more options if they are not ready to be fully on the cloud.

More recently they have focused on more strategic bundling and educating channel partners on the value of such bundles to end users.

Star2Star

Before going on any further about the business, it’s probably to go over the Star2Star acquisition. Star2Star was purchased in early 2021. Star2Star was privately held at the time and the founder stayed on with STC. Not only was the price quite high (like everything during the time) but part of the purchase price was shares in STC which vested over 14 quarters. STC has since cleaned this up and there are no shares to vest at this point. I think the investor base has some form of PTSD from this purchase as every quarter that more STC shares vested, the chair would sell them on the market. From the original news release:

Pursuant to the Agreement, Sangoma will acquire Star2Star (the “Acquisition”) for approximately US$437 million, consisting of US$105 million in cash and 110million common shares of Sangoma. The transaction will be subject to approval by Sangoma shareholders at a special meeting of shareholders expected to be held in late March or early April 2021 (the “Special Meeting”), with closing expected to occur shortly thereafter.

Looking at the price paid it was about over 5x revenue and 30x EBITDA. This seems like a bubble with hindsight. I fell for it at the time. Everything was crazy back then with many peers trading at over 20x revenue. Many of us did things we aren’t proud of. In case you forgot, the market cap and enterprise value of Sangoma now is 169 million and 238 million USD.

I feel that S2S is a higher quality business than Sangoma was at the time and increased the durability of the consolidated business. Star2Star combined with the legacy Sangoma business cemented them getting well over 50% of their revenue from services. The visibility was a major factor when Sangoma was hunting for acquisitions. Having said that, they overpaid and structured the share payments poorly.

Some business highlights

The business itself has about a 1% churn which is fantastic.

About 80% of their revenue is service or recurring in nature. The vast majority of the top line weakness over the last couple years has come from the product side of the business which is much more tied to capital spending by customers. I’m hoping we have seen the bottom on the product side.

They have been consistently EBITDA positive for years. Though margins have come in since their peak, they are still strong in the high teens. This is different from many of their peers.

Their peers or competition comes mainly from larger companies like 8x8, Ring Central, Five9, and to some degree Twilio.

Here are their gross margins compared to peers:

And here are EBITDA margins:

And here is revenue growth. The lumpiness in STC growth has been due to the timing of acquisitions. The business has typically run with a mid to high single digit organic growth.

