Sangoma Technologies Update - $STC.to & $SANG

Despite doing the investing thing for over 10 years and being full time for over 3, I make some pretty obvious mistakes. Here is one of them. Looking at my biggest detractor from overall portfolio performance in 2021, Sangoma. I have kept most of my shares over the last 7-8 years. I have trimmed and added here and there, but it's has never been enough to matter much to the portfolio. I last wrote about STC here about 9 months ago. You can see by the tone of the article that I am trying to process why STC is not performing better. I convinced myself that my recent outperformance of mid to late 2020 was due to my intelligence, but it was just a market with ever rising valuations.

I am not happy with my sitting on my hands and doing nothing during the go-go days of early 2021. During Q1 and Q2 2021 there was so much positivity around tech and software that I should have been aware enough to sell some or at least hedge my position. I even reached out to some fellow investors and asked their opinion. A few had said that we likely face valuation compression for the next year or two and STC would not be spared. I thought that maybe the larger companies trading on sales multiples would face compression, but not STC. I was wrong. Understanding the sector backdrop is important. Maybe your part of team #neversell and will hold your winners forever, that's fine. That's just not me.

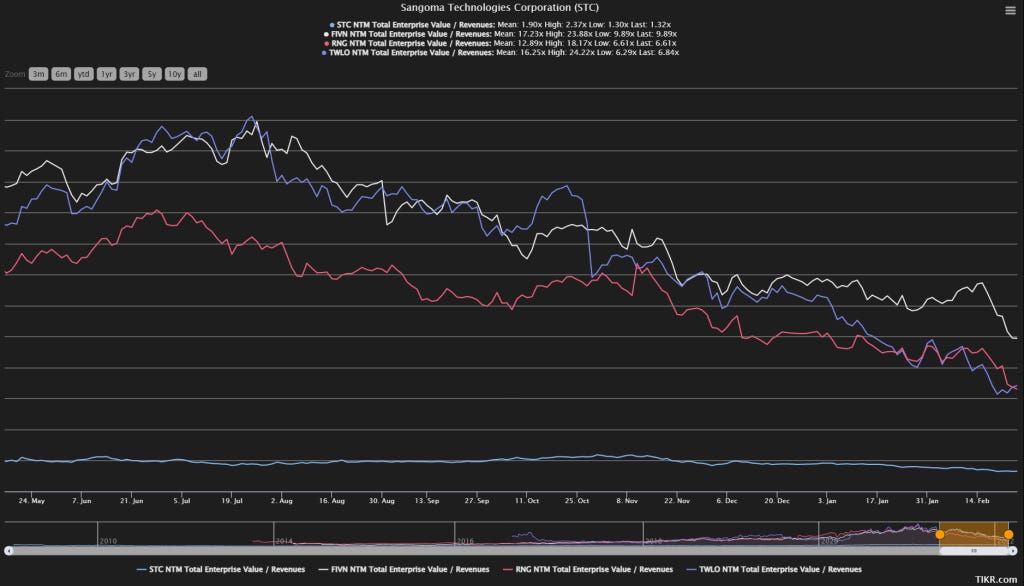

STC has not been alone in the poor performance, here is a look at some comparable companies. The carnage has been broad-based. STC has managed to perform in the middle of the pack.

Here is the EV/S valuation compression in the larger players in the space. Hard to expect STC to outperform when money is flowing out of the sector.

S2S Acquisition

I wrote about the S2S acquisition when it was first announced. At the time the S2S acquisition seemed reasonable given the multiples being paid by other UCaaS companies. Since then, the market has soured on the notion of paying 5x sales and 30x EBITDA for another business. This was fairly dilutive to Sangoma, although I'm not faulting STC. They have made it clear that their strategy is to acquire complementary businesses. Given the backdrop, they could have easily paid a higher multiple (and in prior years they would have been rewarded).

The pro-forma multiples were not that high (about 22x EV/EBITDA), although it probably didn't warrant an overweight position.

Looking ahead

Fiscal Q2 2022 was stronger than expected. The tone on the call was quite positive given some of the challenges that the company has been facing. The even upped guidance during the quarter which was really positive in my eyes as they are quite conservative. This of course was met with an initial rise in the share price that has since been erased. The company expects fiscal year 2022 to have revenue between 215-219 mil and adjusted EBITDA between 42-44 mil. This implies about a 4% organic growth rate for the last 6 months of the year.

