I have done a few of these updates over the last couple of years. I am way overdue for another. If you have any comments or want to provide another perspective, please feel free to comment.

Despite the disclaimer in the banner, I feel it’s important to emphasize that I am an amateur. I am at best a novice with investing in general, and a beginner at all things macro. If you have a different perspective, I would love to hear it.

Background

I own a basket of OFS cos that I consider one position. The idea is that I would spread out specific company risk and take a top down approach. I believe we have underinvested and underappreciate our reliance on hydrocarbons and these businesses should do well. I prefer picks and shovels to producers at this point as I struggle with understanding things like decline rates, required capital to reinvest in production, etc. But I’m open to looking at any company.

I originally dipped my toe in the water in 2019 with MCB.to. I only added a conservative amount of PSD.to in 2021 at the lows in sentiment. As the oil market recovered, I looked elsewhere. I remember how popular oil stocks were again and I was not interested in chasing the trend. I held my positions as I felt there was still upside.

I continued to monitor and build a watchlist of companies that I might invest in. After the price of oil dropped by about 1/3 in late 2022 I started dipping my toes back in. Since then I have gradually added to existing positions and added new names to the basket. I knew I would be early to some degree, but have been wrong on the timing. It’s essentially been an additional 18 months to my timeframe. The last 3 years have not been kind to the price of oil.

Currently the basket is MCB.to, PSD.to, TOT.to, PHX.to, PSI.to and ESI.to.

What did I get wrong

I was focused on North American rig count as it was an indicator of activity and future supply. Too little rigs and (eventually) less oil being supplied. At least that’s what I thought. I was thinking that by this point we would see a decline in production in the US and higher prices.

Let’s dig into what I miscalculated:

The Demand Side

As the we gradually spent all out stimmies from the covid times, the demand picture changed as central banks raised interest rates aggressively.

I was expecting higher demand mainly from China than what materialized. In China the rise of EVs was much faster than I was anticipating thanks to a ton of government support. Depending on where you get your data the numbers can vary a bit, but this shows the overall trend well.

Thus resulting in lower year over year imports for 2024. I was not expecting a ton of growth in percentage terms for China, but I was expecting some growth.

Global demand was up overall, but less than I expected. According to the IEA demand only rose by 830,000 barrels per day in 2024 vs 2023.

The Supply Side

I missed this on a few fronts.

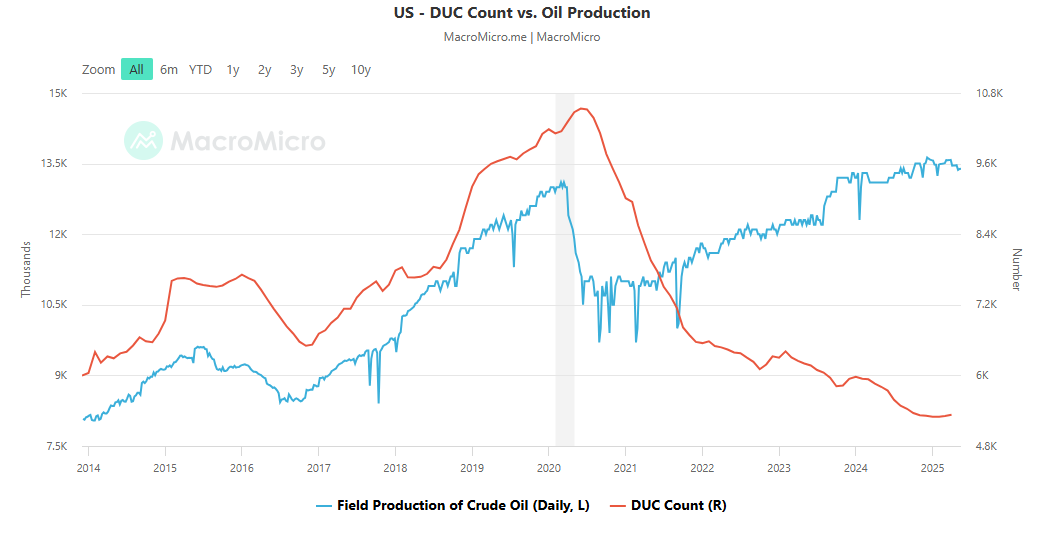

US DUC Drawdown

I underestimated how many DUC (drilled but uncompleted wells) we would eat into. I knew there would be some ebbs and flow in the number of DUC wells, but coming out of 2021 I thought we were at the low in DUC count which was around 6,000. I was wrong. We continued to eat into the DUC inventory over the next few years and are now around 5,300.

US Land Rig Efficiency

Another thing I underestimated is the amount of efficiency gained with more modern drilling equipment. I assumed that there was some efficiency gained, but nowhere near as much as we have seen. You can see the production levels relative to the rig count here.

