*Disclosure: I own shares in STEP.to. I am not a professional. Please do your own due diligence.

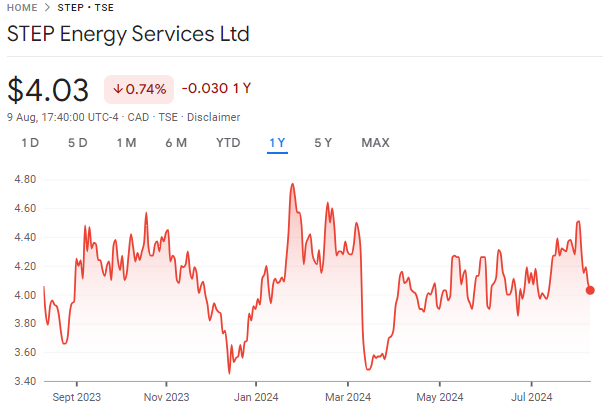

Price (as of close last week): $4.03 CAD

MC: 298 million CAD

EV: 384 million

1 year performance: flat

STEP reported last week and held a call. Results were ahead of my expectations and the stock was up a bit following the call, but ended the week down about 10% due to the drop in WTIC.

*All amounts in CAD unless stated otherwise.

Quarter Recap

Revenue was essentially flat at 231 million.

EBITDA was down to 41.7 million from 47.4 million

Feel that the long term fundamentals are still in place for a decent pricing environment despite the near term weakness.

Call Notes

Canada was strong at 161 million in revenue vs 136 million last year.

US was weak relative to last year (as expected) with revenue at 70.4 million vs 96.1 million.

They can move the crews around in the US to better geographies within the US. They are not looking to take on work at any price.

They feel that Q4 will be slower as majors exhaust their annual budgets and the weak gas prices.

Valuation

STEP is trading at around 2x EV/EBITDA and probably around those numbers for the fill year in 2024.

Closing Thoughts

Recession fears are driving share price movement in the short term. I don’t know when activity returns in the US, but I am confident it will at some point. I think we bottom in the US in 2024 and should see better contribution in 2025. I’m not sure what Canada looks like in 2025 but I remain optimistic.

STEP returns will come from business growth, valuation re-rating and an eventual dividend as they get debt down below 60 million. I foresee a dividend in 2025. But that is just my opinion.

STEP mentioned on the press release that there has been an underinvestment in hydrocarbon production capacity through the last several years. This is something I agree with and as such continue to hold my position.

Thanks for reading.

Dean

* long STEP.to