This can be a polarizing question in the world of microcap investing.

Though this could be categorized as a “lesson”, I am essentially just rambling out loud on this post. As such, I will be filing it as a “Musing”.

Setting the Stage

Let’s qualify what “meeting with management” is. To me, this includes meeting in person at the company’s office or at a conference, a video chat, and a phone call. This is generally the CEO, but really can be anyone who is fundamental to the success of the business. This does not include quarterly conference calls (in my opinion).

In my experience, most people who have strong opinions on this one way or another suffer from “resulting”. They look back and pull out data points that reinforce their beliefs. This is why I think it is so important to journal not just when you make a decision but your thoughts as you continue to own or monitor a company.

On one hand you have people who swear by meeting with management to “look them in the eye,” build rapport or somehow tell if they are lying. These people usually get comfort in knowing the person behind the name. I mean if you are putting a bunch of your or your clients’ money with a company, wouldn’t you want to know who is stewarding the capital? We can all spot a snake oil salesperson, can’t we?

On the other hand, some people swear that meeting management is not necessary. They feel that meeting management is at best non-value add and that they may get “sold” something that they should not. This makes sense to. I mean the CEO is, quite literally, the salesperson for the business to the shareholders. And sometimes salespeople stretch the truth a tad. How many very intelligent people get suckered into things like Time shares, MLMs and get rich quick schemes. There is a personal finance podcast I regularly listen to that has many examples of doctors making poor investments.

If you were looking for a YES/NO answer, then you came to the wrong spot. As with everything, this one lives in the nuance. I am going to make some points for and against for both sides and then wrap it up with how I approach it. FWIW, I have made and lost money with both strategies lol.

For Meeting with Management

I do this if I need clarification on the business, it’s KPIs or the long-term strategy. Maybe this is a business I’m not familiar with or an industry that is new to me. I would want some specific answers that could make or break the investment decision. If you feel that you are a good judge of character, then meeting with them is a good idea. If you can sniff out bullshit, then meet with the CEO.

Many of the investments I make are in businesses whose future looks dramatically different than the past. So, looking backward at the financials doesn’t reveal much. Other than reading the public filings, a major part of the due diligence is speaking with those who are executing the strategy. Asking hard open-ended questions and listening intently to the response.

I don’t come from finance and I’m not managing large sums of money. As such, my name itself carries essentially zero weight (my self deprecating doesn’t help). If I am to hold shares in a company that I think can be a multibagger, then I will be a shareholder for several years. There will be good quarters and bad quarters. Having a good rapport with the CEO can mean you get to have some added context to why things may look worse or better than they really are. This may give you conviction when you need it the most.

How about if you are lucky enough to get a site tour of a business. I have been on a few. Coming from operations in a manufacturing setting in my corporate life allows me to spot things that others on the tour could miss. However, if you took me on a tour of a veterinary office or software company, I wouldn’t have much to add unless there was something glaringly obvious.

Against Meeting with Management

Why would you need to meet with anyone from the company? I mean if they are executing, then the financials would show that right? Maybe you have enough self awareness to know that you may get sold on something you shouldn’t, then don’t meet with them. Maybe management isn’t accessible to you because you are a nobody blogger, and they are somewhat averse to anything IR related. So, you cannot even meet with them even if you wanted to. Or you have a close friend that knows the business better than you ever will and you trust them enough to be a better judge of the strategy than you. So, you could rely on your friend for that part of the due diligence.

You can always rely on conference calls or presentations if they are publicly available for part of the due diligence process. So why would you risk meeting with the CEO in a 1:1 setting and potentially get swindled. There are also a ton of newsletters you can subscribe to that go in depth on the companies they profile and usually meet with management of said company.

Just because you haven’t met with management, doesn’t mean you can’t get a feel for their characters and capabilities. You can also speak with former employees, customers, suppliers, etc. The responses to people outside of company can give you valuable insight, or they may be a waste.

My Personal Experience

I have been on site visits that have been good and bad. One company I was lucky enough to talk to the Production Manager of the facility. After some questions I asked weren’t answered well, I could tell the culture was a bit too much how you say……” this is the way we always do things”. Utilization of the equipment wasn’t properly measured, and sales and marketing were not aligned with operations. One machine that produced a very specific part was backed way up waiting for some sort of customer approval. The operations team didn’t want to commit the 4-5 hours to do a change over so the machine could work on another order, but it had already been sitting for 3 days. Another machine was backed up waiting on one specific operator to run it as he was the only person who knew how to run the machine properly. Not a great look to me. I sold my shares as soon as I was back at home.

Another tour I went on was a very small operation. It had very visual indicators for WIP levels and signs on which worder was responsible to which queue zone. They had a room where they tested the equipment before sending it to the customer. Many of the items in this room where custom made for testing. The room had clear operating instructions with the picture of who was responsible for maintaining the documentation. The team struck me as gritty and very collaborative. Everyone on the production floor wore multiple hats. I added to my position after the tour.