SPR (Strategic Petroleum Reserve)

I did not expect the SPR to be unwound to the degree that it was. The re-build has been fairly muted.

OPEC+ Supply Increase

More recently OPEC+ announced they would be fast tracking their supply increases. This obviously caught the market off guard as oil prices were already down after Liberation Day.

https://www.opec.org/pr-detail/243563-03-may-2025.html

Where are we now

I can ruminate on my mistakes like a pro. I think it’s worth taking a step and looking ahead to see if the trade makes sense here.

Demand

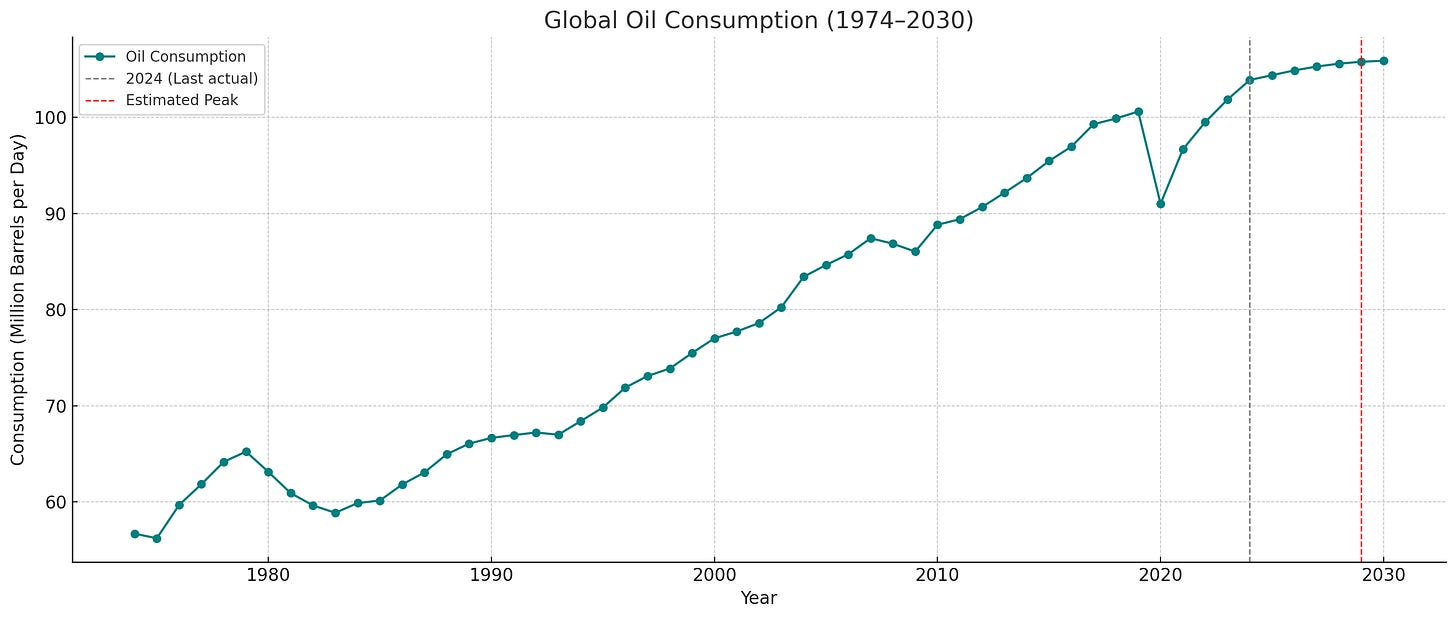

At this point the EIA is stating that we will hit peak oil demand “sometime before 2030”. OPEC does not see us hitting peak oil demand before 2045. FWIW, I find the EIA’s convoluted forecast hard to understand. Here is a quick snapshot of each from ChatGPT.

This all can change as things like EV adoption and technology advancement unfold. Of course much of the required infrastructure to support the consumption of fossil fuels is already built. If renewables want to compete with fossil fuels on an economic basis, they are competing against many decades of capital that has already been spent and the cost is very reasonable on a marginal basis.

Though there will be countries that will demand more or less than anticipated due to a variety of reasons, I don’t see us hitting peak demand in time to hinder the trade to work from here.

Supply

Though demand seems to drive much of the short term gyrations, supply is what I am more bullish on.

Shale Production Levels

US Shale really is a miracle of modern science and a testament to how hard it is to predict the future. Here is production since 2010 from the EIA.

There are couple of nuances that are associated with shale that I feel are worth noting. First is the mix of gas and oil as the well matures.

The first 12 months the mix is 60-80% oil, 20-40% gas.

Years 1-3 are 30-60% oil, 40-70% gas.

Mature wells (3+ years old) are 10-30% oil, 70-90% gas.

This means that the existing wells are becoming more gas heavy.