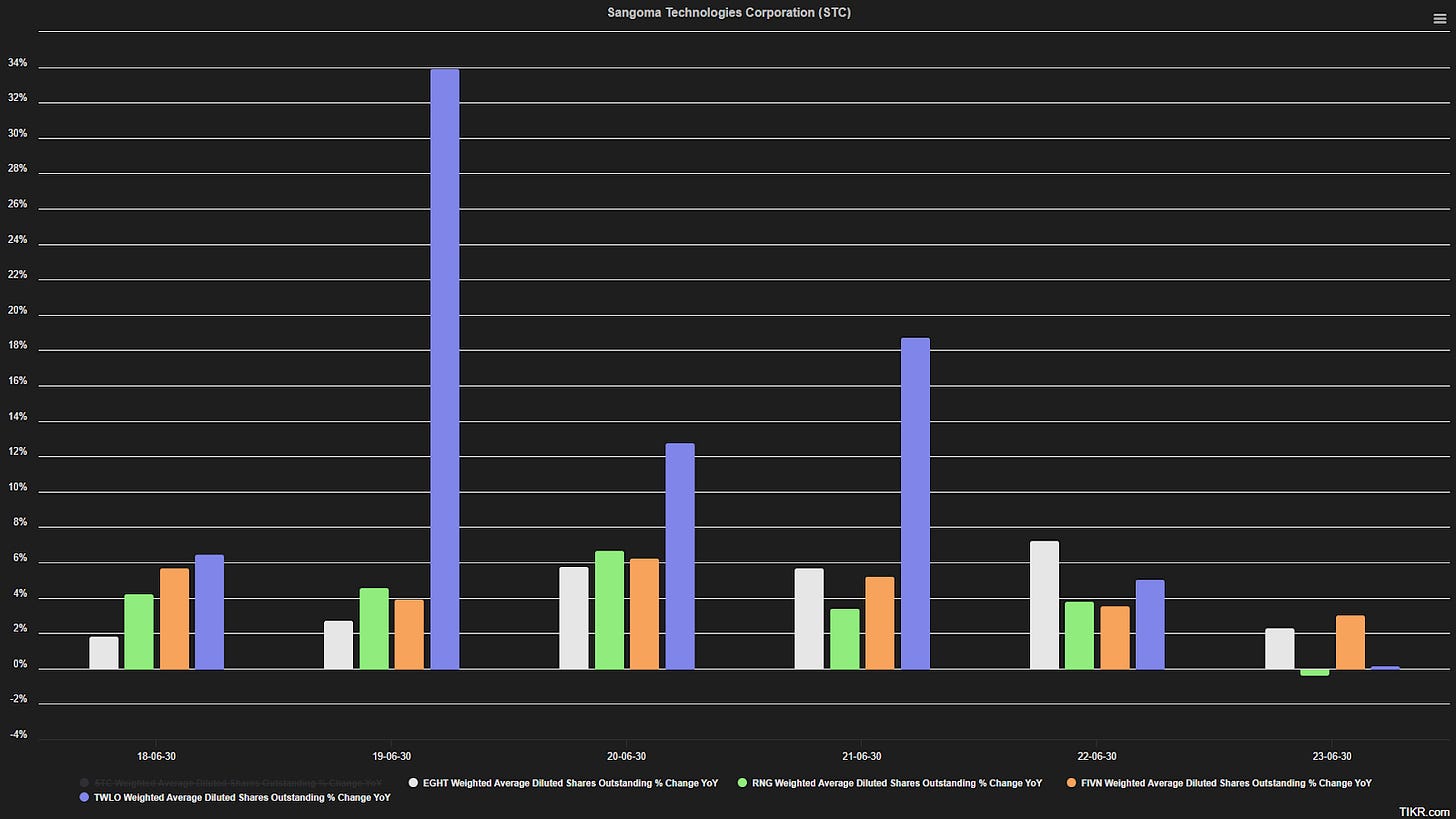

Here is the diluted share count outside of STC. Given the STC share count explosion with the Star2Star acquisition, I removed it from the chart to show how the industry as a whole is no stranger to dilution.

Balance Sheet

The balance sheet is in good shape given the dynamics of the business in my opinion. They got up over 3x EBITDA in net debt after the Star2Star acquisition. They had guided for about 2.4x EBITDA post S2S integration. They have been paying off debt and deleveraging more recently. They mentioned in the most recent press release that they are targeting 60 million in debt by end of Fiscal 2025.

The chart below is a bit misleading as the debt for the S2S acquisition hit the balance sheet before all the EBITDA associated with the business was consolidated in the financial statements.

Given the very low churn, high recurring revenue and reasonable margins, I think the balance sheet leverage is fine here. I think any further deleveraging should just be in anticipation of an acquisition.

Share Structure & Ownership

There are currently 33 million fully diluted shares out. The CEO owns 207,000 shares or 3-4x his salary. I can’t find the exact salary figure, I am using the prior CEO’s salary plus a bit to account for inflation.

There are some funds that own a decent amount of shares. Mawer and Pender together own about 20% of the common. Aimco owns another 3%.

Newspring came over as a shareholder of STC during the Star2Star acquisition. Star2Star was a holding of Newspring. They have a board representation as well. Newspring owns just under 2 million shares or 6%.

Management & Compensation

I’m not privy to what happens behind the scenes, but it looks like the prior CEO and board didn’t see eye to eye. In early 2023 Bill Wignall (then CEO) and David Moore (then EVP Corporate Development) and Sangoma parted ways. It was one of those “effective immediately” leadership changes. Read into that what you will. FWIW, Wignall executed what the market rewarded, growth via acquisition by using their shares as currency while maintaining EBITDA profitable.

The new CEO is Charles Salameh. He has been with the company since August 2023. He has some deep industry experience including positions with Bell Canada, Nortel Networks, HP and more. So far, I think he has done a good job shifting the priorities of the business. I think his real test to shareholders will be in the next 2-3 years with regards to capital allocation.

I don’t have a ton to say about the rest of the management team. There have been some bigger hires, for example more recently the Chief Revenue Officer. I think operationally, there is not that much risk with STC at this multiple. It is mainly a capital allocation story. The CFO came over with Star2Star. I would just echo my comments about the CEO and the capital allocation being the largest area of returns for shareholders.