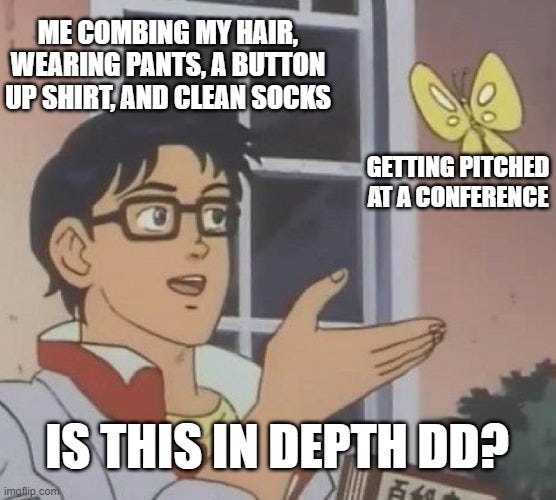

I have also met with the CEO of a company at a conference and walked away feeling very positive on the business. They were very charismatic and energetic about the potential. I was bought in to the opportunity. All I seen was the potential upside. My question on required capital to scale was easily answered. Turns out, it wasn’t quite as easy to scale, and they didn’t execute and needed more capital. Many companies that will need capital will start speaking with potential investors to demonstrate their opportunity only to raise equity shortly thereafter (especially microcaps). I probably could have skipped this meeting and taken a nap. It would have been much cheaper.

I’ve also met with the CEO of a company I loosely follow. His no nonsense attitude and realism gave me comfort that he was on top of the operational bottlenecks that were a key part of my thesis. I purchased some shares shortly after conducting some additional due diligence. It turned out well.

I’ve been successful at investing in businesses that I have never met any of the management team personally. When I first purchased my shares in VMD in 2018 at around $2, I did not know the CEO (Casey Hoyt) at all. And I still haven’t met him. Of course, if he comes to Edmonton, he is more that welcome to grab a deadlift session in my home gym (as are any of you).

I didn’t meet with MTLO management and thought I could sniff out the milestones via the financials, press releases and quarterly reports. It seemed like it had some key ingredients for a multibagger. Management was aligned with the share price, they had a strong market presence, end user adoption was growing. I was joined at the hip with someone worth many multiples of myself and who has been in the industry a long time. I lost money on that one.

My Thoughts

For me, I think the most important thing is your own self awareness. If you are likely to get sold on a timeshare, I would say meeting the CEO of a microcap may not be a good idea. If you are a person that can listen to a compelling pitch and walk away thinking “no thanks, that’s not for me.”, then you are less likely to get sold something you should pass on. I will be honest with the reader; I still have a very hard time saying no to something that has a compelling sales pitch.

Sometimes what seems like a sales pitch is just the CEO having some energy. It’s important for me to remember that the CEO needs to be optimistic about the future of the business. Would I invest with someone that said to you that they envision potentially losing their marketplace presence without a plan? Or that they think they can’t meet their sales objectives? Or someone has a perpetual case of the Monday’s? Of course not. I want drive, imagination, and shareholder alignment with the company’s management team. They must get out of bed every day and go work for me, so I want some optimism.

Closing Comments

As with all things, there is no good answer. No right or wrong. If knowing management integrity is fundamental to the success of the business, then you need to get a good sense of their character. This still doesn’t mean you have to meet them personally. If the business has been around for many cycles in a slow moving or mature industry, then meeting with management is probably not as critical.

If you do this long enough you will get a sense of some things: strong operator, capital markets presence, leadership characteristics, how they treat employees, etc. I’ve also gotten enough reps in to see some very promotional things over the years. The hockey stick forecasts are quite laughable with some hindsight. Some of the conduct would make you laugh and shake your head.

What do you think? Do you like to meet with the CEO in person? Have you fell victim to some charismatic sales pitch? Do you want to grab a deadlift session in my home gym? Or come by and play Lego?

Thanks for reading.

Dean

Interesting topic. It's worth mentioning that a great investment mind like Walter Schloss completely excluded talking to management.

Personally, I have two groups of CEOs who are a big no-no for me:

1. Those who, upon waking up every morning, are more concerned with how they look in the mirror and when they can drink their soy lattes than with running the company.

2. Experts in their field who don't understand the capital market.

Such a good topic, thanks for addressing it. As a small investor, I like to talk to management but don’t get to do it in a constructive way very often. I’ve never had a management meeting where I felt like it really changed the outcome much one way or another. I like to do it when I can and it’s available, but I don’t put much stock in my ability to do it well enough to move the needle on my investing process.