STC will not be immune to wage pressures, supply chain disruptions and input costs rising; although I wouldn't expect them to raise full year guidance without a bunch of confidence in how H2 2022 will turn out.

Valuation

Given the guidance provided they are trading at around 9x EV/2022 EBITDA. When I look at a company like STC, I like to think of what is the steady state/no growth valuation that the business generates. The company has done a good job converting EBITDA into CFFO before working capital adjustments. CFFO is typically a little higher than EBITDA. If I assume that continues and take an estimate of what the business needs from a capex standpoint to maintain their current state. I get close to 10 mil CAD in capital expenditures, development costs, lease payments and interest payments on the debt. I get a little over 10% earnings yield at this price. To me this is what the business generates and I rely on STC to allocate capital in a productive manner. They are likely to grow organically in the mid to high single digits.

FWIW STC does trade at or close to the lowest multiples in what I consider the peer group. I am using 2023 fully diluted shares for STC. There is still further dilution from the S2S acquisition after 2023, so that may not be the appropriate share count to use. Using the expected fully diluted share count from the S2S acquisition at the end of fiscal 2024, I still get 11x EV/EBITDA.

Here are the EV/S of most of the UCaaS sector. Estimates from TIKR. I am using 2022 numbers for STC and 2023 estimates for peers to build in some extra margin of safety.

And here is the EV/EBITDA based on 2023 estimates.

Again, this doesn't take many nuances into account (growth rates, recurring rev, customer concentration, etc).

Lessons Learned

I will be more mindful of the underlying expectations that the market is placing on the companies that I own. Going overweight when you have a small(er) portfolio and live in a multi income household is a different game than when you are paying your bills from the performance of your portfolio alone, let alone supporting two kids as well. For me, position sizing needs to be managed given my reaction (or non-reaction) to sentiment. As expectations continue to ratchet higher, so does risk. 2020 was a mania plain and simple. It was crazy. This bet is different today than it was last year and other times in the past. STC has done well over the last decade and management should be recognized for this. This doesn't mean the market won't get carried away though. I also need to get better at monitoring and understanding fund flows if I own company's that aren't nanocaps. I think if you are looking at a microcap with less than 50 mil market cap then looking at fund flows is less impactful, but STC had an EV over 600 mil.

Looking back to 2020/21, I believe we were in a tech/SaaS bubble/mania. It seems obvious now due to the share price performance of some of the growth stocks. As I look back to the notes I made, the podcasts I listened to and the commentary from newsletters; I can see how the ever rising valuations made it feel like these businesses were worth some pretty unreasonable prices. There are so few companies that deserve to trade at 10x revenue. There have been so many historical examples of when paying 10x revenue has led to ruin like 90% of the time. I recognize the internet is different and that some companies do deserve that multiple, I just don't think I can pick the ones that deserve it vs. the ones that don't. Though STC never traded at 10x revenue, it doesn't mean that 20-25x EBITDA is reasonable.

Here is how the high flyers of 2020/21 have performed since their peak. Many of these are down, but are still not cheap. Many are still capital incinerators and I wouldn't be surprised if most underperform the S&P 500 over the next decade.

Summary

I think I'm getting over 10% yield on my capital at this price (after removing some one-time expenses). The business should still have a tailwind given the migration to the cloud. It is run by competent operators who have demonstrated an ability to acquire and integrate other businesses. They have demonstrated the ability to run a profitable business consistently. Shares are already down over 50% from the high. Of course, they can go lower and STC could trade at single digit multiples. Given how conservative the management team is, I don't think they would raise guidance if they didn't think they could hit it.

VG was recently bought buy Ericcson. As well, there is still M&A happening in the space. I do worry that UCaaS is more commoditized than I originally thought. Although I think the focus on SMB can differentiate STC and make customers more "sticky". Here is a list of M&A in the space.

Strong grip from spending too much time in the gym = too much bagholding.

Anyone else own STC?

Dean

*long $STC.to at time of writing.