As usual the compensation consists of base salary and some performance bonus. The performance bonus was based on individual targets, revenue growth and EBITDA growth. The compensation doesn’t seem to be egregious to me.

Board

The board consists of 6 members with the most recent addition of April Walker in July. Chair of the board is Norm Worthington, the founder and CEO of Star2Star. Marc Lederman is on the board as well. He is the cofounder of NewSpring (who was a holder of Star2Star). The remaining board members own only a token amount of shares (less than 100k in total). As with almost all my holders, I would like the independent board members to have more at stake here.

Risks

Here are the main risks in Sangoma as I see them.

Churn could increase or the marketplace becomes more competitive.

So far churn has been stable at Sangoma according to the new CEO. It’s a bit hard for me to tell how sensitive the customers are to prices. My channel checks tell me that stickiness is high once a customer is on a specific platform. So unless there is a pronounced “race to the bottom”, I am not overly concerned at this point. Having said that, the industry has been blessed with a large adoption tailwind that is slowing moving forward.

Dilution.

I don’t think the board would approve of issuing shares to purchase another company, but you never know. I think the past taught them a lesson with large dilution. I still think it is a risk though.

Capital (mis)allocation is a potential.

Similar to the point prior. I don’t think this is a huge risk per se, but it can hurt IRR from here. I have a hard time seeing how the next 10 years will be like the last 10 years for this company. These businesses were rewarded for growth via dilution and I don’t think that’s what we see moving forward. There is a potential for them to miss the opportunity to buyback shares at FCF yield north of 25% two to three years out. I am all for cleaning up the balance sheet to a certain point, but given the high revenue visibility I don’t think deleveraging at 120mph is the wisest move with capital.

Organic growth stalls or goes negative.

This is similar to the churn risk, but thinking about it as less about losing customers and more about not being able to increase the ARPU. This is one of the largest risks to me. I’m not talking about the product side of the business having lumpiness due to customer capex, I’m talking about service revenue. Navigating a business with some growth is a way different game than one that is contracting.

Management change.

I think if the CEO leaves for greener pastures, it sets a hard narrative for the market to overcome.

Concentrated holders.

Though this may not be a business risk, it is a risk to the share price. Given how concentrated the holdings are and how illiquid the stock is, someone seeking an exit for any reason could grenade the price of the stock.

M&A Fumble.

Though I don’t see any “transformational” deals on the horizon, a fumble with an acquired company is a risk. I can see them purchasing a smaller company to expand their product suite or geographically. If they happen to fumble, then I think the stock suffers.

Valuation

Sangoma has pretty much always traded at a discount to it’s larger peers. There are some with multiples that are close to STC, but they are getting the good old Canadian discount.

They currently trade at 5.6x EV/EBITDA based on midpoint of guidance. I have this at about 8-9x EV/FCF.

Multiples have come down a ton and of course the share prices have as well. STC has performed among the best over the last 6 years by “only” losing 35% of it’s value. RNG is down over 80%. ooof

Peak to trough looks like a massacre. Everything down at least 75%.

Most Recent Financials

As hinted at earlier, product revenue peaked in Q4 2022. That’s now 7 quarters of at best flat year over year comps. This makes the consolidated revenue numbers screen poorly and I think it’s keeping many out of the stock. The last quarter has seen EBITDA off by 9% and revenue off by 3%. Who wants to own that when there are other software companies growing.

There was mention of a shuffle in their sales initiatives to better align resources of the business with customers requirements. Given their reliance on channel partners, there is only so much they control. In my mind, STC is a mid to high single digit organic growth story.

Closing Thoughts

Despite the strong run over the last year, it feels like Canada and Microcap are swear words for institutions in today’s market. I think this opportunity exists due to the colorful history of STC, somewhat debt heavy balance sheet and lack of clarity on how UCaaS providers will act in the marketplace with slower growth. All of these narratives can change in my opinion. These particular software focused companies have been hit harder (if not the hardest) of all the software companies. Multiples have pulled back to the point where 8x8 and RNG are trading at the cheapest valuation ever (or very close to ever). I think it speaks to how low expectations are from here.

There are some catalysts that I think will help the stock.

If they issue guidance for fiscal 2025 on the Q4 2024 earnings release.

A small tuck in acquisition.

Continued deleveraging of the balance sheet.

Share repurchases.

Product revenue to bottom and the yoy comps improve.

Let me know what you think.

Thanks for reading.

Dean

*long STC.to at time of writing.