I added STEP to the OFS basket in the mid 3s. Here is a quick and dirty write-up.

Company Name: Step Energy Services Ltd.

Ticker: STEP.to

Price: $4.00ish

Shares (diluted): 73.8

MC: 300 mil CAD

EV (my calculation): 430 mil CAD

Background - From AIF

STEP was founded in 2011 as a private company and began operations in the spring of 2012 as a specialized coiled tubing company. It has since grown to become an integrated fracturing, and coiled tubing services provider. This has been accomplished through both the organic development of specialized fit-for-purpose equipment and through strategic acquisitions.

On May 2, 2017, STEP completed its IPO, issuing 10 million Common Shares at a price of $10 per Common Share for total gross proceeds of $100 million. STEP became a “reporting issuer” or the equivalent in each of the provinces of Canada, and its Common Shares trade on the TSX under the symbol “STEP”.

Services Provided

Fracturing Services

Fracturing services involve pumping a customized fracturing fluid through a wellbore and into a target reservoir formation. With the advent of the modern shale play, fracturing intensity (length of laterals, number of fracturing stages and volume of proppant per stage) has increased, requiring a considerable amount of technical skill from service companies in designing fracturing fluids and managing the fracturing process. As a result, STEP's technology development team is an integral part of the fracturing and refracturing operation, working closely with clients and field professionals to provide fit-for-purpose solutions in stimulation chemistry, acidizing and production enhancement.

Coiled Tubing Services

Coiled tubing is a continuous long steel pipe wound on a reel and is transported to a well location. It is straightened prior to pushing into a wellbore and is spooled back onto the reel on completion of the well intervention. First developed in the 1960s for well cleanouts, coiled tubing services are primarily used in the completion of new wells or enhancement of existing wells. The advancement of deep resource plays (Montney, Duvernay, Deep Basin, Permian, and Eagle Ford) and horizontal pad drilling has increased the demand for deeper, sophisticated coiled tubing units.

Geography - From AIF

There is nothing particularly ground breaking about their geographical mix.

In Canada:

a fleet of 282,500 HP in fracturing capacity servicing E&P companies in the Montney, Duvernay, Viking and Deep Basin areas; and

16 purpose-built coiled tubing units, eight of which were deployed at December 31, 2022 in primarily the same plays.

In the U.S.:

a fleet of 207,500 HP in fracturing capacity servicing E&P companies in the Permian and Eagleford basins in Texas; and

19 purpose-built coiled tubing units. Seven units were deployed in the Permian and Eagle Ford basins in Texas, two units were deployed in the Bakken basin in North Dakota, two units were deployed in the Uinta-Piceance and Niobrara-DJ basins in Colorado, four units were maintained for re-deployment and four units require refurbishment.

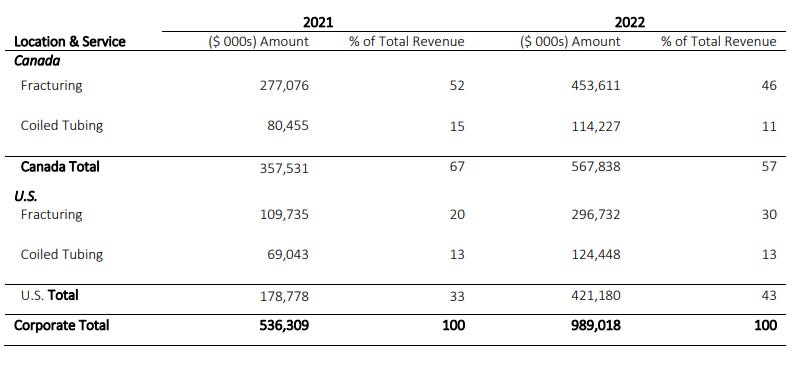

Here is the mix for 2022 and 2021.

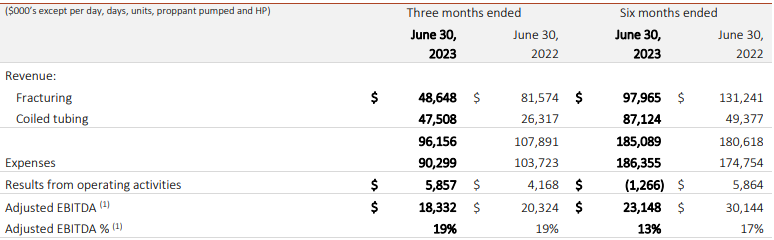

Here is the mix last q:

Canada

USA

Balance Sheet

STEP was in a net cash position before the Tucker acquisition in early 2018 .

STEP is utilizing approximately $30 million available cash on its balance sheet, proceeds from the $50 million equity Offering and the remainder from the New Credit Facilities to finance the Acquisition.

The valuation paid wasn’t bad given the estimates at the time. Layer on a slower than expected market in 2018/19 and covid related lockdowns left STEP quite leveraged. The share price has responded well since the bottom in 2020 and had a very strong 2022 as oil traded above $100.

STEP has done a good job at prioritizing reducing debt as activity has gradually returned.

Share Ownership

There isn’t a ton of direct insider ownership, ARC Financial owns 40 mil shares or about 59% of the common. ARC is a energy focused private equity fund based in Calgary. ARC has a strong presence on the board with two positions including the Chair.

Q2 2023

Results were generally ahead of expectations. The Canadian market remains strong and looks to continue this into H2 2023. US market has been more challenging, although it seems to have stabilized in the quarter and looks to be at least stable through the remainder of 2023.

Oil price, activity levels and assumptions

One can’t buy shares at these levels without an expectation on activity levels. Oil has bounced/recovered at the start of H2 2023. Oil generally is stronger in the second half of the year from a seasonal standpoint. Though I’m relieved that oil has not made a new low, I’m not expecting a new high given the excess supply from OPEC that can accessed at any time. E&Ps have continued their discipline with regards to their spending. So far this continues to be my expectations.

STEP is currently trading at 2.2x EV/2023 Est EBITDA which is a fair price to pay. I think STEP will give some upside leverage to activity levels, sentiment and the deleveraging of the balance sheet is a nice extra at these prices.

Anyone else own STEP?

Thanks for reading.

Dean

Still have some STEP shares as well. They will meet their debt targets this year which is essentially debt free minus the working capital requirements. I wonder if Arc Financial will want dividends from here. Doubt they spend it all on upgrades to Tier IV.