Second is the decline in high quality or Tier 1 acreage. Enverus revised their estimates for Tier 1 acreage down to 75,000 acres this year. We started the boom with over 200,000+ acres of Tier 1 land. As the lowest cost land gets eaten up, the incremental cost of break even continues to creep higher. Depending on which company you get your data from, but break even for tier 1 is 40-50, tier 2 is 50-60 and tier 3 is 60-70. At least that’s the numbers I use. Don’t quote me on them.

The tone on the large North American producers is that we are a production peak in share, at least a temporary one as the price is too low to increase drilling from here.

I don’t know how the EIA thinks that production will remain stable given the rig count keeps dropping. So if prices stay here or go lower, I can’t see the estimates in the above coming true.

DUC Inventory

DUC levels are near the trough levels of the last 10 years. This low incremental cost supply has been tapped.

Supply Disruptions are at low levels

We have seen stability in oil supply for the most part. Currently disruptions are at their lowest in a long time. Call me cynic (I prefer a realist), but a major supply shock wouldn’t be uncommon.

SPR

Has to be refilled at some point. Or at least I don’t think it was designed to be used as a lever to pull to support consumers. I think at some point the US refills it.

Cost Discipline

The industry has been through some lean years. There has been no easy money for oil and gas companies for the majority of the last decade. The majority of the companies throughout the entire industry have demonstrated a surprising amount of capital discipline. From paying down debt to buying back shares to increasing dividends, the companies have become quite shareholder friendly. I don’t see this changing in the short term.

Global Capex

So far I have been focusing on US land, this is due to it being the primary increase in production over the last cycle. The Crude Chronicles has a terrific chart on his post here that goes over capex cycles globally. I won’t put his chart on here without his permission. What I take away from it is we aren’t seeing an influx of capital to grow production from these levels, at least not at these prices.

OPEC+ Production and Spare Capacity

OPEC and/or OPEC+ production levels are down from their peak prior to covid.

The amount of spare capacity is up from the trough in 2004-2008. The relative stability in the OPEC members from 2015-2019 coupled with the large increase in US shale have led us to today. This is something to watch for as OPEC could decide to put more oil on the market.

OECD Inventories

The consensus is for inventories to build from here, albeit very gradually.

What Would Break My Thesis

For my top down trade to work, I need to be right that there will be an increase in spending. I need to be “kind of” right on the timing. I can wait it out a bit, but I’m sure my stocks would get creamed in a down market.

For me to rethink my position:

I would have to see a continued trend of EVs in China, but at an accelerated pace.

I would have to see increase in EV adoption for the marginal demand countries. I’m thinking India and Brazil specifically.

If Trump digs his heels in further with tariffs and the result is global recession. For now, things seem somewhat stable but many of these tariffs are paused and not completely negotiated. This is a moving target and it feels like there is no industry that is safe from his social media focus.

If we see supply growth out of the US land market even at these prices, then I need to rethink my thesis as prices are still too high to hurt supply.

If OPEC+ dumps on the market, it would hurt my businesses and I would reconsider my positions. I don’t know if I would sell everything, but I would probably reduce exposure.

Given the current exposure is heavily in North America, there could be something specific to this geography that hinders my companies from keeping up with a strong oil market. I would look to rebalance if the thesis is working but there is something specific to North American that I feel isn’t worth the risk.

Closing Thoughts

Though there is much focus on demand data in the short term, I believe that supply is more important to focus on here. I was around when the experts were calling for $200 oil in 2008. We were all going to travel less due to the high costs. Turns out we weren’t running out of oil, just needed a price signal for the market to invest in pulling more of it out of the ground.

With all these factors in mind, I believe that the next five years will see more capital being spent on global oil production than the last five. Our reliance on oil has not been disrupted so far, and I don’t think that changes.

Layer on things like Aramco expected dividend down 30% this year and I don’t think we are at a place when supply increases. In my opinion the EIA is too optimistic in US production. Investor sentiment “feels” overly negative to me, but that could also just be my echo chamber.

My latest additions and the companies that I have on my watchlist have more direct exposure to the cycle. I prefer the picks and shovels businesses rather than the producers. Although I will admit that I have put some large Canadian producers into my kids education savings.

I hope you enjoyed this. If you have any questions or comments, please feel free to leave them below.

Thanks for taking the time to read my work.

Dean

Good article. I believe US OFS is the place to be here in a very consolidated and bifurcated industry. Personally added a significant PTEN position on the last two days of the week. Did trade ACDC during the downturn but it has since covered. I prefer the drilling companies here. US LNG is ramping up and they need to increase activity levels going forward, that might not be apparent tomorrow but it should be in the coming months or year. Consolidation means less equipment available when the pendulum tilts. Margins still holding up despite reduced activity levels. I don't see much growth in Canada OFS wise but we also not seeing the declines...

Good overview. Persistent US supply via huge productivity improvements and disappointing demand in China seem to have been the biggest negative factors for oil the past couple of years.